Chevron 2011 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2011 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2011 Annual Report 15

mostly oset by increased production from the Tahiti Field.

e net liquids component of oil-equivalent production for

2011 averaged 465,000 barrels per day, down 5 percent from

2010 and 4 percent from 2009. Net natural gas production

averaged about 1.3 billion cubic feet per day in 2011, down

approximately 3 percent from 2010 and about 9 percent

from 2009. Refer to the “Selected Operating Data” table on

page 18 for a three-year comparative of production volumes

in the United States.

International Upstream

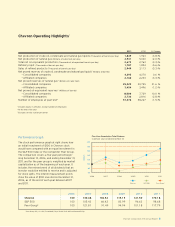

Millions of dollars 2011 2010 2009

Earnings* $ 18,274 $ 13,555 $ 8,670

*Includes foreign currency eects: $ 211 $ (293) $ (578)

International upstream earnings of $18.3 billion in 2011

increased $4.7 billion from 2010. Higher prices for crude oil

increased earnings by $7.1 billion. is benet was partly

oset by higher tax items of about $1.7 billion and higher

operating expenses, including fuel, of about $1.0 billion.

Foreign currency eects increased earnings by $211 million

in 2011, compared with a decrease of $293 million a year

earlier.

Earnings of $13.6 billion in 2010 increased $4.9 billion

from 2009. Higher prices for crude oil and natural gas

increased earnings by $4.3 billion, and an increase in net oil-

equivalent production in the 2010 period beneted income

by about $1.2 billion. is net benet was partly oset by

higher operating expenses of $500 million. A favorable

change in tax items of about $450 million was mostly oset

by higher depreciation expenses. e 2009 period included

gains of about $500 million on asset sales and tax items

related to the Gorgon Project in Australia. Foreign currency

eects decreased earnings by $293 million in the 2010

period, compared with a reduction of $578 million a year

earlier, primarily reecting noncash losses on balance sheet

remeasurement.

e company’s average realization for international crude

oil and natural gas liquids in 2011 was $101.53 per barrel,

compared with $72.68 in 2010 and $55.97 in 2009. e

average natural gas realization was $5.39 per thousand cubic

feet in 2011, compared with $4.64 and $4.01 in 2010 and

2009, respectively.

International net oil-equivalent production of 2.0 mil-

lion barrels per day in 2011 decreased about 3 percent from

2010 and remained relatively at with 2009. e volumes in

2011 and 2010 include synthetic oil that was reported in

2009 as production from oil sands in Canada. Absent price

eects on entitlement volumes, net oil-equivalent production

decreased 1 percent in 2011 and increased 5 percent in 2010,

when compared with the prior year’s production.

e net liquids component of international oil-equivalent

production was about 1.4 million barrels per day in 2011,

a decrease of approximately 3 percent from 2010 and an

increase of approximately 2 percent from 2009. International

net natural gas production of 3.7 billion cubic feet per day in

2011 was down 2 percent from 2010 and up 2 percent from

2009.

Refer to the “Selected Operating Data” table, on page 18,

for a three-year comparative of international production vol-

umes.

U.S. Downstream

Millions of dollars 2011 2010 2009

Earnings $ 1,506 $ 1,339 $ (121)

U.S. downstream operations earned $1.5 billion in 2011,

compared with $1.3 billion in 2010. Earnings beneted by

$300 million from improved margins on rened products,

$200 million from higher earnings from the 50 percent-owned

Chevron Phillips Chemical Company LLC (CPChem), and

$50 million from the absence of 2010 charges related to

employee reductions. ese benets were partly oset by the

absence of a $400 million gain on the sale of the company’s

ownership interest in the Colonial Pipeline Company recog-

nized in 2010.

Earnings increased $1.5 billion in 2010 from 2009.

Improved margins on rened products increased earnings

by about $550 million. Also contributing to the increase

was the nearly $400 million gain on the sale of the com-

pany’s ownership interest in the Colonial Pipeline Company.

Higher earnings from chemicals operations increased earn-

ings by about $300 million, largely from improved margins

at CPChem.

