Chevron 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 Chevron Corporation 2011 Annual Report

Notes to the Consolidated Financial Statements

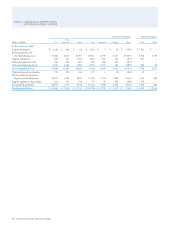

Millions of dollars, except per-share amounts

the company made payments of $74 associated with these lia-

bilities. e majority of the payments were in Downstream.

e balance at December 31, 2011, was classied as a current

liability on the Consolidated Balance Sheet.

Amounts Before Tax

Balance at January 1, 2011 $ 138

Adjustments (28)

Payments (74)

Balance at December 31, 2011 $ 36

Note 24

Other Contingencies and Commitments

Income Taxes e company calculates its income tax expense

and liabilities quarterly. ese liabilities generally are subject

to audit and are not nalized with the individual taxing

authorities until several years after the end of the annual

period for which income taxes have been calculated. Refer to

Note 15, beginning on page 51, for a discussion of the

periodsfor which tax returns have been audited for the com-

pany’s major tax jurisdictions and a discussion for all tax

jurisdictions of the dierences between the amount of tax

benets recognized in the nancial statements and the

amount taken or expected to be taken in a tax return. e

company does not expect settlement of income tax liabilities

associated with uncertain tax positions to have a material

eect on its results of operations, consolidated nancial

position or liquidity.

Guarantees e company’s guarantee of approximately $600

is associated with certain payments under a terminal use

agreement entered into by a company aliate. e termi-

nal commenced operations in third quarter 2011. Over the

approximate 16-year term of the guarantee, the maximum

guarantee amount will be reduced over time as certain fees

are paid by the aliate. ere are numerous cross-indemnity

agreements with the aliate and the other partners to permit

recovery of amounts paid under the guarantee. Chevron has

recorded no liability for its obligation under this guarantee.

Indemnications e company provided certain indemnities

of contingent liabilities of Equilon and Motiva to Shell and

Saudi Rening, Inc., in connection with the February 2002

sale of the company’s interests in those investments. rough

the end of 2011, the company paid $48 under these indem-

nities and continues to be obligated up to $250 for possible

additional indemnication payments in the future.

e company has also provided indemnities relating to

contingent environmental liabilities of assets originally con-

tributed by Texaco to the Equilon and Motiva joint ventures

and environmental conditions that existed prior to the for-

mation of Equilon and Motiva, or that occurred during the

period of Texaco’s ownership interest in the joint ventures.

In general, the environmental conditions or events that are

subject to these indemnities must have arisen prior to Decem-

ber 2001. Claims had to be asserted by February 2009 for

Equilon indemnities and must be asserted no later than Feb-

ruary 2012 for Motiva indemnities. In February 2012, Motiva

Enterprises LLC delivered a letter to the company purporting

to preserve unmatured claims for certain Motiva indemnities.

e letter itself provides no estimate of the ultimate claim

amount. Management does not believe this letter or any other

information provides a basis to estimate the amount, if any, of

a range of loss or potential range of loss with respect to either

the Equilon or the Motiva indemnities. Under the terms of

these indemnities, there is no maximum limit on the amount

of potential future payments. e company posts no assets as

collateral and has made no payments under the indemnities.

e amounts payable for the indemnities described in

the preceding paragraph are to be net of amounts recov-

ered from insurance carriers and others and net of liabilities

recorded by Equilon or Motiva prior to September 30, 2001,

for any applicable incident.

In the acquisition of Unocal, the company assumed

certain indemnities relating to contingent environmental

liabil ities associated with assets that were sold in 1997. e

acquirer of those assets shared in certain environmental

remediation costs up to a maximum obligation of $200, which

had been reached at December 31, 2009. Under the indemni-

cation agreement, after reaching the $200 obligation, Chevron

is solely responsible until April 2022, when the indemnica-

tion expires. e environmental conditions or events that are

subject to these indemnities must have arisen prior to the sale

of the assets in 1997.

Although the company has provided for known obliga-

tions under this indemnity that are probable and reasonably

estimable, the amount of additional future costs may be

material to results of operations in the period in which they

are recognized. e company does not expect these costs will

have a material eect on its consolidated nancial position

orliquidity.

Long-Term Unconditional Purchase Obligations and Commit-

ments, Including roughput and Take-or-Pay Agreements e

company and its subsidiaries have certain other contingent

liabilities with respect to long-term unconditional purchase

obligations and commitments, including throughput and

take-or-pay agreements, some of which relate to suppliers’

nancing arrangements. e agreements typically provide

goods and services, such as pipe line and storage capacity, drill-

ing rigs, utilities, and petroleum products, to be used or sold

in the ordinary course of the company’s business. e aggre-

gate approximate amounts of required payments under these

Note 23 Restructuring and Reorganization – Continued