Avis 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

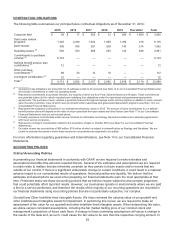

46

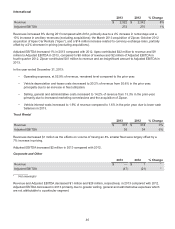

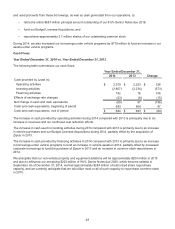

International

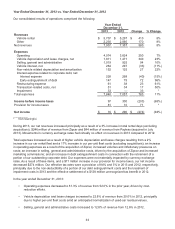

2013 2012 % Change

Revenue $ 2,522 $ 2,342 8%

Adjusted EBITDA 272 270 1%

Revenues increased 8% during 2013 compared with 2012, primarily due to a 4% increase in rental days and a

10% increase in ancillary revenues (excluding acquisitions), the March 2013 acquisition of Zipcar, October 2012

acquisition of Apex Car Rentals (“Apex”), and a $14 million increase related to currency exchange rates, partially

offset by a 2% decrease in pricing (excluding acquisitions).

Adjusted EBITDA increased 1% in 2013 compared with 2012. Apex contributed $42 million to revenue and $9

million to Adjusted EBITDA in 2013, compared to $8 million of revenue and $2 million of Adjusted EBITDA in

fourth quarter 2012. Zipcar contributed $41 million to revenue and an insignificant amount to Adjusted EBITDA in

2013.

In the year ended December 31, 2013:

• Operating expenses, at 52.9% of revenue, remained level compared to the prior year.

• Vehicle depreciation and lease costs decreased to 20.2% of revenue from 20.6% in the prior year,

principally due to an increase in fleet utilization.

• Selling, general and administrative costs increased to 14.2% of revenue from 13.3% in the prior-year,

primarily due to increased marketing commissions and the acquisition of Zipcar.

• Vehicle interest costs increased to 1.9% of revenue compared to 1.6% in the prior year, due to lower cash

balances in 2013.

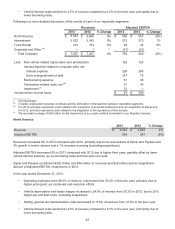

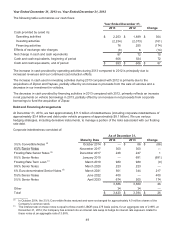

Truck Rental

2013 2012 % Change

Revenue $ 373 $ 374 0%

Adjusted EBITDA 36 34 6%

Revenues decreased $1 million as the effects on volume of having an 8% smaller fleet were largely offset by a

7% increase in pricing.

Adjusted EBITDA increased $2 million in 2013 compared with 2012.

Corporate and Other

2013 2012 % Change

Revenue $ — $ 1 *

Adjusted EBITDA (47) (21) *

__________

* Not meaningful

Revenue and Adjusted EBITDA decreased $1 million and $26 million, respectively, in 2013 compared with 2012.

Adjusted EBITDA decreased in 2013 primarily due to greater selling, general and administrative expenses which

are not attributable to a particular segment.