Chevron 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2011 Annual Report 41

Note 7

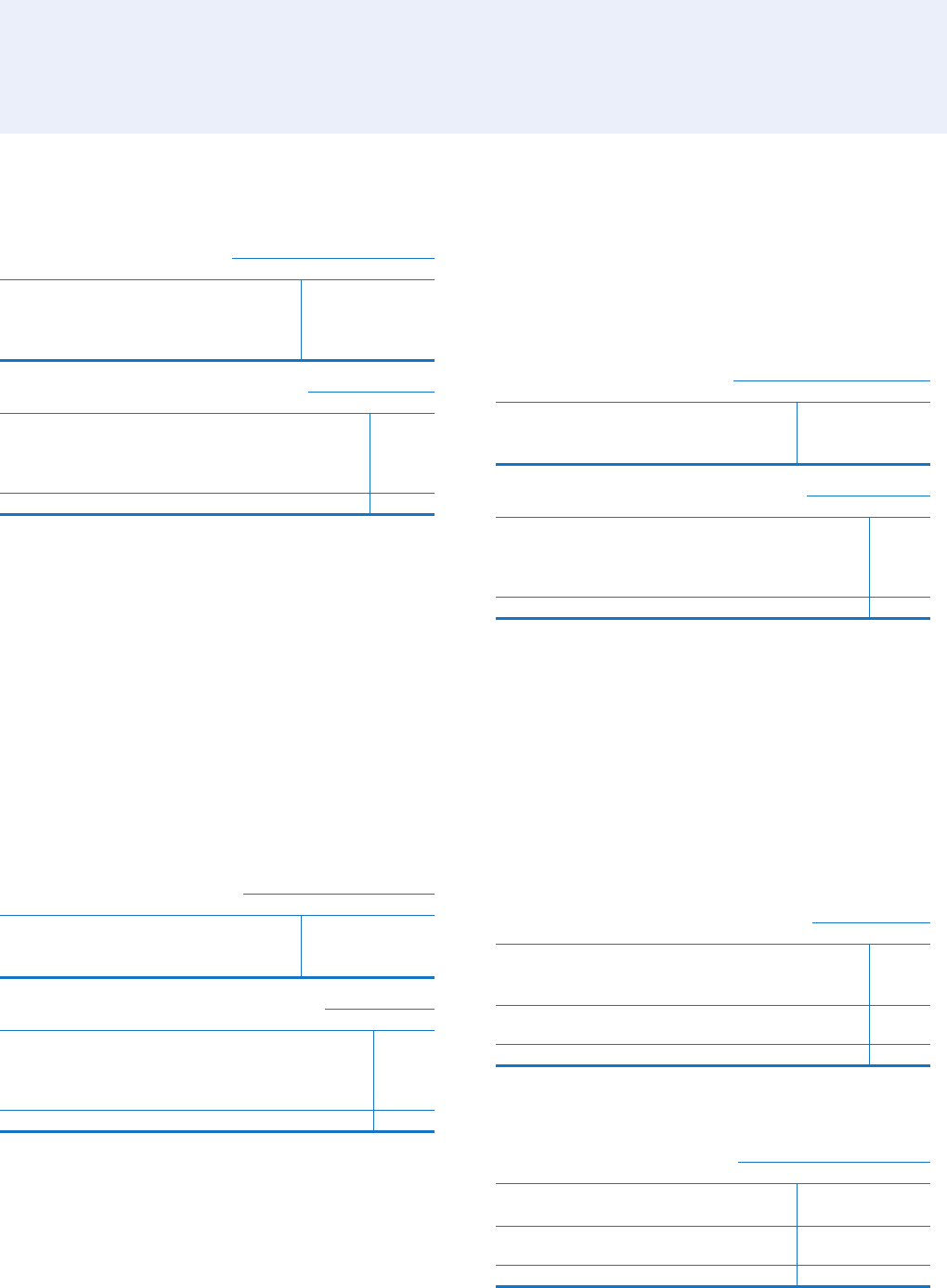

Summarized Financial Data — Tengizchevroil LLP

Chevron has a 50 percent equity ownership interest in

Tengizchevroil LLP (TCO). Refer to Note 12, on page 47,

foradiscussion of TCO operations.

