Avis 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-23

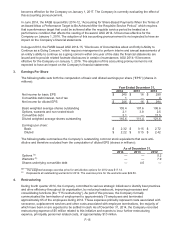

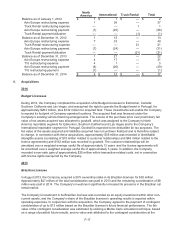

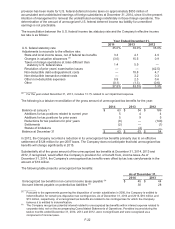

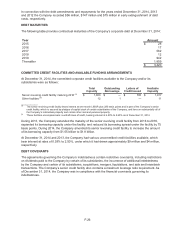

9. Other Current Assets

Other current assets consisted of:

As of December 31,

2014 2013

Prepaid expenses $ 192 $ 187

Sales and use taxes 125 132

Other 139 136

Other current assets $ 456 $ 455

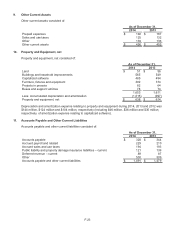

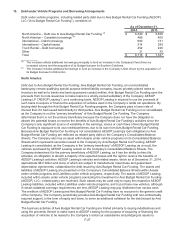

10. Property and Equipment, net

Property and equipment, net consisted of:

As of December 31,

2014 2013

Land $51$56

Buildings and leasehold improvements 565 549

Capitalized software 485 494

Furniture, fixtures and equipment 392 374

Projects in process 82 64

Buses and support vehicles 78 74

1,653 1,611

Less: Accumulated depreciation and amortization (1,015) (997)

Property and equipment, net $ 638 $ 614

Depreciation and amortization expense relating to property and equipment during 2014, 2013 and 2012 was

$144 million, $124 million and $104 million, respectively (including $46 million, $36 million and $30 million,

respectively, of amortization expense relating to capitalized software).

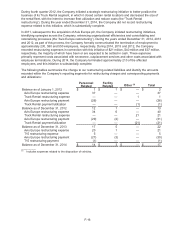

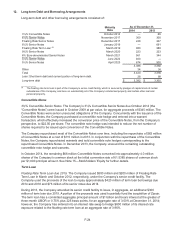

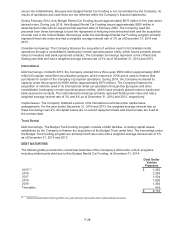

11. Accounts Payable and Other Current Liabilities

Accounts payable and other current liabilities consisted of:

As of December 31,

2014 2013

Accounts payable $ 328 $ 344

Accrued payroll and related 229 210

Accrued sales and use taxes 194 193

Public liability and property damage insurance liabilities – current 121 136

Deferred revenue – current 89 87

Other 530 509

Accounts payable and other current liabilities $ 1,491 $ 1,479