Cigna 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

the line of credit agreement, the Company has an additional life and health insurance companies. The RBC rules recommend a

$5.3 billion of borrowing capacity in addition to the $5.2 billion of minimum level of capital depending on the types and quality of

debt outstanding. investments held, the types of business written and the types of

liabilities incurred. If the ratio of the insurer’s adjusted surplus to its

The Company maintains a capital management strategy to risk-based capital falls below statutory required minimums, the

permanently invest the earnings for certain of its foreign operations insurer could be subject to regulatory actions ranging from increased

overseas. During the first quarter of 2012 the Company expanded this scrutiny to conservatorship.

strategy to its China and Indonesia operations. As of December 31,

2012 the Company’s cash and cash equivalents in its foreign In addition, various non-U.S. jurisdictions prescribe minimum

operations were $768 million, and permanently reinvested earnings surplus requirements that are based upon solvency, liquidity and

were approximately $628 million. Repatriation of foreign cash via a reserve coverage measures. During 2012, the Company’s HMOs and

dividend of these permanently reinvested earnings would result in a life and health insurance subsidiaries, as well as non-U.S. insurance

charge for the incremental U.S. taxes due on the repatriation. Because subsidiaries, were compliant with applicable RBC and non-U.S.

of the size, strength and diversity of earnings from domestic sources, surplus rules.

management does not believe this global capital management strategy Solvency II. Cigna’s businesses in the European Union will be subject

materially limits the Company’s ability to meet its liquidity and to the directive on insurance regulation and solvency requirements

capital needs in the United States. known as Solvency II. This directive will impose economic risk-based

Though the Company believes it has adequate sources of liquidity, solvency requirements and supervisory rules and is expected to

continued significant disruption or volatility in the capital and credit become effective in January 2014, although certain regulators are

markets could affect the Company’s ability to access those markets for requiring companies to demonstrate technical capability and comply

additional borrowings or increase costs associated with borrowing with increased capital levels in advance of the effective date. Cigna’s

funds. European insurance companies are capitalized at levels consistent with

projected Solvency II requirements and in compliance with

Solvency regulation. Many states have adopted some form of the anticipated technical capability requirements.

National Association of Insurance Commissioners (‘‘NAIC’’) model

solvency-related laws and risk-based capital rules (‘‘RBC rules’’) for

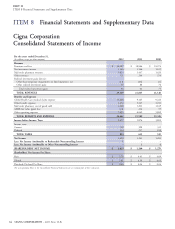

Guarantees and Contractual Obligations

The Company is contingently liable for various contractual obligations entered into in the ordinary course of business. The maturities of the

Company’s primary contractual cash obligations, as of December 31, 2012, are estimated to be as follows:

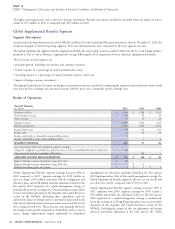

(In millions, on an undiscounted basis)

Total Less than 1 year 1-3 years 4-5 years After 5 years

On-Balance Sheet:

Insurance liabilities:

Contractholder deposit funds $ 7,104 $ 677 $ 938 $ 817 $ 4,672

Future policy benefits 11,489 486 1,153 1,083 8,767

Global Health Care medical claims payable 1,864 1,796 29 9 30

Unpaid claims and claims expenses 4,379 1,321 857 590 1,611

Short-term debt 200 200 - - -

Long-term debt 8,955 269 549 1,352 6,785

Other long-term liabilities 1,037 433 166 111 327

Off-Balance Sheet:

Purchase obligations 871 393 289 120 69

Operating leases 570 116 190 108 156

TOTAL $ 36,469 $ 5,691 $ 4,171 $ 4,190 $ 22,417

As discussed further in Note 25 to the Consolidated Financial

On-Balance Sheet:

Statements, effective February 4, 2013, the Company entered into a

Insurance liabilities. Contractual cash obligations for insurance

reinsurance agreement for its GMDB and GMIB businesses. The

liabilities, excluding unearned premiums and fees, represent

reinsurance premium due to Berkshire of $2.2 billion is not included

estimated net benefit payments for health, life and disability

in the contractual obligations table presented above. In addition, the

insurance policies and annuity contracts. Recorded contractholder

expected future cash flows for GMDB and GMIB contracts included

deposit funds reflect current fund balances primarily from universal

in the table above do not consider this reinsurance arrangement.

life customers. Contractual cash obligations for these universal life

contracts are estimated by projecting future payments using

assumptions for lapse, withdrawal and mortality. These projected

future payments include estimated future interest crediting on

54 CIGNA CORPORATION - 2012 Form 10-K

•