Avis 2014 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2014 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

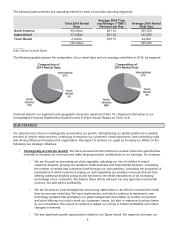

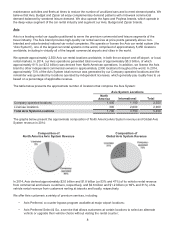

The following table presents key operating metrics for each of our three reporting segments:

Total 2014 Rental

Days

Average 2014 Time

and Mileage (“T&M”)

Revenue per Day

Average 2014 Rental

Fleet Size

North America 95 million $41.33 369,000

International 37 million $41.34 144,000

Truck Rental 4 million $78.15 22,000

136 million 535,000

________

Note: Figures exclude Zipcar.

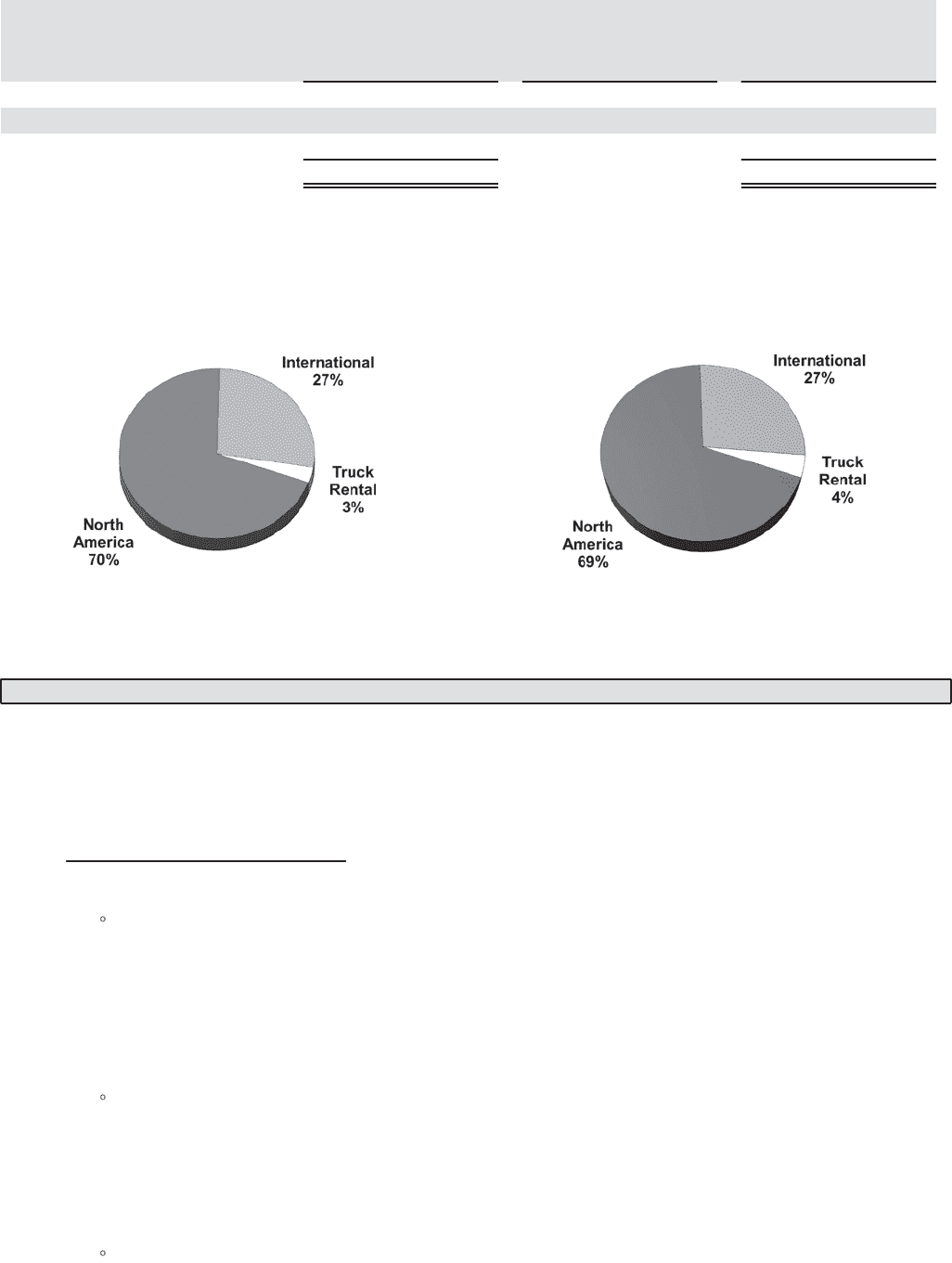

The following graphs present the composition of our rental days and our average rental fleet in 2014, by segment:

Composition of

2014 Rental Days

Composition of

2014 Rental Fleet

Financial data for our segments and geographic areas are reported in Note 19—Segment Information to our

Consolidated Financial Statements included in Item 8 of this Annual Report on Form 10-K.

OUR STRATEGY

Our objective is to focus on strategically accelerating our growth, strengthening our global position as a leading

provider of vehicle rental services, continuing to enhance our customers’ rental experience, and controlling costs

and driving efficiency throughout the organization. We expect to achieve our goals by focusing our efforts on the

following core strategic initiatives:

•Strategically Accelerate Growth. We have pursued and will continue to pursue numerous opportunities

intended to increase our revenues and make disproportionate contributions to our earnings. For instance:

We are focused on promoting car class upgrades, adjusting our mix of vehicles to match

customer demand, growing our rentals to small-business and international travelers, increasing

the number of rentals that customers book through our own websites, increasing the proportion of

transactions in which customers prepay us, and expanding our ancillary revenues derived from

offering additional ancillary products and services to the rental transactions of an increasing

percentage of our customers. We believe these efforts will each not only generate incremental

revenue, but also add to profitability.

We are focused on yield management and pricing optimization in an effort to increase the rental

fees we earn per rental day. We have implemented, and plan to continue to implement, new

technology systems that strengthen our yield management and enable us to tailor our product

and price offerings not only to meet our customers’ needs, but also in response to actions taken

by our competitors. We expect to continue to adjust our pricing to bolster profitability and match

changes in demand.

We see significant growth opportunities related to our Zipcar brand. We expect to increase our