Avis 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-37

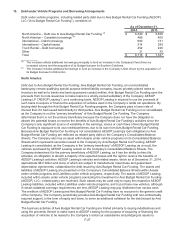

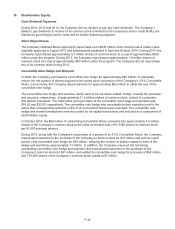

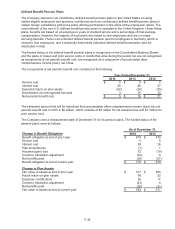

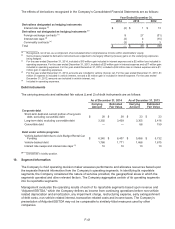

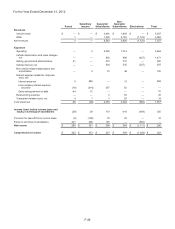

As of December 31,

Funded Status 2014 2013

Classification of net balance sheet assets (liabilities)

Non-current assets $ 15 $ —

Current liabilities (1) —

Non-current liabilities (177) (153)

Net funded status $ (163) $ (153)

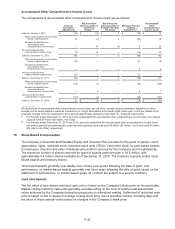

The following assumptions were used to determine pension obligations and pension costs for the principal

plans in which the Company’s employees participated:

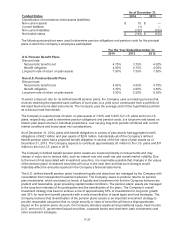

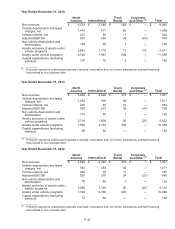

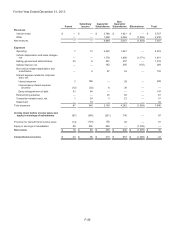

For the Year Ended December 31,

2014 2013 2012

U.S. Pension Benefit Plans

Discount rate:

Net periodic benefit cost 4.75% 3.75% 4.00%

Benefit obligation 4.00% 4.75% 4.00%

Long-term rate of return on plan assets 7.50% 7.50% 7.50%

Non-U.S. Pension Benefit Plans

Discount rate:

Net periodic benefit cost 4.50% 4.50% 4.75%

Benefit obligation 3.30% 4.50% 4.50%

Long-term rate of return on plan assets 5.30% 5.25% 5.35%

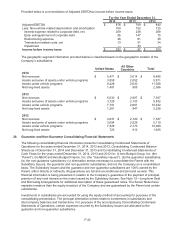

To select a discount rate for its defined benefit pension plans, the Company uses a modeling process that

involves matching the expected cash outflows of such plan, to a yield curve constructed from a portfolio of

AA-rated fixed-income debt instruments. The Company uses the average yield of this hypothetical portfolio

as a discount rate benchmark.

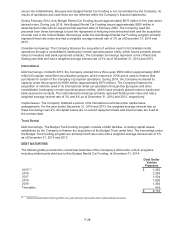

The Company’s expected rate of return on plan assets of 7.50% and 5.30% for U.S. plans and non-U.S.

plans, respectively, used to determine pension obligations and pension costs, is a long-term rate based on

historic plan asset returns in individual jurisdictions, over varying long-term periods combined with current

market conditions and broad asset mix considerations.

As of December 31, 2014, plans with benefit obligations in excess of plan assets had aggregate benefit

obligations of $421 million and plan assets of $243 million. Substantially all of the Company’s defined

benefit pension plans had a projected benefit obligation in excess of the fair value of plan assets as of

December 31, 2013. The Company expects to contribute approximately $1 million to the U.S. plans and $11

million to the non-U.S. plans in 2015.

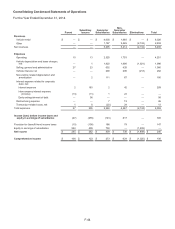

The Company’s defined benefit pension plans’ assets are invested primarily in mutual funds and may

change in value due to various risks, such as interest rate and credit risk and overall market volatility. Due

to the level of risk associated with investment securities, it is reasonably possible that changes in the values

of the pension plans’ investment securities will occur in the near term and that such changes would

materially affect the amounts reported in the Company’s financial statements.

The U.S. defined benefit pension plans’ investment goals and objectives are managed by the Company with

consultation from independent investment advisors. The Company seeks to produce returns on pension

plan investments, which are based on levels of liquidity and investment risk that the Company believes are

prudent and reasonable, given prevailing capital market conditions. The pension plans’ assets are managed

in the long-term interests of the participants and the beneficiaries of the plans. The Company’s overall

investment strategy has been to achieve a mix of approximately 65% of investments for long-term growth

and 35% for near-term benefit payments with a wide diversification of asset types and fund strategies. The

Company believes that diversification of the pension plans’ assets is an important investment strategy to

provide reasonable assurance that no single security or class of securities will have a disproportionate

impact on the pension plans. As such, the Company allocates assets among traditional equity, fixed income

(U.S. and non-U.S. government issued securities, corporate bonds and short-term cash investments) and

other investment strategies.