Avis 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-22

provision has been made for U.S. federal deferred income taxes on approximately $853 million of

accumulated and undistributed earnings of foreign subsidiaries at December 31, 2014, since it is the present

intention of management to reinvest the undistributed earnings indefinitely in those foreign operations. The

determination of the amount of unrecognized U.S. federal deferred income tax liability for unremitted

earnings is not practicable.

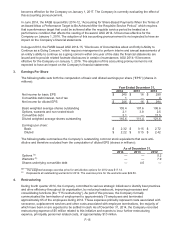

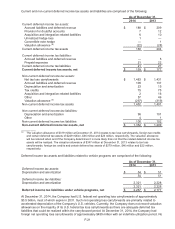

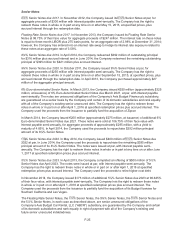

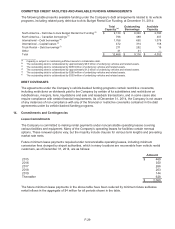

The reconciliation between the U.S. federal income tax statutory rate and the Company’s effective income

tax rate is as follows:

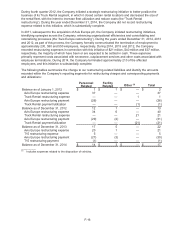

Year Ended December 31,

2014 2013 2012

U.S. federal statutory rate 35.0% 35.0% 35.0%

Adjustments to reconcile to the effective rate:

State and local income taxes, net of federal tax benefits 3.3 4.1 4.9

Changes in valuation allowances (a) (3.0) 15.5 0.9

Taxes on foreign operations at rates different than

statutory U.S. federal rates 1.4 5.9 —

Resolution of prior years’ examination issues — — (42.5)

Non-deductible debt extinguishment costs — 18.8 4.7

Non-deductible transaction-related costs — 3.2 0.3

Other non-deductible expenses 0.9 2.3 0.6

Other (0.1) (1.3) (0.6)

37.5% 83.5% 3.3%

__________

(a) For the year ended December 31, 2013, includes 13.1% related to our impairment expense.

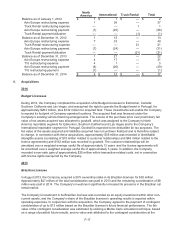

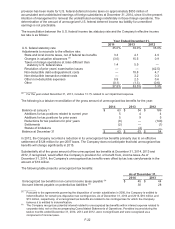

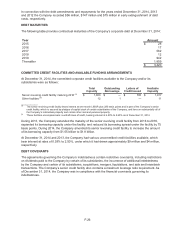

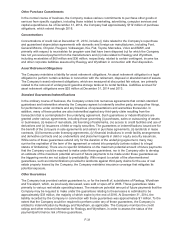

The following is a tabular reconciliation of the gross amount of unrecognized tax benefits for the year:

2014 2013 2012

Balance at January 1 $ 63 $ 54 $ 186

Additions for tax positions related to current year 5 4 4

Additions for tax positions for prior years 5 9 5

Reductions for tax positions for prior years (8) — (140)

Settlements (2) — (1)

Statute of limitations — (4) —

Balance at December 31 $ 63 $ 63 $ 54

In 2012, the Company recorded a reduction in its unrecognized tax benefits primarily due to an effective

settlement of $128 million for pre-2007 taxes. The Company does not anticipate that total unrecognized tax

benefits will change significantly in 2015.

Substantially all of the gross amount of the unrecognized tax benefits at December 31, 2014, 2013 and

2012, if recognized, would affect the Company’s provision for, or benefit from, income taxes. As of

December 31, 2014, the Company’s unrecognized tax benefits were offset by tax loss carryforwards in the

amount of $18 million.

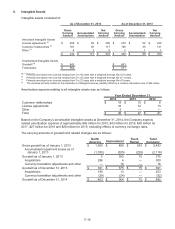

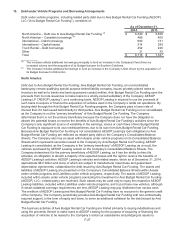

The following table presents unrecognized tax benefits:

As of December 31,

2014 2013

Unrecognized tax benefit in non-current income taxes payable (a) $45$44

Accrued interest payable on potential tax liabilities (b) 30 28

__________

(a) Pursuant to the agreements governing the disposition of certain subsidiaries in 2006, the Company is entitled to

indemnification for certain pre-disposition tax contingencies. As of December 31, 2014 and 2013, $16 million and

$15 million, respectively, of unrecognized tax benefits are related to tax contingencies for which the Company

believes it is entitled to indemnification.

(b) The Company recognizes potential interest related to unrecognized tax benefits within interest expense related to

corporate debt, net on the accompanying Consolidated Statements of Operations. Penalties incurred during the

twelve months ended December 31, 2014, 2013 and 2012, were not significant and were recognized as a

component of income taxes.