U-Haul 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

The Cargo Van/Pickup Note has a fixed interest rate of 5.40% with an estimated final maturity of May 2010. At March

31, 2009, the outstanding balance was $86.6 million. The note is secured by the cargo vans and pickup trucks that were

purchased and the operating cash flows associated with their operation.

The Box Truck Note and Cargo Van/Pickup Note have the benefit of financial guaranty insurance policies that

guarantee the timely payment of interest on and the ultimate payment of the principal of the notes.

The Box Truck Note and the Cargo Van/Pickup Note are subject to certain covenants with respect to liens, additional

indebtedness of the special purpose entities, the disposition of assets and other customary covenants of bankruptcy-remote

special purpose entities. The default provisions of the notes include non-payment of principal or interest and other standard

reporting and change in control covenants.

Other Obligations

In April 2008, the Company entered into a $10.0 million capital lease for new rental equipment. The term of the lease is

seven years and the Company has the option to purchase the equipment at a predetermined amount after the fifth year of the

lease. In March 2009, the Company entered into a $2.6 million capital lease for new rental equipment. The term of the lease

is seven years. At March 31, 2009, the balances on these leases were $11.8 million.

The Company entered into $0.8 million of premium financing arrangements for one year expiring in April 2009 at a rate

of 3.64%. At March 31, 2009, the outstanding balance of this arrangement was $0.1 million.

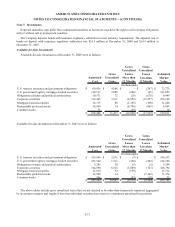

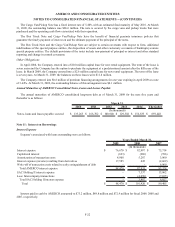

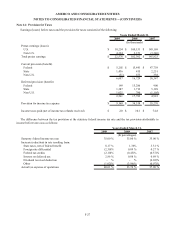

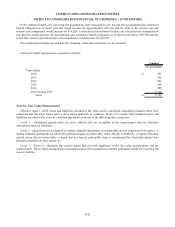

Annual Maturities of AMERCO Consolidated Notes, Loans and Leases Payable

The annual maturities of AMERCO consolidated long-term debt as of March 31, 2009 for the next five years and

thereafter is as follows:

2010 2011 2012 2013 2014 Thereafter

Notes, loans and leases payable, secured $ 133,265 $ 166,702 $ 100,940 $ 129,302 $ 156,833 $ 859,448

March 31,

(In thousands)

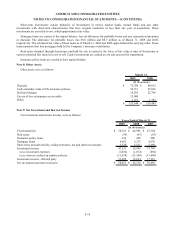

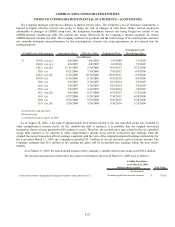

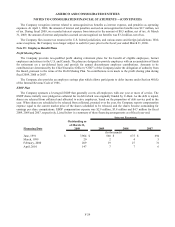

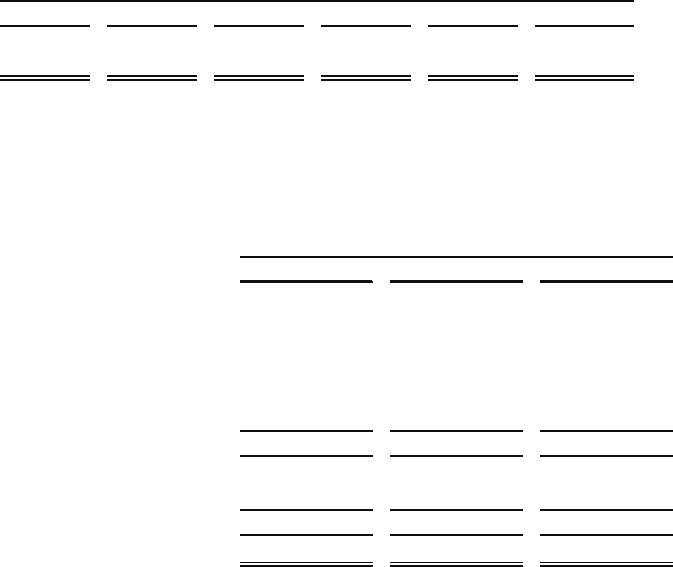

Note 11: Interest on Borrowings

Interest Expense

Expense’s associated with loans outstanding were as follows:

2009 2008 2007

Interest expense $ 76,670 $ 92,997 $ 75,714

Capitalized interest (693) (996) (596)

Amortization of transaction costs 4,908 5,287 3,960

Interest expense (income) resulting from derivatives 17,585 645 (2,669)

Write-off of transaction costs related to early extinguishment of debt - - 6,969

Total AMERCO interest expense 98,470 97,933 83,378

SAC Holding II interest expense - 7,537 13,062

Less: Intercompany transactions - (4,050) (7,035)

Total SAC Holding II interest expense - 3,487 6,027

Total $ 98,470 $ 101,420 $ 89,405

Years Ended March 31,

(In thousands)

Interest paid in cash by AMERCO amounted to $73.2 million, $89.8 million and $72.9 million for fiscal 2009, 2008 and

2007, respectively.

F-22