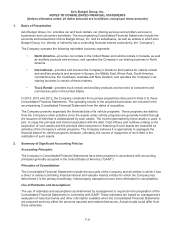

Avis 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F-12

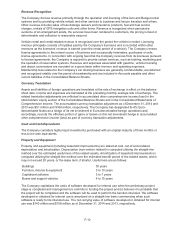

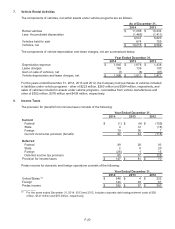

television, travel partner rewards programs, Internet advertising and other advertising and promotions and

were approximately $112 million, $116 million and $127 million in 2014, 2013 and 2012, respectively.

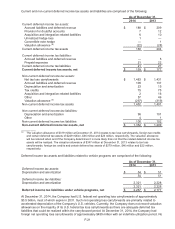

Taxes

The Company accounts for income taxes under the asset and liability method, which requires the

recognition of deferred tax assets and liabilities for the expected future tax consequences of events that

have been included in the financial statements. Under this method, deferred tax assets and liabilities are

determined based on the differences between the financial statement and tax basis of assets and liabilities

using enacted tax rates in effect for the year in which the differences are expected to reverse. The effect of

a change in tax rates on deferred tax assets and liabilities is recognized in income in the period that

includes the enactment date.

The Company records net deferred tax assets to the extent it believes that it is more likely than not that

these assets will be realized. In making such determination, the Company considers all available positive

and negative evidence, including scheduled reversals of deferred tax liabilities, projected future taxable

income, tax planning strategies and recent results of operations. In the event the Company were to

determine that it would be able to realize the deferred income tax assets in the future in excess of their net

recorded amount, the Company would adjust the valuation allowance, which would reduce the provision for

income taxes.

The Company reports revenues net of any tax assessed by a governmental authority that is both imposed

on and concurrent with a specific revenue-producing transaction between a seller and a customer.

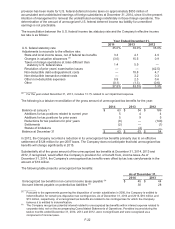

Fair Value Measurements

The Company measures fair value of assets and liabilities and discloses the source for such fair value

measurements. Financial assets and liabilities are classified as follows: Level 1, which refers to assets and

liabilities valued using quoted prices from active markets for identical assets or liabilities; Level 2, which

refers to assets and liabilities for which significant other observable market inputs are readily available; and

Level 3, which are valued based on significant unobservable inputs.

The fair value of the Company’s financial instruments is generally determined by reference to market values

resulting from trading on a national securities exchange or in an over-the-counter market (Level 1 inputs). In

some cases where quoted market prices are not available, prices are derived by considering the yield of the

benchmark security that was issued to initially price the instruments and adjusting this rate by the credit

spread that market participants would demand for the instruments as of the measurement date (Level 2

inputs). In situations where long-term borrowings are part of a conduit facility backed by short-term floating

rate debt, the Company has determined that its carrying value approximates the fair value of this debt

(Level 2 inputs). The carrying amounts of cash and cash equivalents, available-for-sale securities, accounts

receivable, program cash and accounts payable and accrued liabilities approximate fair value due to the

short-term maturities of these assets and liabilities.

The Company’s derivative assets and liabilities consist principally of currency exchange contracts, interest

rate swaps, interest rate contracts and commodity contracts, and are carried at fair value based on

significant observable inputs (Level 2 inputs). Derivatives entered into by the Company are typically

executed over-the-counter and are valued using internal valuation techniques, as no quoted market prices

exist for such instruments. The valuation technique and inputs depend on the type of derivative and the

nature of the underlying exposure. The Company principally uses discounted cash flows to value these

instruments. These models take into account a variety of factors including, where applicable, maturity,

commodity prices, interest rate yield curves of the Company and counterparties, credit curves, counterparty

creditworthiness and currency exchange rates. These factors are applied on a consistent basis and are

based upon observable inputs where available.

Derivative Instruments

Derivative instruments are used as part of the Company’s overall strategy to manage exposure to market

risks associated with fluctuations in currency exchange rates, interest rates and gasoline costs. As a matter

of policy, derivatives are not used for trading or speculative purposes.