Rened product sales of 1.26 million barrels per day in

2011 declined 7 percent, mainly due to lower gasoline, gas

oil, and kerosene sales. Sales volumes of rened products were

1.35 million barrels per day in 2010, a decrease of 4 percent

from 2009. e decline was mainly in gasoline and jet fuel

sales. U.S. branded gasoline sales decreased to 514,000 bar-

rels per day in 2011, representing approximately 10 percent

and 17 percent declines from 2010 and 2009, respectively.

e decline in 2011, relative to 2010 and 2009, was primarily

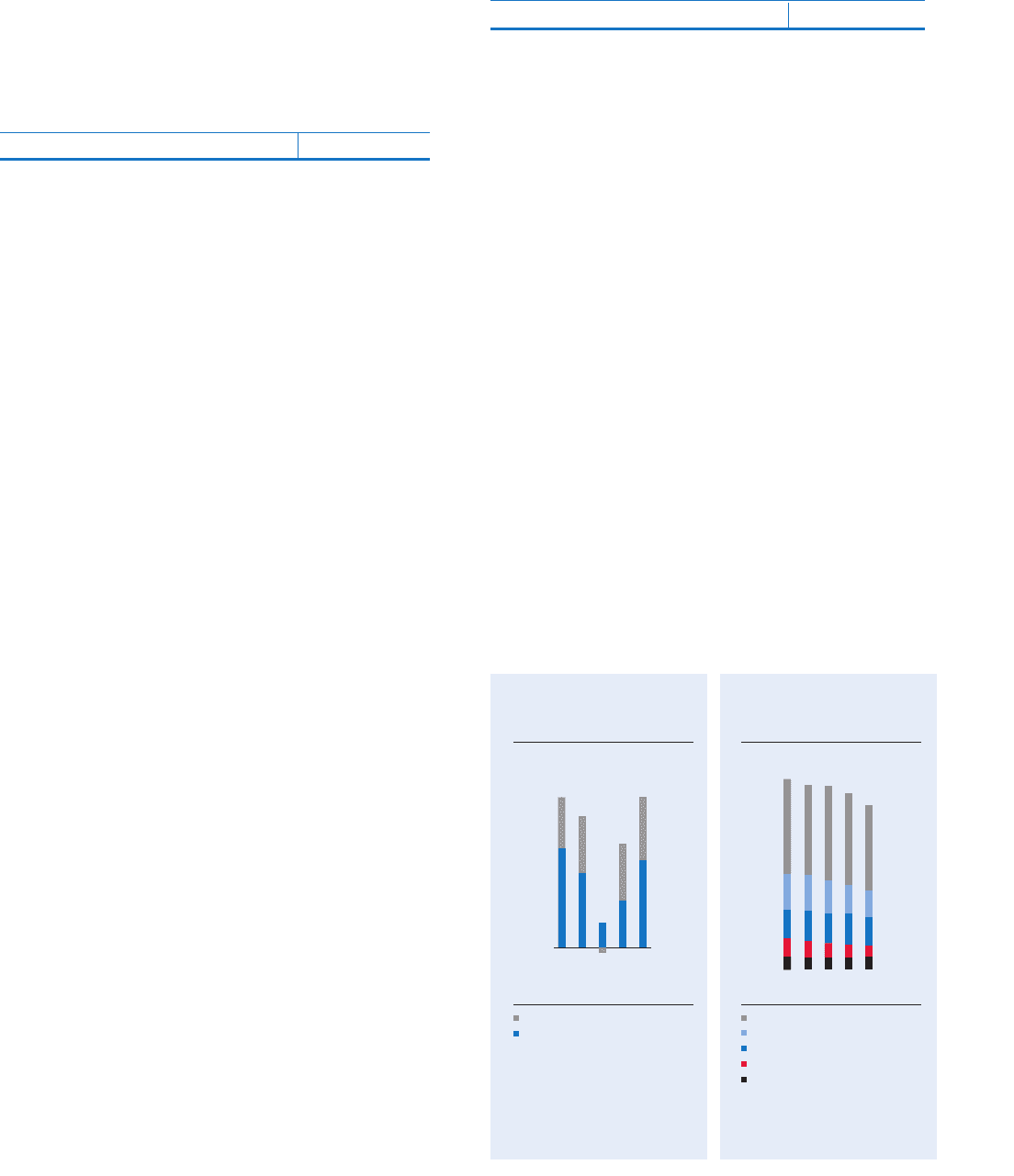

Downstream earnings increased

45 percent from 2010 due to higher

margins on the sale of refined

products, gains on asset sales

and higher earnings from CPChem.

*Includes equity in affiliates.

United States

International

-0.5

4.5

3.5

2.5

0.5

1.5

Worldwide Downstream

Earnings*

Billions of dollars

$3.6

0807 09 10 11

0

1600

1200

800

400

U.S. Gasoline & Other

Refined Product Sales

Thousands of barrels per day

Gasoline

Jet Fuel

Gas Oils & Kerosene

Residual Fuel Oil

Other

Refined-product sales volumes

decreased about 7 percent from

2010 on lower sales of gasoline and

lower sales of gas oils and kerosene.

1,257

0807 09 10 11