Avis 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

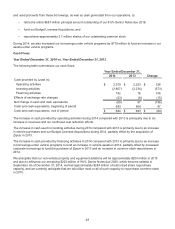

in currency exchange rates would not have a material impact on our 2014 earnings. Because unrealized gains or

losses related to foreign currency forward and swap contracts are expected to be offset by corresponding gains or

losses on the underlying exposures being hedged, when combined, these foreign currency contracts and the

offsetting underlying commitments do not create a material impact on our Consolidated Financial Statements.

Interest Rate Risk Management

Our primary interest rate exposure at December 31, 2014 was interest rate fluctuations in the United States,

specifically LIBOR and commercial paper interest rates due to their impact on variable rate borrowings and other

interest rate sensitive liabilities. We use interest rate swaps and caps to manage our exposure to interest rate

movements. We anticipate that LIBOR and commercial paper rates will remain a primary market risk exposure for

the foreseeable future.

We assess our market risk based on changes in interest rates utilizing a sensitivity analysis. Based on our interest

rate exposures and derivatives as of December 31, 2014, we estimate that a 10% change in interest rates would

not have a material impact on our 2014 earnings. Because gains or losses related to interest rate derivatives are

expected to be offset by corresponding gains or losses on the underlying exposures being hedged, when

combined, these interest rate contracts and the offsetting underlying commitments do not create a material impact

on our Consolidated Financial Statements.

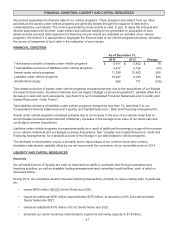

Commodity Risk Management

We have commodity price exposure related to fluctuations in the price of gasoline. We anticipate that such

commodity risk will remain a market risk exposure for the foreseeable future. We determined that a hypothetical

10% change in the price of gasoline would not have a material impact on our earnings as of December 31, 2014.

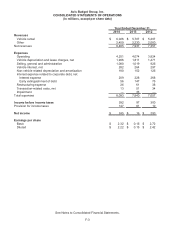

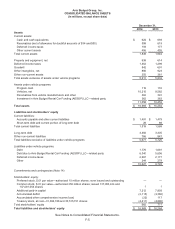

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

See Consolidated Financial Statements and Consolidated Financial Statement Index commencing on Page F-1

hereof.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

(a) Disclosure Controls and Procedures. Under the supervision and with the participation of our Chief Executive

Officer and Chief Financial Officer, our management conducted an evaluation of the effectiveness of our

disclosure controls and procedures (as such term is defined in Rules 13a-15(e) and 15d-15(e) under the

Securities Exchange Act of 1934, as amended (the “Exchange Act”)). Based on such evaluation, our Chief

Executive Officer and Chief Financial Officer have concluded that our disclosure controls and procedures

were effective as of the end of the period covered by this annual report.

(b) Management’s Annual Report on Internal Control Over Financial Reporting. Our management is responsible

for establishing and maintaining adequate internal control over financial reporting, as defined in Rules 13a-15

(f) and 15d-15(f) under the Exchange Act. Our management assessed the effectiveness of our internal control

over financial reporting as of December 31, 2014. In making this assessment, management used the criteria

set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal

Control - Integrated Framework (2013). Based on this assessment, our management believes that, as of

December 31, 2014, our internal control over financial reporting is effective. The effectiveness of the

Company’s internal control over financial reporting as of December 31, 2014, has been audited by Deloitte &

Touche LLP, an independent registered public accounting firm. Their attestation report is included below.

(c) Changes in Internal Control Over Financial Reporting. During the last fiscal quarter, there has been no

change in the Company’s internal control over financial reporting (as such term is defined in Rules 13a-15(f)

and 15d-15(f) under the Exchange Act) that has materially affected, or is reasonably likely to materially affect,

the Company’s internal control over financial reporting.