Chevron 2011 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2011 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

10 Chevron Corporation 2011 Annual Report

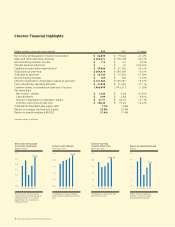

Key Financial Results

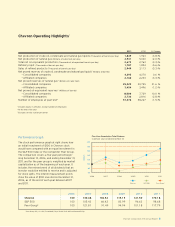

Millions of dollars, except per-share amounts 2011 2010 2009

Net Income Attributable to

Chevron Corporation $ 26,895 $ 19,024 $ 10,483

Per Share Amounts:

Net Income Attributable to

Chevron Corporation

– Basic $ 13.54 $ 9.53 $ 5.26

– Diluted $ 13.44 $ 9.48 $ 5.24

Dividends $ 3.09 $ 2.84 $ 2.66

Sales and Other

Operating Revenues $ 244,371 $ 198,198 $ 167,402

Return on:

Capital Employed 21.6% 17.4% 10.6%

Stockholders’ Equity 23.8% 19.3% 11.7%

Earnings by Major Operating Area

Millions of dollars 2011 2010 2009

Upstream1

United States $ 6,512 $ 4,122 $ 2,262

International 18,274 13,555 8,670

Total Upstream 24,786 17,677 10,932

Downstream1

United States 1,506 1,339 (121)

International 2,085 1,139 594

Total Downstream 3,591 2,478 473

All Other (1,482) (1,131) (922)

Net Income Attributable to

Chevron Corporation2,3 $ 26,895 $ 19,024 $ 10,483

1 2009 information has been revised to conform with the 2011 and 2010 segment

presentation.

2 Includes foreign currency eects: $ 121 $ (423) $ (744)

3 Also referred to as “earnings” in the discussions that follow.

Refer to the “Results of Operations” section beginning

on page 14 for a discussion of nancial results by major

operating area for the three years ended December 31, 2011.

Business Environment and Outlook

Chevron is a global energy company with substantial busi-

ness activities in the following countries: Angola, Argentina,

Australia, Azerbaijan, Bangladesh, Brazil, Cambodia,

Canada, Chad, China, Colombia, Democratic Republic of

the Congo, Denmark, Indonesia, Kazakhstan, Myanmar, the

Netherlands, Nigeria, Norway, the Partitioned Zone between

Saudi Arabia and Kuwait, the Philippines, Republic of the

Congo, Singapore, South Africa, South Korea, ailand,

Trinidad and Tobago, the United Kingdom, the United

States, Venezuela and Vietnam.

Earnings of the company depend mostly on the prot-

ability of its upstream and downstream business segments.

e single biggest factor that aects the results of operations

for the company is movement in the price of crude oil. In the

downstream business, crude oil is the largest cost component

of rened products. Seasonality is not a primary driver of

changes in the company’s quarterly earnings during the year.

To sustain its long-term competitive position in the

upstream business, the company must develop and replenish

an inventory of projects that oer attractive nancial returns

for the investment required. Identifying promising areas for

exploration, acquiring the necessary rights to explore for and

to produce crude oil and natural gas, drilling successfully,

and handling the many technical and operational details in

a safe and cost-eective manner are all important factors in

this eort. Projects often require long lead times and large

capital commitments.

e company’s operations, especially upstream, can also

be aected by changing economic, regulatory and political

environments in the various countries in which it operates,

including the United States. From time to time, certain

governments have sought to renegotiate contracts or impose

additional costs on the company. Governments may attempt

to do so in the future. Civil unrest, acts of violence or

strained relations between a government and the company or

other governments may impact the company’s operations or

investments. ose developments have at times signicantly

aected the company’s operations and results and are care-

fully considered by management when evaluating the level of

current and future activity in such countries.

e company also continually evaluates opportunities to

dispose of assets that are not expected to provide sucient

long-term value or to acquire assets or operations comple-

mentary to its asset base to help augment the company’s

nancial performance and growth. Refer to the “Results of

Operations” section beginning on page 14 for discussions of

net gains on asset sales during 2011. Asset dispositions and

restructurings may also occur in future periods and could

result in signicant gains or losses.

e company closely monitors developments in the

nancial and credit markets, the level of worldwide economic

activity, and the implications for the company of movements

in prices for crude oil and natural gas. Management takes

these developments into account in the conduct of daily

operations and for business planning.

Comments related to earnings trends for the company’s

major business areas are as follows:

Upstream Earnings for the upstream segment are closely

aligned with industry price levels for crude oil and natural

gas. Crude oil and natural gas prices are subject to external

factors over which the company has no control, including

product demand connected with global economic conditions,

industry inventory levels, production quotas imposed by the

Organization of Petroleum Exporting Countries (OPEC),

weather-related damage and disruptions, competing fuel

prices, and regional supply interruptions or fears thereof that

Management’s Discussion and Analysis of

Financial Condition and Results of Operations