Avis 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-15

becomes effective for the Company on January 1, 2017. The Company is currently evaluating the effect of

this accounting pronouncement.

In June 2014, the FASB issued ASU 2014-12, “Accounting for Share-Based Payments When the Terms of

an Award Allow a Performance Target to Be Achieved After the Requisite Service Period,” which requires

that a performance target that could be achieved after the requisite service period be treated as a

performance condition that affects the vesting of the award. ASU 2014-12 becomes effective for the

Company on January 1, 2016. The adoption of this accounting pronouncement is not expected to have an

impact on the Company’s financial statements.

In August 2014, the FASB issued ASU 2014-15, “Disclosure of Uncertainties about an Entity’s Ability to

Continue as a Going Concern,” which requires management to perform interim and annual assessments of

an entity’s ability to continue as a going concern within one year of the date the financial statements are

issued and to provide related footnote disclosures in certain circumstances. ASU 2014-15 becomes

effective for the Company on January 1, 2016. The adoption of this accounting pronouncement is not

expected to have an impact on the Company’s financial statements.

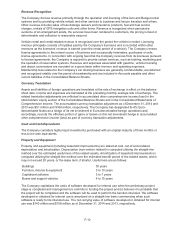

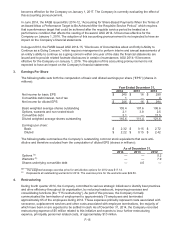

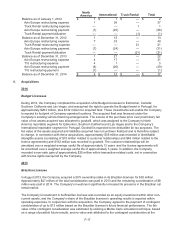

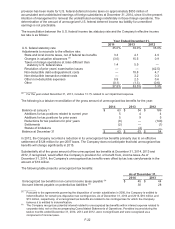

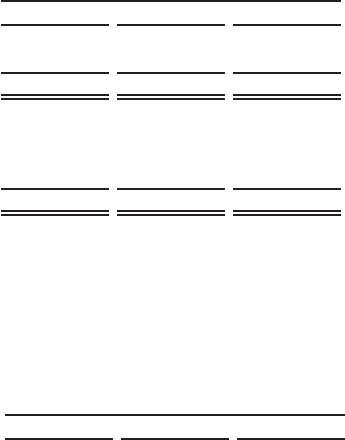

3. Earnings Per Share

The following table sets forth the computation of basic and diluted earnings per share (“EPS”) (shares in

millions):

Year Ended December 31,

2014 2013 2012

Net income for basic EPS $ 245 $ 16 $ 290

Convertible debt interest, net of tax 1 — 4

Net income for diluted EPS $ 246 $ 16 $ 294

Basic weighted average shares outstanding 105.4 107.6 106.6

Options, warrants and non-vested stock 2.1 3.8 2.5

Convertible debt 3.1 — 12.5

Diluted weighted average shares outstanding 110.6 111.4 121.6

Earnings per share:

Basic $ 2.32 $ 0.15 $ 2.72

Diluted $ 2.22 $ 0.15 $ 2.42

The following table summarizes the Company’s outstanding common stock equivalents that were anti-

dilutive and therefore excluded from the computation of diluted EPS (shares in millions):

As of December 31,

2014 2013 2012

Options (a) ——0.2

Warrants (b) ——7.9

Shares underlying convertible debt — 4.0 —

__________

(a) The weighted average exercise price for anti-dilutive options for 2012 was $17.12.

(b) Represents all outstanding warrants for 2012. The exercise price for the warrants was $22.50.

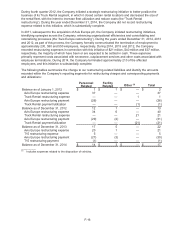

4. Restructuring

During fourth quarter 2014, the Company committed to various strategic initiatives to identify best practices

and drive efficiency throughout its organization, by reducing headcount, improving processes and

consolidating functions (the “T15 restructuring”). As part of this process, the Company formally

communicated the termination of employment to approximately 75 employees and terminated

approximately 65 of the employees during 2014. These expenses primarily represent costs associated with

severance, outplacement services and other costs associated with employee terminations, the majority of

which have been or are expected to be settled in cash. As of December 31, 2014, the Company recorded

restructuring expense of $5 million related to this initiative and expects to incur further restructuring

expense, principally personnel related costs, of approximately $10 million.