Avis 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-21

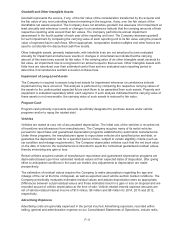

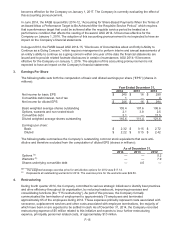

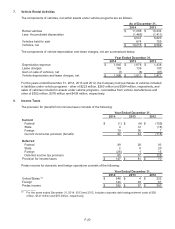

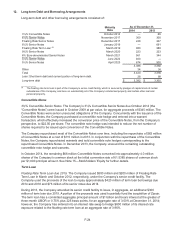

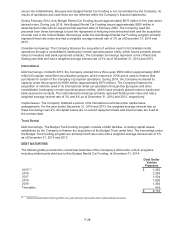

Current and non-current deferred income tax assets and liabilities are comprised of the following:

As of December 31,

2014 2013

Current deferred income tax assets:

Accrued liabilities and deferred revenue $ 188 $ 209

Provision for doubtful accounts 7 12

Acquisition and integration-related liabilities 6 10

Unrealized hedge loss 1 —

Convertible note hedge — 1

Valuation allowance (a) (22) (28)

Current deferred income tax assets 180 204

Current deferred income tax liabilities:

Accrued liabilities and deferred revenue — 5

Prepaid expenses 21 22

Current deferred income tax liabilities 21 27

Current deferred income tax assets, net $ 159 $ 177

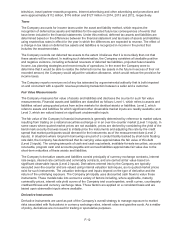

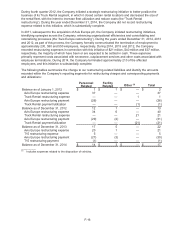

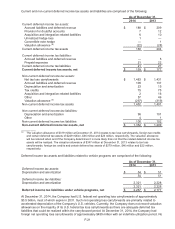

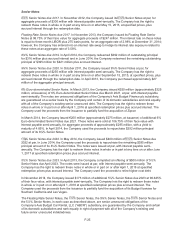

Non-current deferred income tax assets:

Net tax loss carryforwards $ 1,483 $ 1,431

Accrued liabilities and deferred revenue 109 137

Depreciation and amortization 23 15

Tax credits 75 75

Acquisition and integration-related liabilities 2 16

Other 57 46

Valuation allowance (a) (297) (319)

Non-current deferred income tax assets 1,452 1,401

Non-current deferred income tax liabilities:

Depreciation and amortization 96 101

Other 41

Non-current deferred income tax liabilities 100 102

Non-current deferred income tax assets, net $ 1,352 $ 1,299

__________

(a) The valuation allowance of $319 million at December 31, 2014 relates to tax loss carryforwards, foreign tax credits

and certain deferred tax assets of $249 million, $46 million and $24 million, respectively. The valuation allowance

will be reduced when and if the Company determines it is more likely than not that the related deferred income tax

assets will be realized. The valuation allowance of $347 million at December 31, 2013 relates to tax loss

carryforwards, foreign tax credits and certain deferred tax assets of $279 million, $46 million and $22 million,

respectively.

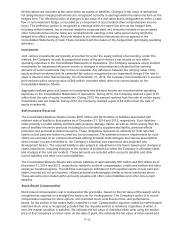

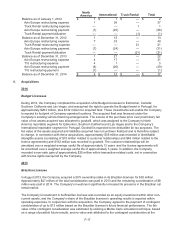

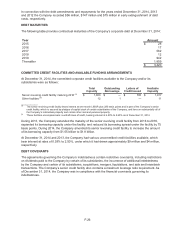

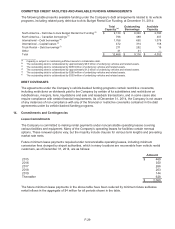

Deferred income tax assets and liabilities related to vehicle programs are comprised of the following:

As of December 31,

2014 2013

Deferred income tax assets:

Depreciation and amortization $ 54 $ 51

54 51

Deferred income tax liabilities:

Depreciation and amortization 2,321 2,228

2,321 2,228

Deferred income tax liabilities under vehicle programs, net $ 2,267 $ 2,177

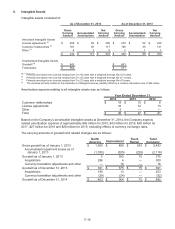

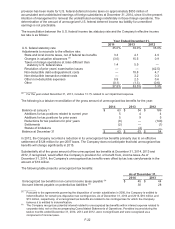

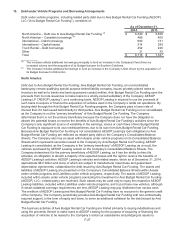

At December 31, 2014, the Company had U.S. federal net operating loss carryforwards of approximately

$3.5 billion, most of which expire in 2031. Such net operating loss carryforwards are primarily related to

accelerated depreciation of the Company’s U.S. vehicles. Currently, the Company does not record valuation

allowances on the majority of its U.S. federal tax loss carryforwards as there are adequate deferred tax

liabilities that could be realized within the carryforward period. At December 31, 2014, the Company had

foreign net operating loss carryforwards of approximately $459 million with an indefinite utilization period. No