Avis 2014 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2014 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

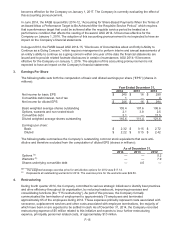

F-17

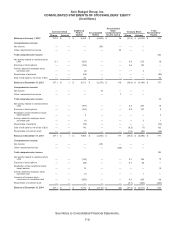

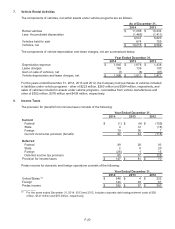

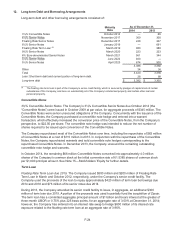

North

America International Truck Rental Total

Balance as of January 1, 2012 $ 1 $ 1 $ — $ 2

Avis Europe restructuring expense 1 36 — 37

Truck Rental restructuring expense ——11

Avis Europe restructuring payment (1)(25) — (26)

Truck Rental payment/utilization —— (1) (1)

Balance as of December 31, 2012 1 12 — 13

Avis Europe restructuring expense 7 33 — 40

Truck Rental restructuring expense ——2121

Avis Europe restructuring payment (7)(24) — (31)

Truck Rental payment/utilization —— (21) (21)

Balance as of December 31, 2013 1 21 — 22

Avis Europe restructuring expense 4 17 — 21

T15 restructuring expense 4 1 — 5

Avis Europe restructuring payment (4) (26) — (30)

T15 restructuring payment (1)— — (1)

Balance as of December 31, 2014 $ 4 $ 13 $ — $ 17

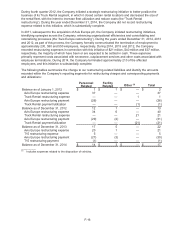

5. Acquisitions

2014

Budget Licensees

During 2014, the Company completed the acquisition of its Budget licensees for Edmonton, Canada;

Southern California and Las Vegas, and reacquired the right to operate the Budget brand in Portugal, for

approximately $263 million, plus $132 million for acquired fleet. These investments will enable the Company

to expand its footprint of Company-operated locations. The acquired fleet was financed under the

Company’s existing vehicle financing arrangements. The excess of the purchase price over preliminary fair

value of net assets acquired was allocated to goodwill, which was assigned to the Company’s North

America reportable segment for Edmonton, Southern California and Las Vegas and to the Company’s

International reportable segment for Portugal. Goodwill is expected to be deductible for tax purposes. The

fair value of the assets acquired and liabilities assumed has not yet been finalized and is therefore subject

to change. In connection with these acquisitions, approximately $58 million was recorded in identifiable

intangible assets (consisting of $10 million related to customer relationships and $48 million related to the

license agreements) and $192 million was recorded in goodwill. The customer relationships will be

amortized over a weighted average useful life of approximately 12 years and the license agreements will

be amortized over a weighted average useful life of approximately 3 years. In addition, the Company

recorded a non-cash gain of approximately $20 million within transaction-related costs, net in connection

with license rights reacquired by the Company.

2013

Brazilian Licensee

In August 2013, the Company acquired a 50% ownership stake in its Brazilian licensee for $53 million.

Approximately $47 million of the total consideration was paid in 2013 and the remaining consideration of $6

million was paid in 2014. The Company’s investment significantly increased its presence in the Brazilian car

rental market.

The Company’s investment in its Brazilian licensee was recorded as an equity investment within other non-

current assets, and the Company’s share of the Brazilian licensee’s operating results is reported within

operating expenses. In conjunction with the acquisition, the Company agreed to the payment of contingent

consideration of up to $13 million based on the Brazilian licensee’s future financial performance. The fair

value of the contingent consideration was estimated by utilizing a Monte Carlo simulation technique, based

on a range of possible future results, and no value was attributed to the contingent consideration at the