Chevron 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

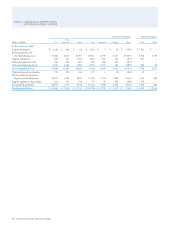

Table V Reserve Quantity Information – Continued

the ratio of proved undeveloped reserves to total proved

reserves has ranged between 37 percent and 44 percent. e

consistent completion of major capital projects has kept the

ratio in a narrow range over this time period.

Proved Reserve Quantities At December 31, 2011, proved

reserves for the company’s consolidated operations were

8.5billion BOE. (Refer to the term “Reserves” on page 8

for the denition of oil-equivalent reserves.) Approximately

23 percent of the total reserves were located in the United

States. For the company’s interests in equity aliates, proved

reserves were 2.7 billion BOE, 78percent of which were asso-

ciated with the company’s 50percent ownership in TCO.

Aside from the Tengiz Field in the TCO aliate, no

single property accounted for more than 5 percent of the

company’s total oil-equivalent proved reserves. About 22

other individual properties in the company’s portfolio of

assets each contained between 1 percent and 5 percent of

the company’s oil-equivalent proved reserves, which in the

aggregate accounted for 47 percent of the company’s total

oil-equivalent proved reserves. ese properties were geo-

graphically dispersed, located in the United States, Canada,

South America, Africa, Asia and Australia.

In the United States, total proved reserves at year-end

2011 were 1.9 billion BOE. California properties accounted

for 35 percent of the U.S. reserves, with most classied as

heavy oil. Because of heavy oil’s high viscosity and the need

to employ enhanced recovery methods, most of the com-

pany’s heavy-oil elds in California employ a continuous

steamooding process. e Gulf of Mexico region contains

24 percent of the U.S. reserves, with liquids represent-

ing about 77 percent of reserves in the Gulf. Production

operations are mostly oshore and, as a result, are also

capital intensive. Other U.S. areas represent the remaining

41 percent of U.S. reserves, with liquids accounting for about

42 percent of the total. For production of crude oil, some

elds utilize enhanced recovery methods, including water-

ood and CO2 injection.

For the three years ending December 31, 2011, the pat-

tern of net reserve changes shown in the following tables are

not necessarily indicative of future trends. Apart from acqui-

sitions, the company’s ability to add proved reserves is

aected by, among other things, events and circumstances

that are outside the company’s control, such as delays in gov-

ernment permitting, partner approvals of development plans,

changes in oil and gas prices, OPEC constraints, geopolitical

uncertainties, and civil unrest.

e company’s estimated net proved reserves of crude

oil, condensate, natural gas liquids and synthetic oil and

changes thereto for the years 2009, 2010 and 2011 are shown

in the table on the following page. e company’s estimated

net proved reserves of natural gas are shown on page 81.

78 Chevron Corporation 2011 Annual Report