U-Haul 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 31

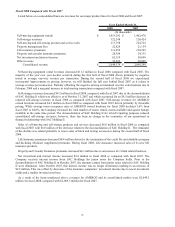

Life Insurance

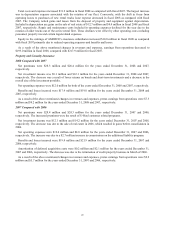

2008 Compared with 2007

Net premiums were $109.6 million and $112.0 million for the years ended December 31, 2008 and 2007,

respectively. Medicare supplement premiums decreased by $6.0 million due to policy lapses and lower first year

sales offset by an increase in life insurance premiums of $6.8 million due to increased sales. Oxford stopped writing

new credit insurance business in 2006 and as a result, credit insurance premiums decreased by $2.0 million. Other

premiums decreased $1.2 million.

Net investment income was $20.4 million and $20.9 million for the years ended December 31, 2008 and 2007,

respectively. The decrease was due to a net reduction in invested assets and lower investment yields.

Net operating expenses were $21.3 million and $23.8 million for the years ended December 31, 2008 and 2007,

respectively. The decrease was primarily attributable to the reduction of expenses on credit insurance due to

business discontinuance and capitalization of life insurance acquisition expenses.

Benefits incurred were $83.6 million and $83.4 million, for the years ended December 31, 2008 and 2007,

respectively. This increase was the result of a $3.2 million decrease in Medicare supplement due to policy

decrements, offset by life insurance benefits of $6.0 million due to increased sales. Other benefits decreased $2.6

million.

Amortization of deferred acquisition costs (“DAC”) and the value of business acquired (“VOBA”) was $12.4

million and $13.0 million for the years ended December 31, 2008 and 2007, respectively. Amortization of DAC for

the credit business decreased $1.4 million as a result of the runoff status of this program. Amortization of DAC for

the life business increased $1.9 million due to increased sales. Medicare supplement decreased by $1.3 million due

to the full amortization of VOBA associated with the CFLIC acquisition.

As a result of the above mentioned changes in revenues and expenses, pretax earnings from operations were $17.7

million and $17.2 million for the years ended December 31, 2008 and 2007, respectively.

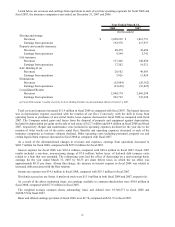

2007 Compared with 2006

Net premiums were $112.0 million and $121.6 million for the years ended December 31, 2007 and 2006,

respectively. Medicare supplement premiums decreased by $4.1 million due to policy lapses and lower first year

sales offset by an increase in life insurance premiums of $2.9 million due to increased sales. Oxford stopped writing

new credit insurance business in 2006 and as a result, credit insurance premiums decreased by $5.9 million.

Net investment income was $20.9 million and $22.5 million for the years ended December 31, 2007 and 2006,

respectively. The decrease was due to a net reduction in invested assets and lower investment yields.

Net operating expenses were $23.8 million and $30.9 million for the years ended December 31, 2007 and 2006,

respectively. The decrease was primarily attributable to the reduction of expenses on credit insurance due to

business discontinuance and additional costs in 2006 related to the acquisition of DGLIC.

Benefits incurred were $83.4 million and $88.3 million, for the years ended December 31, 2007 and 2006,

respectively. This decrease was the result of a $2.0 million decrease in Medicare supplement due to policy

decrements and a decrease of $1.7 million in credit insurance due to decreased exposure, offset by life insurance

benefits of $1.5 million due to increased sales.

DAC and VOBA was $13.0 million and $15.1 million for the years ended December 31, 2007 and 2006,

respectively. The credit business had a decrease of amortization of $3.9 million due to decreased business, offset by

an increase of $2.3 million in annuities due to an update of DAC assumptions.

As a result of the above mentioned changes in revenues and expenses, pretax earnings from operations were $17.2

million and $14.5 million for the years ended December 31, 2007 and 2006, respectively.