U-Haul 2009 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2009 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

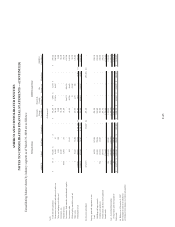

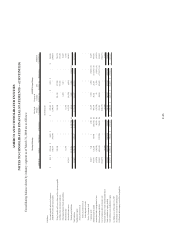

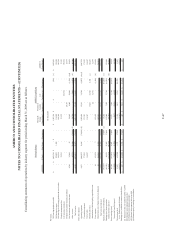

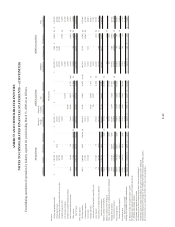

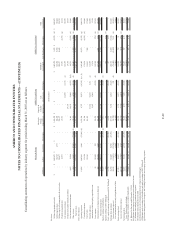

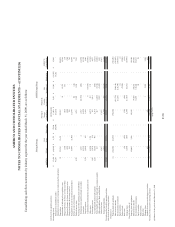

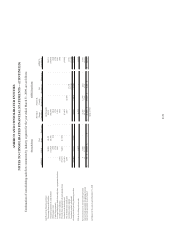

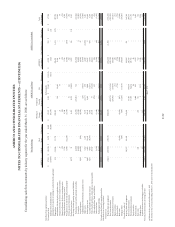

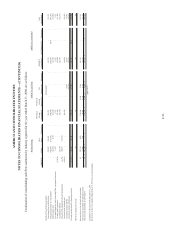

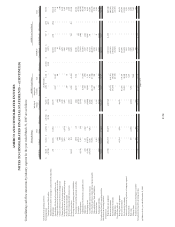

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

F-49

Consolidating statements of operations by industry segment for period ending March 31, 2007 are as follows:

AMERCO U-Haul Real Estate Eliminations

Moving &

Storage

Consolidated

Property &

Casualty

Insurance (a)

Life

Insurance (a) Eliminations

AMERCO

Consolidated SAC Holding II Eliminations

Total

Consolidated

Revenues:

Self-moving equipment rentals -$ 1,462,470$ -$ -$ 1,462,470$ -$ -$ -$ 1,462,470$ 9,225$ (9,225)$ (b) 1,462,470$

Self-storage revenues - 104,725 1,773 - 106,498 - - - 106,498 19,926 - 126,424

Self-moving & self-storage products & service sales - 208,677 - - 208,677 - - - 208,677 16,045 - 224,722

Property management fees - 23,951 - - 23,951 - - - 23,951 - (2,797) (g) 21,154

Life insurance premiums - - - - - - 121,590 (1,191) (c) 120,399 - - 120,399

Property and casualty insurance premiums - - - - - 24,335 - - 24,335 - - 24,335

Net investment and interest income 4,867 29,294 - - 34,161 14,151 22,490 (4,071) (b,d) 66,731 - (7,035) (d) 59,696

Other revenue 204 31,403 67,436 (73,049) (b) 25,994 - 4,740 (1,333) (b) 29,401 1,407 (710) (b) 30,098

Total revenues 5,071 1,860,520 69,209 (73,049) 1,861,751 38,486 148,820 (6,595) 2,042,462 46,603 (19,767) 2,069,298

Costs and expenses:

Operating expenses 12,096 1,085,619 8,843 (73,049) (b) 1,033,509 8,787 30,871 (10,765) (b, c, d) 1,062,402 22,573 (2,797) (g) 1,082,178

Commission expenses - 172,124 - - 172,124 - - - 172,124 - (9,225) (b) 162,899

Cost of sales - 110,163 - - 110,163 - - - 110,163 7,485 - 117,648

Benefits and losses - - - - - 21,901 88,347 6,711 (c) 116,959 - - 116,959

Amortization of deferred policy acquisition costs - - - - - 2,057 15,081 - 17,138 - - 17,138

Lease expense 88 149,649 853 - 150,590 - - (2,221) (b) 148,369 - (710) (b) 147,659

Depreciation, net of (gains) losses on disposals 293 180,560 6,605 - 187,458 - - - 187,458 2,691 (560) (e) 189,589

Total costs and expenses 12,477 1,698,115 16,301 (73,049) 1,653,844 32,745 134,299 (6,275) 1,814,613 32,749 (13,292) 1,834,070

Equity in earnings of subsidiaries 35,269 - - (25,766) (f) 9,503 - - (9,503) (f) - - - -

Equity in earnings of SAC Holding II 527 - - - 527 - - - 527 - (527) (f) -

Total - equity in earnings of subsidiaries and SAC Holding II 35,796 - - (25,766) 10,030 - - (9,503) 527 - (527) -

Earnings from operations 28,390 162,405 52,908 (25,766) 217,937 5,741 14,521 (9,823) 228,376 13,854 (7,002) 235,228

Interest income (expense) 89,026 (114,051) (51,704) - (76,729) - - 320 (d) (76,409) (13,062) 7,035 (d) (82,436)

Fees and amortization on early extinguishment of debt - (302) (6,667) - (6,969) - - - (6,969) - - (6,969)

Pretax earnings (loss) 117,416 48,052 (5,463) (25,766) 134,239 5,741 14,521 (9,503) 144,998 792 33 145,823

Income tax benefit (expense) (27,211) (17,948) 1,125 - (44,034) (5,896) (4,863) - (54,793) (265) (212) (e) (55,270)

Net earnings (loss) 90,205 30,104 (4,338) (25,766) 90,205 (155) 9,658 (9,503) 90,205 527 (179) 90,553

Less: Preferred stock dividends (12,963) - - - (12,963) - - - (12,963) - - (12,963)

Earn

i

ngs

(l

oss

)

ava

il

a

bl

e to common s

h

are

h

o

ld

ers 77,242$ 30,104$ (4,338)$ (25,766)$ 77,242$ (155)$ 9,658$ (9,503)$ 77,242$ 527$ (179)$ 77,590$

(a) Balances for the year ended December 31, 2006

(b) Eliminate intercompany lease income and commission income

(c ) Eliminate intercompany premiums and expenses

(d) Eliminate intercompany interest on debt

(e) Eliminate gain on sale of surplus property from U-Haul to SAC Holding II

(f) Eliminate equity in earnings of subsidiaries and equity in earnings of SAC Holding II

(g) Eliminate management fees charged to SAC Holding II and other intercompany operating expenses

(In thousands)

Moving & Storage AMERCO Legal Group AMERCO as Consolidated