Chevron 2011 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2011 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

14 Chevron Corporation 2011 Annual Report

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

350,000 total acres in the Antrim and Collingwood/Utica

Shale formations. Additional asset acquisitions in 2011

expanded the company’s holdings in the Marcellus and

Utica to approximately 700,000 and 600,000 total acres,

respectively.

Downstream

Africa During 2011, the company completed the sale of cer-

tain marketing businesses in ve countries in Africa.

Caribbean and Latin America In 2011, the company

completed the sale of its fuels marketing and aviation busi-

nesses in 16 countries in the Caribbean and Latin America.

In fourth quarter 2011, the company signed agreements to

sell certain fuels marketing and aviation businesses in the

Central Caribbean. e company expects to complete these

sales in 2012 following receipt of required local regulatory

and government approvals.

Europe In August 2011, the company completed the sale

of its rening and marketing assets in the United Kingdom

and Ireland, including the Pembroke Renery.

Singapore In February 2012, the company reached a

nal investment decision to signicantly increase the capacity

of the existing additives plant in Singapore.

United States In January 2011, the company announced

the nal investment decision on a $1.4 billion project to

construct a base oil manufacturing facility at the Pascagoula,

Mississippi, renery. e facility is expected to produce

approximately 25,000 barrels per day of premium base oil.

Other

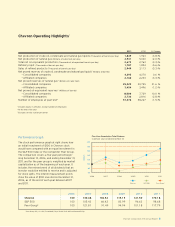

Common Stock Dividends e quarterly common stock

dividend increased by 8.3 percent in April 2011 and by

3.8 percent in October 2011, to $0.81 per common share,

making 2011 the 24th consecutive year that the company

increased its annual dividend payment.

Common Stock Repurchase Program e company pur-

chased $4.25 billion of its common stock in 2011 under its

share repurchase program. e program began in 2010 and

has no set term or monetary limits.

Results of Operations

Major Operating Areas e following section presents the

results of operations for the company’s business segments –

Upstream and Downstream – as well as for “All Other.”

Earnings are also presented for the U.S. and international

geographic areas of the Upstream and Downstream business

segments. Refer to Note 11, beginning on page 45, for a

discussion of the company’s “reportable segments,” as dened

in accounting standards forsegment reporting (Accounting

Standards Codication (ASC) 280). is section should also

be read in conjunction with the discussion in “Business

Environment and Outlook” on pages 10 through 13.

U.S. Upstream

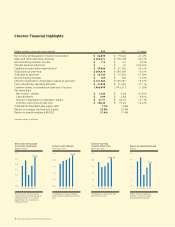

Millions of dollars 2011 2010 2009

Earnings $ 6,512 $ 4,122 $ 2,262

U.S. upstream earnings of $6.51 billion in 2011 increased

$2.4 billion from 2010. e benet of higher crude oil real-

izations increased earnings by $2.8 billion between periods.

Partly osetting this eect were lower net oil-equivalent pro-

duction which decreased earnings by about $400 million and

higher operating expenses of $200 million.

U.S. upstream earnings of $4.1 billion in 2010 increased

$1.9 billion from 2009. Higher prices for crude oil and natu-

ral gas increased earnings by $2.1 billion between periods.

Partly osetting these eects were higher operating expenses

of $200 million, in part due to the Gulf of Mexico drilling

moratorium. Lower exploration expenses were essentially o-

set by higher tax items and higher depreciation expenses.

e company’s average realization for U.S. crude oil and

natural gas liquids in 2011 was $97.51 per barrel, compared

with $71.59 in 2010 and $54.36 in 2009. e average

natural gas realization was $4.04 per thousand cubic feet in

2011, compared with $4.26 and $3.73 in 2010 and 2009,

respectively.

Net oil-equivalent production in 2011 averaged 678,000

barrels per day, down 4 percent from 2010 and 5 percent

from 2009. Between 2011 and 2010, the decrease in produc-

tion was associated with normal eld declines and

maintenance-related downtime. Partially osetting this

decrease were new production from acquisitions in the Mar-

cellus Shale and increases at the Perdido project in the Gulf of

Mexico. Natural eld declines between 2010 and 2009 were

0

1500

1200

900

600

300

Exploration Expenses

Millions of dollars

United States

International

Exploration expenses increased

6 percent from 2010 mainly due

to higher geological and

geophysical expense in the

international segment.

0807 09 10 11

$1,216

0.0

25.0

15.0

20.0

10.0

5.0

Worldwide Upstream Earnings

Billions of dollars

Earnings increased in 2011 on

higher average prices for crude oil.

United States

International

0807 09 10 11

$24.8