U-Haul 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 35

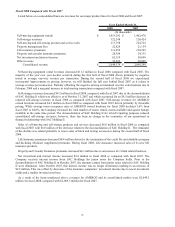

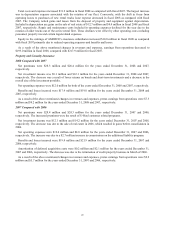

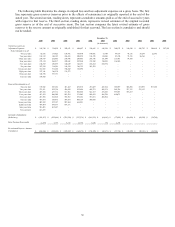

Liquidity and Capital Resources - Summary

We believe we have the financial resources needed to meet our business plans and to meet our business

requirements including capital expenditures for the investment in our rental fleet, rental equipment and storage

space, working capital requirements, and our preferred stock dividend program.

Our borrowing strategy is primarily focused on asset-backed financing and rental equipment operating leases. As

part of this strategy, we seek to ladder maturities and hedge floating rate loans through the use of interest rate swaps.

While each of these loans typically contains provisions governing the amount that can be borrowed in relation to

specific assets, the overall structure is flexible with no limits on overall Company borrowings. Management feels it

has adequate liquidity between cash and cash equivalents and unused borrowing capacity in existing facilities to

meet the current and expected needs of the Company over the next several years. At March 31, 2009, we had cash

availability under existing credit facilities of $42.7 million. It is possible that circumstances beyond our control

could alter the ability of the financial institutions to lend us the unused lines of credit. Despite the current financial

market conditions, we believe that there are additional opportunities for leverage in our existing capital structure.

For a more detailed discussion of our long-term debt and borrowing capacity, please refer to Note 10 Borrowings of

the Notes to Consolidated Financial Statements.

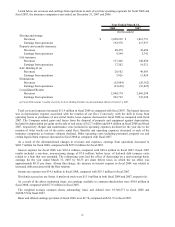

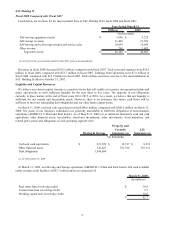

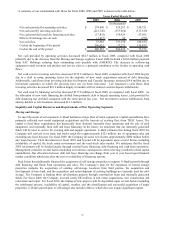

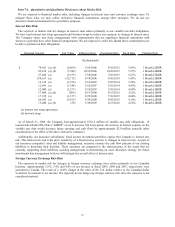

Fair Value of Financial Instruments

On April 1, 2008 we adopted SFAS 157. Effective on this date, assets and liabilities recorded at fair value on the

condensed consolidated balance sheets were measured and classified based upon a three tiered approach to

valuation. SFAS 157 requires that financial assets and liabilities recorded at fair value be classified and disclosed in

a Level 1, Level 2 or Level 3 category. For more information, see Note 16 Fair Value Measurements of the Notes to

Consolidated Financial Statements.

The available-for-sale securities held by the Company are recorded at fair value. These values are determined

primarily from actively traded markets where prices are based either on direct market quotes or observed

transactions. Liquidity is a factor considered during the determination of the fair value of these securities. Market

price quotes may not be readily available for certain securities or the market for them has slowed or ceased. In

situations where the market is determined to be illiquid, fair value is determined based upon limited available

information and other factors including expected cash flows. At March 31, 2009, we had $2.4 million of available-

for-sale assets classified in Level 3.

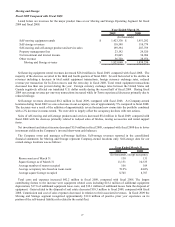

The interest rate swaps held by the Company as hedges against interest rate risk for our variable rate debt are

recorded at fair value. These values are determined using pricing valuation models which include broker quotes for

which significant inputs are observable. They include adjustments for counterparty credit quality and other deal-

specific factors, where appropriate.