U-Haul 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

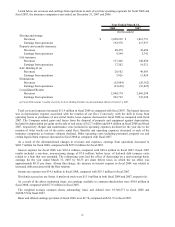

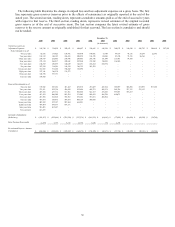

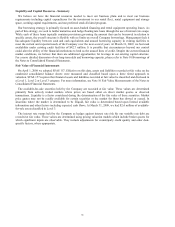

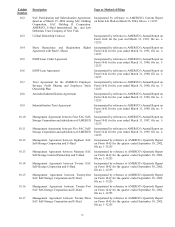

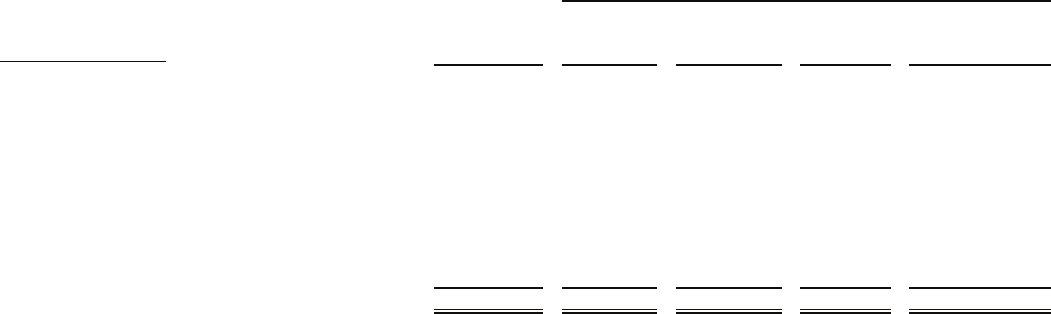

Disclosures about Contractual Obligations and Commercial Commitments

The following table provides contractual commitments and contingencies as of March 31, 2009:

Contractual Obligations Total

Prior to

03/31/10

04/01/10

03/31/12

04/01/12

03/31/14

April 1, 2014

and Thereafter

Notes, loans and leases payable - Principal $ 1,339,210 $ 95,985 $ 267,642 $ 286,135 $ 689,448

Notes, loans and leases payable - Interest 261,888 53,354 88,847 73,799 45,888

Revolving credit agreements - Principal 207,280 37,280 - - 170,000

Revolving credit agreements - Interest 37,593 4,190 7,990 7,990 17,423

AMERCO's operating leases 625,206 147,258 236,762 174,209 66,977

Property and casualty obligations (a) 114,403 17,634 20,872 14,020 61,877

Life, health and annuity obligations (b) 1,747,006 139,581 246,372 216,908 1,144,145

Self insurance accruals (c ) 358,280 115,080 146,687 67,567 28,946

Post retirement benefit liability 9,749 595 1,494 1,898 5,762

Total contractual obligations $ 4,700,615 $ 610,957 $ 1,016,666 $ 842,526 $ 2,230,466

Payment due by Period (as of March 31, 2009)

(In thousands)

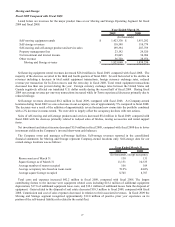

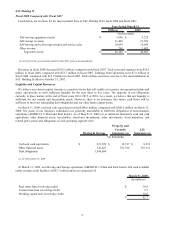

(a) these estimated obligations for unpaid losses and loss adjustment expenses include case reserves for reported claims

and incurred but not reported (“IBNR”) and are net of expected reinsurance recoveries. The ultimate amount to settle

both the case reserves and IBNR is an estimate based upon historical experience and current trends and could

materially differ from actual results. The assumptions do not include future premiums. Due to the significant

assumption employed in this model, the amounts shown could materially differ from actual results.

(b) these estimated obligations are based on mortality, morbidity, withdrawal and lapse assumptions drawn from our

historical experience and adjusted for any known trends. These obligations are derived from the current balance sheet

amount and include expected interest crediting but no amounts for future annuity deposits or premiums for life and

Medicare supplement policies. The cash flows shown are undiscounted for interest and as a result total outflows for all

years shown significantly exceed the corresponding liabilities of $435.9 million included in our consolidated balance

sheet as of March 31, 2009. Oxford expects to fully fund these obligations from their invested asset portfolio. Due to

the significant assumptions employed in this model, the amounts shown could materially differ from actual results.

(c) these estimated obligation are primarily the Company’s self insurance accruals for portions of the liability coverage

for our rental equipment. The estimates for future settlement are based upon historical experience and current trends.

Due to the significant assumption employed in this model, the amounts shown could materially differ from actual

results.

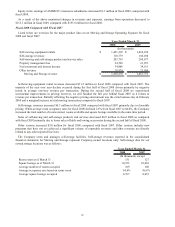

As presented above, contractual obligations on debt and guarantees represent principal payments while contractual

obligations for operating leases represent the notional payments under the lease arrangements. Interest on variable

rate debt is based on the applicable rate at March 31, 2009 without regard to associated interest rate swaps.

FASB Interpretation No. 48, Accounting for Uncertainties in Income Taxes - an interpretation of FASB statement

No. 109 (“FIN 48”) liabilities and interest of $10.9 million is not included above due to uncertainty surrounding

ultimate settlements, if any.

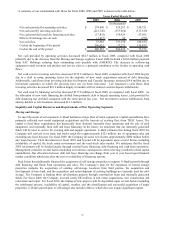

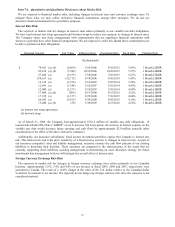

Off Balance Sheet Arrangements

The Company uses off-balance sheet arrangements in situations where management believes that the economics

and sound business principles warrant their use.

AMERCO utilizes operating leases for certain rental equipment and facilities with terms expiring substantially

through 2016, with the exception of one land lease expiring in 2034. In the event of a shortfall in proceeds from the

sales of the underlying rental equipment assets, AMERCO has guaranteed approximately $183.4 million of residual

values at March 31, 2009 for these assets at the end of their respective lease terms. AMERCO has been leasing

rental equipment since 1987. To date, we have not experienced residual value shortfalls related to these leasing

arrangements. Using the average cost of fleet related debt as the discount rate, the present value of AMERCO’s

minimum lease payments and residual value guarantees was $679.7 million at March 31, 2009.

36