Avis 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-30

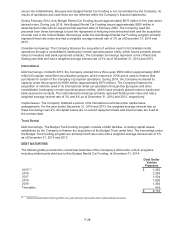

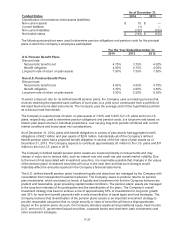

The Company maintains concession agreements with various airport authorities that allow the Company to

conduct its car rental operations on site. In general, concession fees for airport locations are based on a

percentage of total commissionable revenue (as defined by each airport authority), subject to minimum

annual guaranteed amounts. These concession fees, which are included in the Company’s total rent

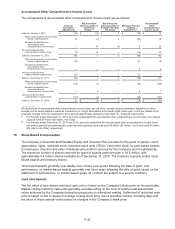

expense, were as follows for the years ended December 31:

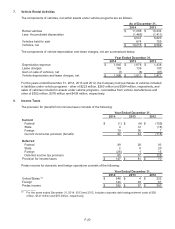

2014 2013 2012

Rent expense (including minimum concession fees) $ 639 $ 622 $ 600

Contingent concession expense 193 173 155

832 795 755

Less: sublease rental income (6) (5) (5)

Total $ 826 $ 790 $ 750

Commitments under capital leases, other than those within the Company’s vehicle rental programs, for

which the future minimum lease payments have been reflected in Note 13—Debt Under Vehicle Programs

and Borrowing Arrangements, are not significant.

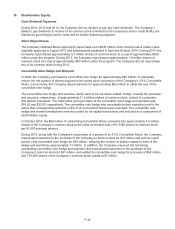

The Company leases a portion of its vehicles under operating leases, which extend through 2018. As of

December 31, 2014, the Company has guaranteed up to $100 million of residual values for these vehicles

at the end of their respective lease terms. The Company believes that, based on current market conditions,

the net proceeds from the sale of these vehicles at the end of their lease terms will equal or exceed their net

book values and therefore has not recorded a liability related to guaranteed residual values.

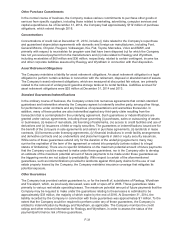

Contingencies

The Company is involved in claims, legal proceedings and governmental inquiries related, among other

things, to its vehicle rental operations, including contract and licensee disputes, wage-and-hour claims,

competition matters, employment matters, insurance claims, intellectual property claims and other

regulatory, environmental, commercial and tax matters. Litigation is inherently unpredictable and, although

the Company believes that its accruals are adequate and/or that it has valid defenses in these matters,

unfavorable resolutions could occur. The potential exposure resulting from adverse outcomes of such legal

proceedings in which it is reasonably possible that a loss may be incurred could, in the aggregate, range up

to approximately $20 million in excess of amounts accrued as of December 31, 2014. However, the

Company does not believe that the impact of such litigation should result in a material liability to the

Company in relation to its consolidated financial condition or results of operations.

Additionally, in 2006, the Company completed the spin-offs of its Realogy and Wyndham subsidiaries. In

connection with the spin-offs, Realogy assumed 62.5% and Wyndham assumed 37.5% of certain

contingent and other corporate liabilities of the Company that are not primarily related to any of the

respective businesses of Realogy, Wyndham, our former Travelport subsidiary and/or the Company’s

vehicle rental operations, and in each case incurred or allegedly incurred on or prior to each subsidiary’s

disposition (“Assumed Liabilities”). If Realogy or Wyndham were to default on its payment of costs or

expenses to the Company related to any Assumed Liabilities, the Company would be responsible for 50%

of the defaulting party’s obligation. The Company does not believe that the impact of any resolution of

contingent liabilities constituting Assumed Liabilities should result in a material liability to the Company in

relation to its consolidated financial position or liquidity, as Realogy and Wyndham each have agreed to

assume responsibility for these liabilities. The Company is also named in various litigation that is primarily

related to the businesses of its former subsidiaries, including Realogy, Wyndham and their current or former

subsidiaries. The Company is entitled to indemnification from such entities for any liability resulting from

such litigation.

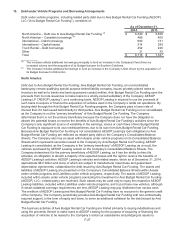

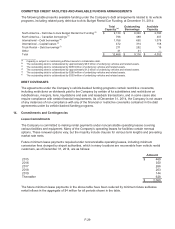

Commitments to Purchase Vehicles

The Company maintains agreements with vehicle manufacturers under which the Company has agreed to

purchase approximately $6.7 billion of vehicles from manufacturers over the next 12 months. The majority

of these commitments are subject to the vehicle manufacturers satisfying their obligations under their

respective repurchase and guaranteed depreciation agreements. The purchase of such vehicles is financed

primarily through the issuance of vehicle-backed debt and cash received upon the disposition of vehicles.