Avis 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

At December 31, 2014, the Company had various other uncommitted credit facilities available, which bear interest

at rates of 0.39% to 2.50%, under which it had drawn approximately $9 million.

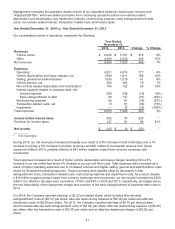

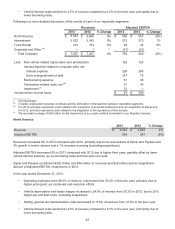

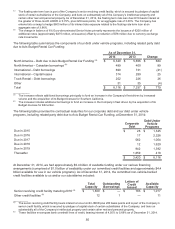

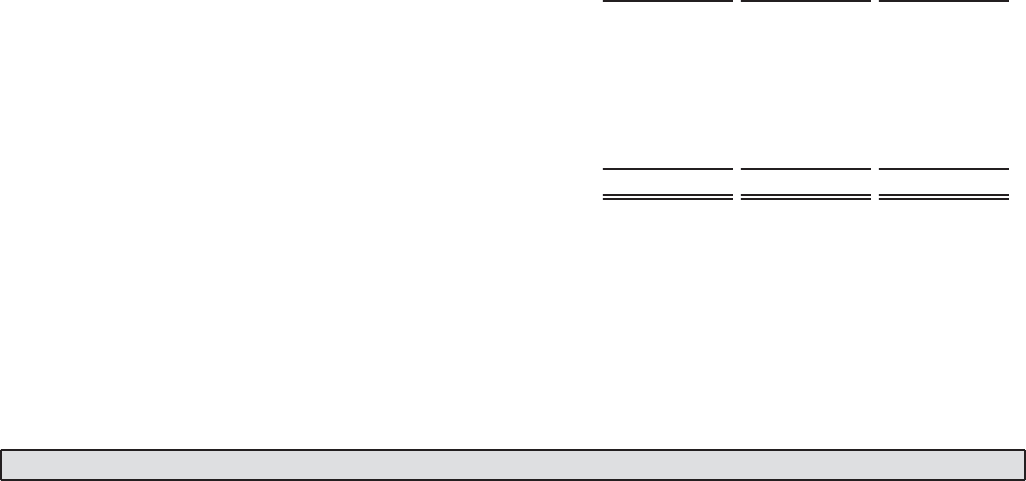

The following table presents available funding under our debt arrangements related to our vehicle programs,

including related party debt due to Avis Budget Rental Car Funding, at December 31, 2014:

Total

Capacity(a) Outstanding

Borrowings

Available

Capacity

North America – Debt due to Avis Budget Rental Car Funding (b) $ 9,130 $ 6,340 $ 2,790

North America – Canadian borrowings (c) 796 489 307

International – Debt borrowings (d) 1,768 690 1,078

International – Capital Leases (e) 472 314 158

Truck Rental – Debt borrowings (f) 271 252 19

Other 31 31 —

Total $ 12,468 $ 8,116 $ 4,352

__________

(a) Capacity is subject to maintaining sufficient assets to collateralize debt.

(b) The outstanding debt is collateralized by approximately $8.0 billion of underlying vehicles and related assets.

(c) The outstanding debt is collateralized by $659 million of underlying vehicles and related assets.

(d) The outstanding debt is collateralized by approximately $1.2 billion of underlying vehicles and related assets.

(e) The outstanding debt is collateralized by $298 million of underlying vehicles and related assets.

(f) The outstanding debt is collateralized by $339 million of underlying vehicles and related assets.

The significant terms for our outstanding debt instruments, credit facilities and available funding arrangements as

of December 31, 2014, can be found in Notes 12 and 13 to our Consolidated Financial Statements.

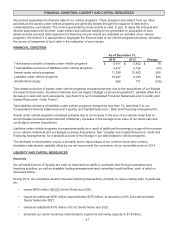

LIQUIDITY RISK

Our primary liquidity needs include the payment of operating expenses, servicing of corporate and vehicle-related

debt and procurement of rental vehicles to be used in our operations. The present intention of management is to

reinvest the undistributed earnings of the Company’s foreign subsidiaries indefinitely into its foreign operations.

We do not anticipate the need to repatriate foreign earnings to the United States to service corporate debt or for

other U.S. needs. Our primary sources of funding are operating revenue, cash received upon the sale of vehicles,

borrowings under our vehicle-backed borrowing arrangements and our senior revolving credit facility, and other

financing activities.

As discussed above, as of December 31, 2014, we have cash and cash equivalents of $624 million, available

borrowing capacity under our committed credit facilities of $1.0 billion, and available capacity under our vehicle

programs of approximately $4.4 billion.

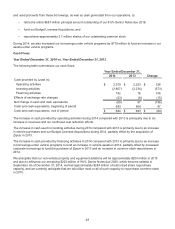

Our liquidity position could be negatively affected by financial market disruptions or a downturn in the U.S. and

worldwide economies, which may result in unfavorable conditions in the vehicle rental industry, in the asset-

backed financing market, and in the credit markets, generally. We believe these factors have in the past affected

and could in the future affect the debt ratings assigned to us by credit rating agencies and the cost of our

borrowings. Additionally, a downturn in the worldwide economy or a disruption in the credit markets could impact

our liquidity due to (i) decreased demand and pricing for vehicles in the used vehicle market, (ii) increased costs

associated with, and/or reduced capacity or increased collateral needs under, our financings, (iii) the adverse

impact of vehicle manufacturers, including Ford, General Motors, Chrysler, Peugeot, Volkswagen, Kia, Fiat,

Toyota, Mercedes, Volvo and BMW, being unable or unwilling to honor their obligations to repurchase or

guarantee the depreciation on the related program vehicles and (iv) disruption in our ability to obtain financing due

to negative credit events specific to us or affecting the overall debt market (see Item 1A. Risk Factors for further

discussion).

Our liquidity position could also be negatively impacted if we are unable to remain in compliance with the financial

and other covenants associated with our senior revolving credit facility and other borrowings including a maximum

leverage ratio. As of December 31, 2014, we were in compliance with the financial covenants governing our

indebtedness.