U-Haul 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

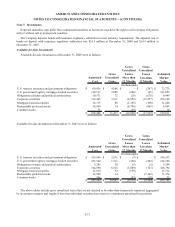

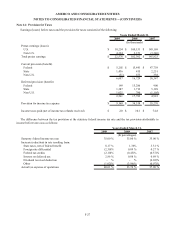

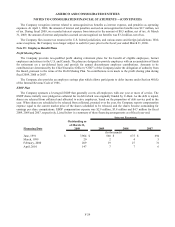

Note 14: Provision for Taxes

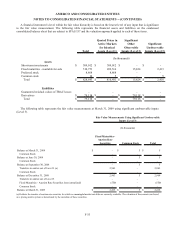

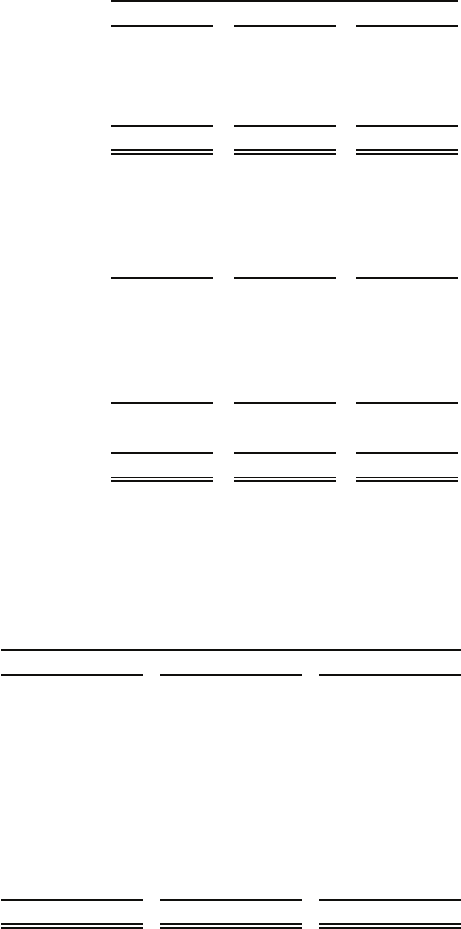

Earnings (losses) before taxes and the provision for taxes consisted of the following:

2009 2008 2007

Pretax earnings (losses):

U.S. $ 18,254 $ 100,151 $ 149,169

Non-U.S. 4,324 2,151 (3,346)

Total pretax earnings $ 22,578 $ 102,302 $ 145,823

Current provision (benefit)

Federal $ 5,202 $ 15,441 $ 47,758

State 1,436 415 2,251

Non-U.S. (31) 873 338

6,607 16,729 50,347

Deferred provision (benefit)

Federal 149 15,286 900

State 1,387 1,713 5,128

Non-U.S. 1,025 790 (1,105)

2,561 17,789 4,923

Provision for income tax expense $ 9,168 $ 34,518 $ 55,270

Income taxes paid (net of income tax refunds received) $ 2.0 $ 10.1 $ 74.8

Years Ended March 31,

(In thousands)

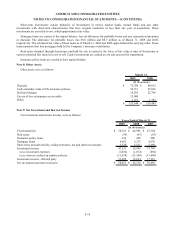

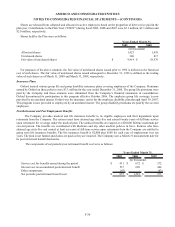

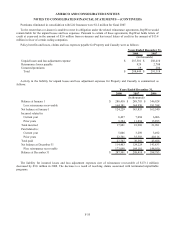

The difference between the tax provision at the statutory federal income tax rate and the tax provision attributable to

income before taxes was as follows:

2009 2008 2007

Statutory federal income tax rate 35.00 % 35.00 % 35.00 %

Increase (reduction) in rate resulting from:

State taxes, net of federal benefit 8.17 % 1.36% 3.31 %

Foreign rate differential (2.30)% 0.89 % 0.27 %

Federal tax credits (2.10)% (0.43)% (0.37)%

Interest on deferred tax 2.86 % 0.88 % 0.69 %

Dividend received deduction - % - % (0.03)%

Other (1.02)% (3.96)% (0.97)%

Actual tax expense of operations 40.61 % 33.74 % 37.90 %

Years Ended March 31,

(In percentages)

F-27