Chevron 2011 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2011 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

12 Chevron Corporation 2011 Annual Report

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

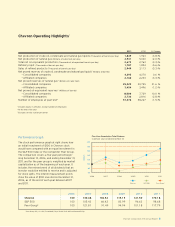

e company’s worldwide net oil-equivalent production

in 2011 averaged 2.673 million barrels per day. About one-

fth of the company’s net oil-equivalent production in 2011

occurred in the OPEC-member countries of Angola, Nigeria,

Venezuela and the Partitioned Zone between Saudi Arabia

and Kuwait. OPEC quotas had no eect on the company’s

net crude oil production in 2011 or 2010. At their December

2011 meeting, members of OPEC supported maintaining

the current production level of 30 million barrels per day

and made no change to the production quotas in eect since

December 2008.

e company estimates that oil-equivalent production

in 2012 will average approximately 2.680 million barrels per

day based on the average Brent price of $111 per barrel for

the full-year 2011. is estimate is subject to many factors

and uncertainties, including quotas that may be imposed

by OPEC, price eects on entitlement volumes, changes in

scal terms or restrictions on the scope of company opera-

tions, delays in project startups, uctuations in demand for

natural gas in various markets, weather conditions that may

shut in production, civil unrest, changing geopolitics, delays

in completion of maintenance turnarounds, greater-than-

expected declines in production from mature elds, or other

disruptions to operations. e outlook for future production

levels is also aected by the size and number of economic

investment opportunities and, for new large-scale projects, the

time lag between initial exploration and the beginning of pro-

duction. Investments in upstream projects generally begin well

in advance of the start of the associated crude oil and natural

gas production. A signicant majority of Chevron’s upstream

investment is made outside the United States.

Refer to the “Results of Operations” section on pages

14 through 15 for additional discussion of the company’s

upstream business.

Refer to Table V beginning on page 75 for a tabulation of

the company’s proved net oil and gas reserves by geographic

area at the beginning of 2009 and each year-end from 2009

through 2011, and an accompanying discussion of major

changes to proved reserves by geographic area for the three-

year period ending December 31, 2011.

In early November 2011, while drilling a development

well in the deepwater Frade Field in Brazil, an unantici-

pated pressure spike caused oil to migrate from the well

bore through a series of ssures to the sea oor, emitting

approximately 2,400 barrels of oil. e resulting surface

sheen has since dissipated, and there have been no coastal or

wildlife impacts. Upon detection, the company immediately

took steps to stop the release. Chevron’s emergency plan,

approved by the Brazilian environment and natural resources

regulatory agency IBAMA, was implemented according to

the law and industry standards. e source of the seep was

contained within four days. As of December 31, 2011, the

nancial impact of the incident was not material to the com-

pany’s annual net income. However, the company’s ultimate

exposure related to nes and penalties is not currently deter-

minable, and could be signicant to net income in any one

period.

Downstream Earnings for the downstream segment are

closely tied to margins on the rening, manufacturing and

marketing of products that include gasoline, diesel, jet fuel,

lubricants, fuel oil, fuel and lubricant additives, and petro-

chemicals. Industry margins are sometimes volatile and can

be aected by the global and regional supply-and-demand

balance for rened products and petrochemicals and by

changes in the price of crude oil, other renery and petro-

chemical feedstocks, and natural gas. Industry margins can

also be inuenced by inventory levels, geopolitical events,

costs of materials and services, renery or chemical plant

capacity utilization, maintenance programs, and disruptions

at reneries or chemical plants resulting from unplanned out-

ages due to severe weather, res or other operational events.

Other factors aecting protability for downstream

operations include the reliability and eciency of the com-

pany’s rening, marketing and petrochemical assets, the

eectiveness of its crude oil and product supply functions,

and the volatility of tanker-charter rates for the company’s

shipping operations, which are driven by the industry’s

demand for crude oil and product tankers. Other factors

beyond the company’s control include the general level of

ination and energy costs to operate the company’s rening,

marketing and petrochemical assets.

e company’s most signicant marketing areas are the

West Coast of North America, the U.S. Gulf Coast, Asia and

southern Africa. Chevron operates or has signicant ownership

interests in reneries in each of these areas. In 2011, the com-

pany’s margins improved over 2010, supported by higher global

product demand and tighter global rened product supplies.

e company made further progress during 2011 implement-

ing the previously announced restructuring of its downstream

businesses, including the employee-reduction programs for

the United States and international operations. Approximately

2,300 employees in the downstream operations are currently

expected to be released under these programs. About 2,100

employees have been released through December 31, 2011,

with the programs being substantially completed. Substan-

tially all of the remaining employees designated for release

under the programs are expected to leave in 2012. About 900

of the aected employees were located in the United States.

Refer to Note 23 of the Consolidated Financial Statements, on

pages 63 through 64, for further discussion.