Chevron 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2011 Annual Report 53

Uncertain Income Tax Positions Under accounting standards

for uncertainty in income taxes (ASC 740-10), a company

recognizes a tax benet in the nancial statements for an

uncertain tax position only if management’s assessment is

that the position is “more likely than not” (i.e., a likelihood

greater than 50 percent) to be allowed by the tax jurisdiction

based solely on the technical merits of the position. e term

“tax position” in the accounting standards for income taxes

refers to a position in a previously led tax return or a posi-

tion expected to be taken in a future tax return that is

reected in measuring current or deferred income tax assets

and liabilities for interim or annual periods.

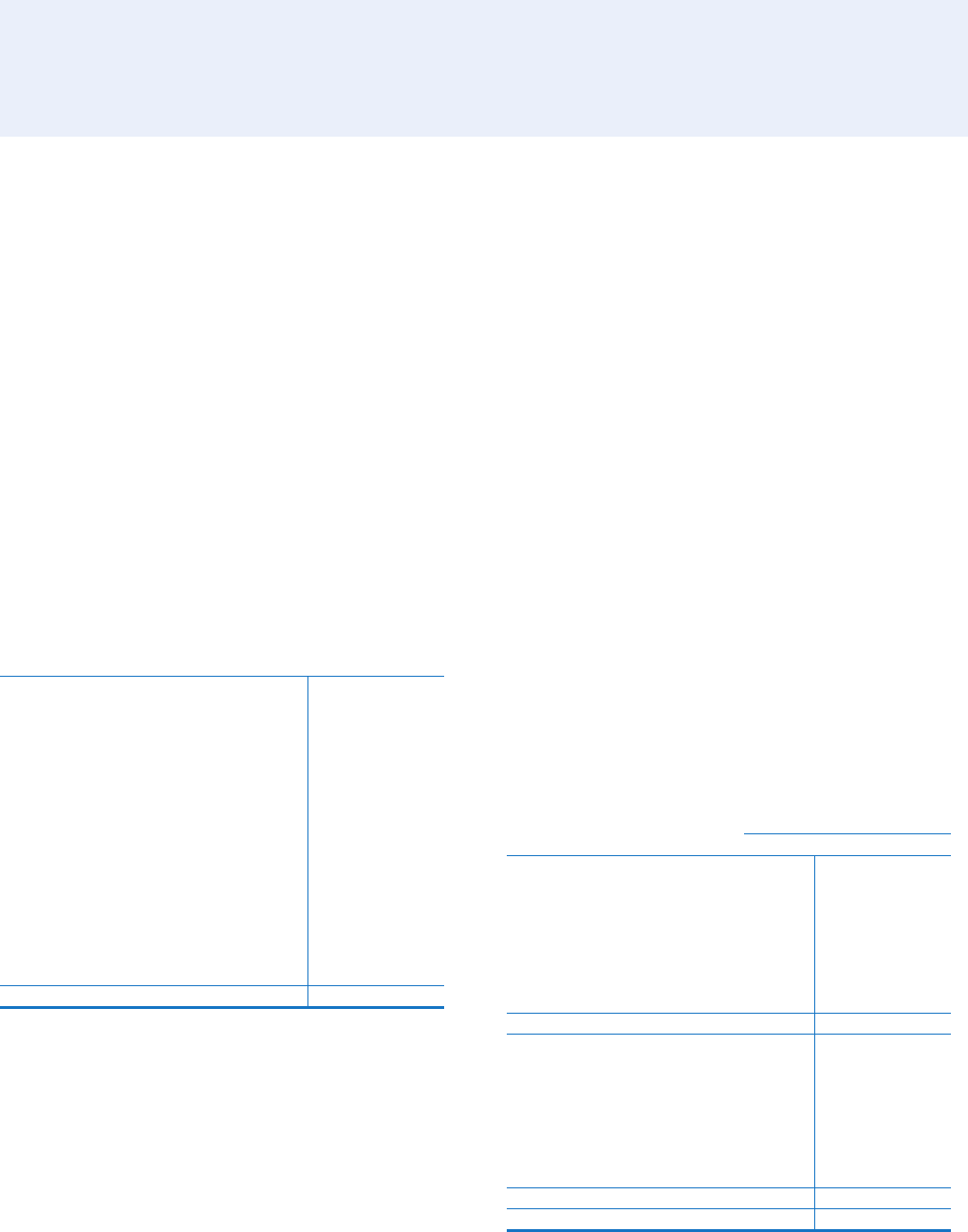

e following table indicates the changes to the compa-

ny’s unrecognized tax benets for the years ended December

31, 2011, 2010 and 2009. e term “unrecognized tax ben-

ets” in the accounting standards for income taxes refers to

the dierences between a tax position taken or expected to be

taken in a tax return and the benet measured and recognized

in the nancial statements. Interest and penalties are not

included.

2011 2010 2009

Balance at January 1 $ 3,507 $ 3,195 $ 2,696

Foreign currency eects (2) 17 (1)

Additions based on tax positions

taken in current year 469 334 459

Reductions based on tax positions

taken in current year – – –

Additions/reductions resulting from

current-year asset acquisitions/sales (41) – –

Additions for tax positions taken

in prior years 236 270 533

Reductions for tax positions taken

in prior years (366) (165) (182)

Settlements with taxing authorities

in current year (318) (136) (300)

Reductions as a result of a lapse

of the applicable statute of limitations (4) (8) (10)

Balance at December 31 $ 3,481 $ 3,507 $ 3,195

Approximately 80 percent of the $3,481 of unrecog-

nized tax benets at December 31, 2011, would have an

impact on the eective tax rate if subsequently recognized.

Certain of these unrecognized tax benets relate to tax

carryforwards that may require a full valuation allowance

atthe time of any such recognition.

Tax positions for Chevron and its subsidiaries and

aliates are subject to income tax audits by many tax juris-

