Cigna 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8 Financial Statements and Supplementary Data

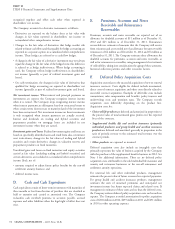

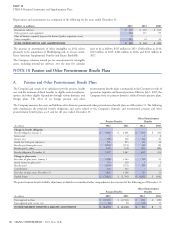

Incurred but not yet reported comprises the majority of the reserve balance as follows:

(In millions)

2012 2011

Incurred but not yet reported $ 1,541 $ 1,059

Reported claims in process 243 232

Other medical expense payable 72 14

MEDICAL CLAIMS PAYABLE $ 1,856 $ 1,305

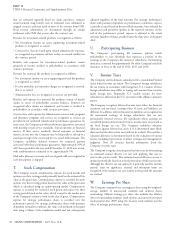

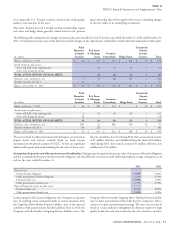

Activity in medical claims payable was as follows:

(In millions)

2012 2011 2010

Balance at January 1, $ 1,305 $ 1,400 $ 1,045

Less: Reinsurance and other amounts recoverable 249 284 257

Balance at January 1, net 1,056 1,116 788

Acquired net: 504 - -

Incurred claims related to:

Current year 14,428 9,265 9,337

Prior years (200) (140) (115)

Total incurred 14,228 9,125 9,222

Paid claims related to:

Current year 12,854 8,227 8,217

Prior years 1,320 958 677

Total paid 14,174 9,185 8,894

Balance at December 31, net 1,614 1,056 1,116

Add: Reinsurance and other amounts recoverable 242 249 284

Balance at December 31, $ 1,856 $ 1,305 $ 1,400

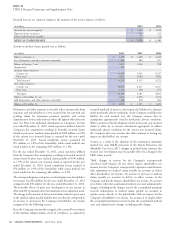

Reinsurance and other amounts recoverable reflect amounts due from actuarial standards of practice, that require the liabilities be adequate

reinsurers and policyholders to cover incurred but not reported and under moderately adverse conditions. As the Company establishes the

pending claims for minimum premium products and certain liability for each incurral year, the Company ensures that its

administrative services only business where the right of offset does not assumptions appropriately consider moderately adverse conditions.

exist. See Note 8 for additional information on reinsurance. For the When a portion of the development related to the prior year incurred

year ended December 31, 2012, actual experience differed from the claims is offset by an increase determined appropriate to address

Company’s key assumptions resulting in favorable incurred claims moderately adverse conditions for the current year incurred claims,

related to prior years’ medical claims payable of $200 million, or 2.2% the Company does not consider that offset amount as having any

of the current year incurred claims as reported for the year ended impact on shareholders’ net income.

December 31, 2011. Actual completion factors accounted for Second, as a result of the adoption of the commercial minimum

$91 million, or 1.0% of the favorability, while actual medical cost medical loss ratio (MLR) provisions of the Patient Protection and

trend resulted in the remaining $109 million, or 1.2%. Affordable Care Act in 2011, changes in medical claim estimates due

For the year ended December 31, 2011, actual experience differed to prior year development may be partially offset by a change in the

from the Company’s key assumptions, resulting in favorable incurred MLR rebate accrual.

claims related to prior years’ medical claims payable of $140 million, Third, changes in reserves for the Company’s retrospectively

or 1.5% of the current year incurred claims as reported for the year experience-rated business do not always impact shareholders’ net

ended December 31, 2010. Actual completion factors resulted in income. For the Company’s retrospectively experience-rated business

$96 million, or 1.0% of the favorability, while actual medical cost only adjustments to medical claims payable on accounts in deficit

trend resulted in the remaining $44 million, or 0.5%. affect shareholders’ net income. An increase or decrease to medical

The corresponding impact of prior year development on shareholders’ claims payable on accounts in deficit, in effect, accrues to the

net income was $66 million for the year ended December 31, 2012 Company and directly impacts shareholders’ net income. An account

compared with $49 million for the year ended December 31, 2011. is in deficit when the accumulated medical costs and administrative

The favorable effects of prior year development on net income in charges, including profit charges, exceed the accumulated premium

2012 and 2011 primarily reflect low medical services utilization trend. received. Adjustments to medical claims payable on accounts in

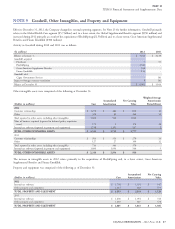

The change in the amount of the incurred claims related to prior years surplus accrue directly to the policyholder with no impact on the

in the medical claims payable liability does not directly correspond to Company’s shareholders’ net income. An account is in surplus when

an increase or decrease in the Company’s shareholders’ net income the accumulated premium received exceeds the accumulated medical

recognized for the following reasons. costs and administrative charges, including profit charges.

First, the Company consistently recognizes the actuarial best estimate

of the ultimate liability within a level of confidence, as required by

82 CIGNA CORPORATION - 2012 Form 10-K