U-Haul 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

The Company currently manages the self-storage properties owned or leased by SAC Holdings, Mercury Partners, L.P.

(“Mercury”), Four SAC Self-Storage Corporation (“4 SAC”), Five SAC Self-Storage Corporation (“5 SAC”), Galaxy

Investments, L.P. (“Galaxy”) and Private Mini pursuant to a standard form of management agreement, under which the

Company receives a management fee of between 4% and 10% of the gross receipts plus reimbursement for certain

expenses. The Company received management fees, exclusive of reimbursed expenses, of $24.3 million, $23.7 million and

$23.5 million from the above mentioned entities during fiscal 2009, 2008 and 2007, respectively. This management fee is

consistent with the fee received for other properties the Company previously managed for third parties. SAC Holdings, 4

SAC, 5 SAC, Galaxy and Private Mini are substantially controlled by Blackwater. Mercury is substantially controlled by

Mark V. Shoen. James P. Shoen, a significant shareholder and director of AMERCO, has an interest in Mercury.

The Company leases space for marketing company offices, vehicle repair shops and hitch installation centers from

subsidiaries of SAC Holdings, 5 SAC and Galaxy. Total lease payments pursuant to such leases were $2.4 million, $2.1

million and $2.7 million for fiscal 2009, 2008 and 2007, respectively. The terms of the leases are similar to the terms of

leases for other properties owned by unrelated parties that are leased to the Company.

At March 31, 2009, subsidiaries of SAC Holdings, 4 SAC, 5 SAC, Galaxy and Private Mini acted as U-Haul

independent dealers. The financial and other terms of the dealership contracts with the aforementioned companies and their

subsidiaries are substantially identical to the terms of those with the Company’s other independent dealers whereby

commissions are paid by the Company based upon equipment rental revenue. The Company paid the above mentioned

entities $34.7 million, $36.0 million and $36.6 million, respectively in commissions pursuant to such dealership contracts

during fiscal 2009, 2008 and 2007, respectively.

These agreements and notes with subsidiaries of SAC Holdings, 4 SAC, 5 SAC, Galaxy and Private Mini, excluding

Dealer Agreements, provided revenues of $43.2 million, expenses of $2.4 million and cash flows of $38.1 million during

fiscal 2009. Revenues and commission expenses related to the Dealer Agreements were $164.0 million and $34.7 million,

respectively.

In prior years, U-Haul sold various properties to SAC Holdings at prices in excess of U-Haul’s carrying values resulting

in gains which U-Haul deferred and treated as additional paid-in capital. The transferred properties have historically been

stated at the original cost basis as the gains were eliminated in consolidation. In March 2004, a portion of these deferred

gains were recognized and treated as contributions from a related party in the amount of $111.0 million as a result of the

deconsolidation of SAC Holding Corporation. In November 2007, the remaining portion of these deferred gains were

recognized and treated as contributions from a related party in the amount of $46.1 million as a result of the deconsolidation

of SAC Holding II.

In March 2009, RepWest purchased shares of AMERCO Series A 8 ½% Preferred Stock on the open market for $0.9

million. RepWest may continue to make investments in AMERCO’s Preferred Shares in the future.

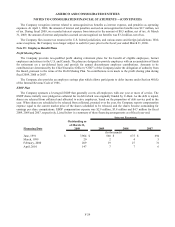

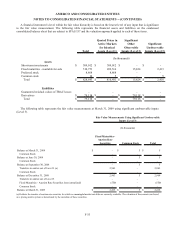

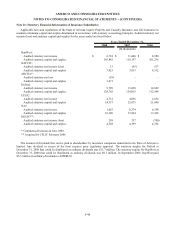

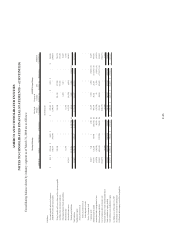

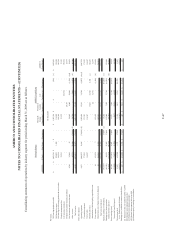

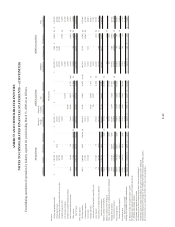

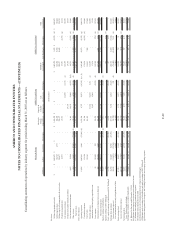

Related Party Assets

2009 2008

U-Haul notes, receivables and interest from Private Mini $ 70,584 $ 71,038

U-Haul notes receivable from SAC Holdings Corporation 197,552 198,144

U-Haul interest receivable from SAC Holdings Corporation 8,815 4,498

U-Haul receivable from SAC Holdings Corporation 20,517 20,617

U-Haul receivable from Mercury 6,264 6,791

Other (198) 2,798

$ 303,534 $ 303,886

March 31,

(In thousands)

F-39