Avis 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-34

Stock Unit Awards

Stock unit awards entitle the holder to receive shares of common stock upon vesting on a one-to-one basis.

Performance-based RSUs principally vest based upon the level of performance attained, but vesting can

increase by up to 20% if certain relative total shareholder return goals are achieved. Market-based RSUs

generally vest based on the level of total shareholder return or absolute stock price attainment.

The grant date fair value of the performance-based RSUs incorporates the total shareholder return metric,

which is estimated using a Monte Carlo simulation model to estimate the Company’s ranking relative to an

applicable stock index. The weighted average assumptions used in the Monte Carlo simulation model to

calculate the fair value of the Company’s stock unit awards are outlined in the table below.

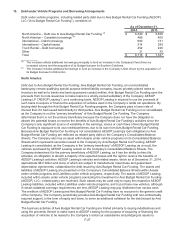

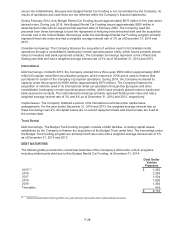

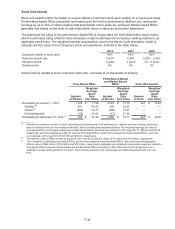

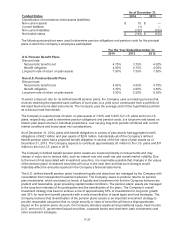

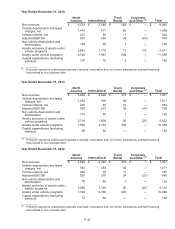

2014 2013 2012

Expected volatility of stock price 40% 43% 50%

Risk-free interest rate 0.83% 0.39% 0.30% - 0.42%

Valuation period 3 years 3 years 2½ - 3 years

Dividend yield 0% 0% 0%

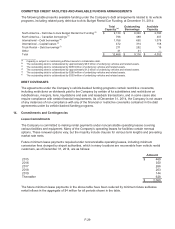

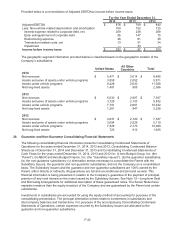

Annual activity related to stock units and cash units, consisted of (in thousands of shares):

Time-Based RSUs

Performance-Based

and Market Based

RSUs Cash Unit Awards

Number

of Shares

Weighted

Average

Grant

Date

Fair Value

Number

of Shares

Weighted

Average

Grant

Date

Fair Value

Number

of Units

Weighted

Average

Grant

Date

Fair Value

Outstanding at January 1, 2014 1,308 $ 17.92 2,043 $ 13.79 267 $ 14.90

Granted (a) 381 42.05 326 42.03 — —

Vested (b) (606) 16.71 (438) 10.91 — —

Forfeited/expired (85) 24.83 (47) 21.36 — —

Outstanding at December 31, 2014 (c) 998 $ 27.26 1,884 $ 19.17 267 $ 14.90

__________

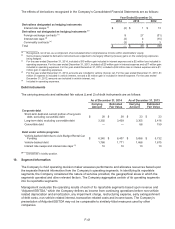

(a) Reflects the maximum number of stock units assuming achievement of all performance-, market- and time-vesting criteria and

does not include those for non-employee directors, which are discussed separately below. The weighted-average fair value of

time-based RSUs, performance-based and market-based RSUs, and cash units granted in 2013 was $21.77, $20.04 and $18.04,

respectively, and the weighted-average fair value of time-based RSUs, performance-based and market-based RSUs, and cash

units granted in 2012 was $14.39, $12.66 and $12.65, respectively.

(b) The total fair value of RSUs vested during 2014, 2013 and 2012 was $15 million, $13 million and $16 million, respectively.

(c) The Company’s outstanding time-based RSUs, performance-based and market-based RSUs, and cash units had aggregate

intrinsic value of $66 million, $125 million and $18 million, respectively. Aggregate unrecognized compensation expense related to

time-based RSUs and performance-based and market-based RSUs amounted to $28 million and will be recognized over a

weighted average vesting period of 0.6 years. The Company assumes that substantially all outstanding awards will vest over

time.