Cigna 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

current fund balances based on current investment yields less the Other long-term liabilities. These items are presented in accounts

estimated cost of insurance charges and mortality and payable, accrued expenses and other liabilities in the Company’s

administrative fees. Actual obligations in any single year will vary Consolidated Balance Sheets. This table includes estimated

based on actual morbidity, mortality, lapse, withdrawal, investment payments for GMIB contracts, pension and other postretirement

and premium experience. The sum of the obligations presented and postemployment benefit obligations, supplemental and

above exceeds the corresponding insurance and contractholder deferred compensation plans, interest rate and foreign currency

liabilities of $18 billion recorded on the balance sheet because the swap contracts, and certain tax and reinsurance liabilities.

recorded insurance liabilities reflect discounting for interest and the Estimated payments of $75 million for deferred compensation,

recorded contractholder liabilities exclude future interest crediting, non-qualified and international pension plans and other

charges and fees. The Company manages its investment portfolios postretirement and postemployment benefit plans are expected to be

to generate cash flows needed to satisfy contractual obligations. Any paid in less than one year. The Company’s best estimate is that

shortfall from expected investment yields could result in increases to contributions to the qualified domestic pension plans during 2013

recorded reserves and adversely impact results of operations. The will be approximately $250 million. The Company expects to make

amounts associated with the sold retirement benefits and individual payments subsequent to 2013 for these obligations, however

life insurance and annuity businesses, as well as the reinsured subsequent payments have been excluded from the table as their

workers’ compensation, personal accident and supplemental timing is based on plan assumptions which may materially differ from

benefits businesses, are excluded from the table above as net cash actual activities (see Note 10 to the Consolidated Financial Statements

flows associated with them are not expected to impact the for further information on pension and other postretirement benefit

Company. The total amount of these reinsured reserves excluded is obligations).

approximately $6 billion.

The above table also does not contain $51 million of liabilities for

Short-term debt represents commercial paper, current maturities of uncertain tax positions because the Company cannot reasonably

long-term debt, and current obligations under capital leases. estimate the timing of their resolution with the respective taxing

Long-term debt includes scheduled interest payments. Capital authorities. See Note 20 to the Consolidated Financial Statements for

leases are included in long-term debt and represent obligations for the year ended December 31, 2012 for further information.

software licenses.

Off-Balance Sheet:

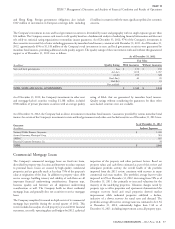

Purchase obligations. As of December 31, 2012, purchase obligations consisted of estimated payments required under contractual

arrangements for future services and investment commitments as follows:

(In millions)

Fixed maturities $58

Commercial mortgage loans 6

Real estate 7

Limited liability entities (other long-term investments) 509

Total investment commitments 580

Future service commitments 291

TOTAL PURCHASE OBLIGATIONS $ 871

The Company had commitments to invest in limited liability entities ability to terminate these agreements, but does not anticipate doing so

that hold real estate, loans to real estate entities or securities. See at this time. Purchase obligations exclude contracts that are cancelable

Note 12(D) to the Consolidated Financial Statements for additional without penalty and those that do not specify minimum levels of

information. goods or services to be purchased.

Future service commitments include an agreement with IBM for Operating leases. For additional information, see Note 22 to the

various information technology (IT) infrastructure services. The Consolidated Financial Statements.

Company’s remaining commitment under this contract is

approximately $15 million over the next year. The Company has the

Guarantees

ability to terminate this agreement with 90 days notice, subject to

termination fees. The Company, through its subsidiaries, is contingently liable for

various financial and other guarantees provided in the ordinary course

The Company’s remaining estimated future service commitments of business. See Note 24 to the Consolidated Financial Statements for

primarily represent contracts for certain outsourced business processes additional information on guarantees.

and IT maintenance and support. The Company generally has the

CIGNA CORPORATION - 2012 Form 10-K 55

•

•

•

•

•