Summarized nancial information for 100 percent of

TCO is presented in the following table:

Year ended December 31

2011 2010 2009

Sales and other operating revenues $ 25,278 $ 17,812 $ 12,013

Costs and other deductions 10,941 8,394 6,044

Net income attributable to TCO 10,039 6,593 4,178

At December 31

2011 2010

Current assets $ 3,477 $ 3,376

Other assets 11,619 11,813

Current liabilities 2,995 2,402

Other liabilities 3,759 4,130

Total TCO net equity 8,342 8,657

Note 8

Lease Commitments

Certain noncancelable leases are classied as capital leases,

and the leased assets are included as part of “Properties, plant

and equipment, at cost” on the Consolidated Balance Sheet.

Such leasing arrangements involve crude oil production

and processing equipment, service stations, bareboat char-

ters, oce buildings, and other facilities. Other leases are

classied as operating leases and are not capitalized. e

payments on such leases are recorded as expense. Details of

the capitalized leased assets are as follows:

At December 31

2011 2010

Upstream $ 585 $ 561

Downstream 316 316

All Other – 169

Tot a l 901 1,046

Less: Accumulated amortization 568 573

Net capitalized leased assets $ 333 $ 473

Rental expenses incurred for operating leases during

2011, 2010 and 2009 were as follows:

Year ended December 31

2011 2010* 2009*

Minimum rentals $ 892 $ 931 $ 933

Contingent rentals 11 10 7

Tot a l 903 941 940

Less: Sublease rental income 39 41 41

Net rental expense $ 864 $ 900 $ 899

*

Prior years have been adjusted to exclude cost of certain charters from rental expenses.

e summarized nancial information for CUSA and its

consolidated subsidiaries is as follows:

Year ended December 31

2011 2010 2009

Sales and other operating

revenues $ 187,917 $ 145,381 $ 121,553

Total costs and other deductions 178,498 139,984 120,053

Net income attributable to CUSA 6,899 4,159 1,141

At December 31

2011 2010

Current assets $ 34,478 $ 29,211

Other assets 47,556 35,294

Current liabilities 19,082 18,098

Other liabilities 26,153 16,785

Total CUSA net equity 36,799 29,622

Memo: Total debt $ 14,763 $ 8,284

Note 6

Summarized Financial Data — Chevron Transport Corporation Ltd.

Chevron Transport Corporation Ltd. (CTC), incorporated in

Bermuda, is an indirect, wholly owned subsidiary of Chevron

Corporation. CTC is the principal operator of Chevron’s inter-

national tanker eet and is engaged in the marine transportation

of crude oil and rened petroleum products. Most of CTC’s

shipping revenue is derived from providing transportation serv-

ices to other Chevron companies. Chevron Corporation has

fully and unconditionally guaranteed this subsidiary’s obliga-

tions in connection with certain debt securities issued by a third

party. Summarized nancial information for CTC and its

consolidated subsidiaries is as follows:

Year ended December 31

2011 2010 2009

Sales and other operating revenues $ 793 $ 885 $ 683

Total costs and other deductions 974 1,008 810

Net loss attributable to CTC (177) (116) (124)

At December 31

2011 2010*

Current assets $ 290 $ 309

Other assets 228 201

Current liabilities 114 101

Other liabilities 346 175

Total CTC net equity 58 234

*2010 current assets and other liabilities conformed with 2011 presentation.

ere were no restrictions on CTC’s ability to pay divi-

dends or make loans or advances at December 31, 2011.

Note 5 Summarized Financial Data – Chevron U.S.A. Inc. – Continued