Chevron 2011 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2011 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

peers. We began initial production of

the Platong II natural gas project in

Thailand. The Angola liquefi ed natural

gas (LNG) project and Usan deepwater

development offshore Nigeria are

expected to begin production in 2012.

Big Foot and Jack/St. Malo in the U.S.

Gulf of Mexico are on schedule to

come

online in 2014. We also advanced

our two world-class LNG projects in

Western Australia. Gorgon achieved

key construction milestones and is

on track for a 2014 startup, and we

broke ground on Wheatstone, with

a planned startup in 2016.

We expanded our strategic position

in natural gas in North America and

Europe. Notably in 2011, we closed

our acquisition of Atlas Energy in the

northeastern United States, drilled

our fi rst shale gas wells in Poland and

Canada, and completed an agreement

to assess shale opportunities in

southern China.

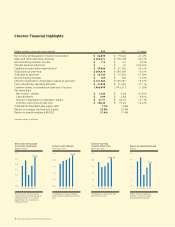

and we delivered a strongly competi-

tive 21.6 percent return on capital

employed. We raised our dividend

twice in 2011, marking the 24th

consecutive year of increases.

We generated a total stockholder

return of 20.3 percent, leading

our peer group in 2011 and

over

the past fi ve- and 10-year periods.

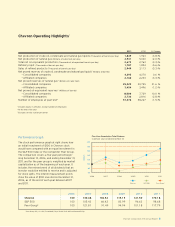

Our fi nancial performance refl ected

outstanding operating results. In

the upstream, we ranked No. 1 in

earnings per barrel relative to our

2011 was a record year for our

fi nancial

performance. Net income

was $26.9 billion on sales and other

operating revenues of $244.4 billion,

Chevron delivered outstanding fi nancial and operating results in 2011. Even during turbulent

economic times, we achieved record earnings, advanced our industry-leading queue of major

capital projects to sustain long-term production growth and largely completed the global

restructuring of our downstream business. And Chevron once again delivered superior

returns for our stockholders.

To Our Stockholders