U-Haul 2009 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2009 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

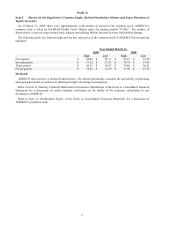

Issuer Purchases of Equity Securities

On December 5, 2007, we announced that the Board had authorized us to repurchase up to $50.0 million of our

common stock. The stock was repurchased by the Company from time to time on the open market through

December 31, 2008. The extent to which the Company repurchased its shares and the timing of such purchases were

dependent upon market conditions and other corporate considerations. The purchases were funded from available

working capital. During fiscal 2009, no shares of our common stock were repurchased, with the exception of the

shares repurchased under our Odd Lot Repurchase Program detailed below.

On August 8, 2008, we announced the Board had authorized us to initiate a no-fee Odd Lot Repurchase Program

(the “Program”) to purchase AMERCO common stock held by persons who own less than 100 shares of AMERCO

common stock. The Program offer expired on December 31, 2008. The following table details the shares purchased

as part of the Program.

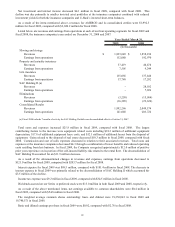

Period

Total # of Shares

Repurchased

Weighted

Average

Price Paid

per Share

Total $ of Shares

Repurchased as Part

of Odd Lot Program

Cumulative Plan Total 23,526 41.47$ 975,722$

On December 3, 2008, the Board authorized and directed us to amend the Employee Stock Ownership Plan

(“ESOP”) to provide that distributions under the ESOP with respect to accounts valued at no more than $1,000 shall

be in the form of cash at the sole discretion of the advisory committee, subject to a participant’s or beneficiary’s

right to elect a distribution of AMERCO common stock. The Board also authorized us, using management’s

discretion, to buy back shares of former employee ESOP participants whose respective ESOP account balances are

valued at more than $1,000 but who own less than 100 shares, at the then-prevailing market prices. No such shares

have been purchased.

In March 2009, RepWest purchased shares of AMERCO Series A 8 ½% Preferred Stock on the open market for

$0.9 million. RepWest may continue to make investments in AMERCO’s Preferred Shares in the future.

15