Avis 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-24

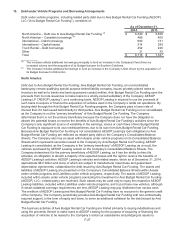

12. Long-term Debt and Borrowing Arrangements

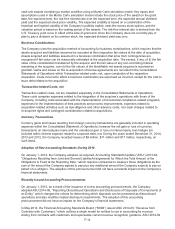

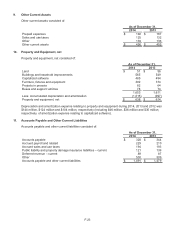

Long-term debt and other borrowing arrangements consisted of:

Maturity

Date

As of December 31,

2014 2013

3½% Convertible Notes October 2014 — 66

November 2017 300 300

Floating Rate Senior Notes December 2017 248 247

8¼% Senior Notes January 2019 — 691

Floating Rate Term Loan (a) March 2019 980 989

9¾% Senior Notes March 2020 223 223

6% Euro-denominated Senior Notes March 2021 561 344

June 2022 400 —

5½% Senior Notes April 2023 674 500

3,386 3,360

Other 34 34

Total 3,420 3,394

Less: Short-term debt and current portion of long-term debt 28 89

Long-term debt $ 3,392 $ 3,305

__________

(a) The floating rate term loan is part of the Company’s senior credit facility, which is secured by pledges of capital stock of certain

subsidiaries of the Company, and liens on substantially all of the Company’s intellectual property and certain other real and

personal property.

Convertible Notes

3½% Convertible Senior Notes. The Company’s 3½% Convertible Senior Notes due October 2014 (the

“Convertible Notes”) were issued in October 2009 at par value, for aggregate proceeds of $345 million. The

Convertible Notes were senior unsecured obligations of the Company. Concurrently with the issuance of the

Convertible Notes, the Company purchased a convertible note hedge and entered into a warrant

transaction, which effectively increased the conversion price of the Convertible Notes, from the Company’s

perspective, to $22.50 per share. The convertible note hedge was intended to reduce the net number of

shares required to be issued upon conversion of the Convertible Notes.

The Company repurchased most of the Convertible Notes over time, including the repurchase of $62 million

of Convertible Notes at a cost of $115 million in 2013. In conjunction with the repurchase of the Convertible

Notes, the Company repurchased warrants and sold convertible note hedges corresponding to the

repurchased Convertible Notes. In December 2013, the Company unwound the remaining outstanding

convertible note hedge and warrants.

In October 2014, the remaining $66 million Convertible Notes converted into approximately 4.0 million

shares of the Company’s common stock at the initial conversion rate of 61.5385 shares of common stock

per $1,000 principal amount. See Note 15—Stockholders’ Equity for further details.

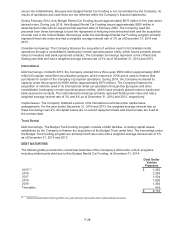

Term Loan

Floating Rate Term Loan due 2019. The Company issued $500 million and $200 million of Floating Rate

Term Loan in March and October 2012, respectively, under the Company’s senior credit facility. The

Company used the proceeds of the loan to repay approximately $420 million of term loan borrowings due

2014 and 2018 and $75 million of its senior notes due 2014.

During 2013, the Company amended its senior credit facility to issue, in aggregate, an additional $300

million of term loan due 2019. A portion of the proceeds was used to partially fund the acquisition of Zipcar.

The term loan has a committed aggregate principal amount of $1 billion and bears interest at the greater of

three-month LIBOR or 0.75% plus 225 basis points, for an aggregate rate of 3.00% at December 31, 2014;

however, the Company has entered into an interest rate swap to hedge $600 million of its interest rate

exposure related to the floating rate term loan at an aggregate rate of 3.96%.