Avis 2014 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2014 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F-32

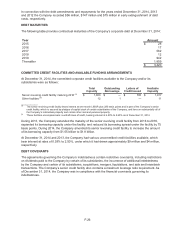

15. Stockholders’ Equity

Cash Dividend Payments

During 2014, 2013 and 2012, the Company did not declare or pay any cash dividends. The Company’s

ability to pay dividends to holders of its common stock is limited by the Company’s senior credit facility, the

indentures governing its senior notes and its vehicle financing programs.

Share Repurchases

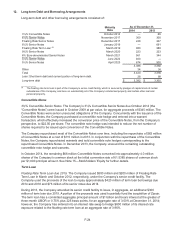

The Company obtained Board approval to repurchase up to $635 million of its common stock under a plan

originally approved in August 2013 and subsequently expanded in April and October 2014. During 2014, the

Company repurchased approximately 5.7 million shares of common stock at a cost of approximately $300

million under the program. During 2013, the Company repurchased approximately 1.6 million shares of

common stock at a cost of approximately $50 million under the program. The Company did not repurchase

any of its common stock during 2012.

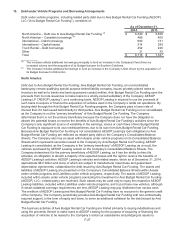

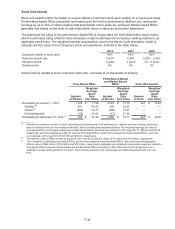

Convertible Note Hedge and Warrants

In 2009, the Company purchased a convertible note hedge for approximately $95 million, to potentially

reduce the net number of shares required to be issued upon conversion of the Company’s 3½% Convertible

Notes. Concurrently, the Company issued warrants for approximately $62 million to offset the cost of the

convertible note hedge.

The convertible note hedge and warrants, which were to be net-share settled, initially covered the purchase

and issuance, respectively, of approximately 21.2 million shares of common stock, subject to customary

anti-dilution provisions. The initial strike price per share of the convertible note hedge and warrants was

$16.25 and $22.50, respectively. The convertible note hedge was exercisable before expiration only to the

extent that corresponding amounts of the 3½% Convertible Notes were exercised. The convertible note

hedge and warrant transactions were accounted for as capital transactions and included as a component of

stockholders’ equity.

In October 2014, the $66 million of outstanding Convertible Notes converted into approximately 4.0 million

shares of the Company’s common stock at the initial conversion rate of 61.5385 shares of common stock

per $1,000 principal amount.

During 2013, along with the Company’s repurchase of a portion of its 3½% Convertible Notes, the Company

repurchased warrants for the purchase of the Company’s common stock for $37 million and sold an equal

portion of its convertible note hedge for $50 million, reducing the number of shares related to each of the

hedge and warrant by approximately 13 million. In addition, the Company unwound the remaining

outstanding convertible note hedge and warrants; and repurchased warrants for the purchase of the

Company’s common stock for $41 million, and settled its convertible note hedge for proceeds of $54 million

and 179,000 shares of the Company’s common stock valued at $7 million.