dictions throughout the world. For the company’s major tax

jurisdictions, examinations of tax returns for certain prior tax years

had not been completed as of December 31, 2011. For these

jurisdictions, the latest years for which income tax examinations

had been nalized were as follows: United States – 2007,

Nigeria – 2000, Angola – 2001, Saudi Arabia – 2003 and

Kazakhstan – 2005.

e company engages in ongoing discussions with tax

authorities regarding the resolution of tax matters in the various

jurisdictions. Both the outcome of these tax matters and the

timing of resolution and/or closure of the tax audits are highly

uncertain. However, it is reasonably possible that developments

on tax matters in certain tax jurisdictions may result in signi-

cant increases or decreases in the company’s total unrecognized

tax benets within the next 12 months. Given the number of

years that still remain subject to examination and the number

of matters being examined in the various tax jurisdictions, the

company is unable to estimate the range of possible adjust-

ments to the balance of unrecognized tax benets.

On the Consolidated Statement of Income, the company

reports interest and penalties related to liabilities for uncertain

tax positions as “Income tax expense.” As of December 31,

2011, accruals of $118 for anticipated interest and penalty

obligations were included on the Consolidated Balance Sheet,

compared with accruals of $225 as of year-end 2010. Income

tax expense (benet) associated with interest and penalties was

$(64), $40 and $(20) in 2011, 2010 and 2009, respectively.

Taxes Other an on Income

Year ended December 31

2011 2010 2009

United States

Excise and similar taxes on

products and merchandise $ 4,199 $ 4,484 $ 4,573

Import duties and other levies 4 – (4)

Property and other

miscellaneous taxes 726 567 584

Payroll taxes 236 219 223

Taxes on production 308 271 135

Total United States 5,473 5,541 5,511

International

Excise and similar taxes on

products and merchandise 3,886 4,107 3,536

Import duties and other levies 3,511 6,183 6,550

Property and other

miscellaneous taxes 2,354 2,000 1,740

Payroll taxes 148 133 134

Taxes on production 256 227 120

Total International 10,155 12,650 12,080

Total taxes other than on income $ 15,628 $ 18,191 $ 17,591

Note 15 Taxes – Continued