U-Haul 2009 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2009 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In April 2009, the FASB issued (FSP) FAS 107-1 and APB 28-1, Disclosures about Fair Value of Financial

Instruments, which increases the frequency of fair value disclosures to a quarterly instead of annual basis. The

guidance relates to fair value disclosures for any financial instruments that are not currently reflected on the balance

sheet at fair value. Effective for interim and annual periods ending after June 15, 2009, but entities may early adopt

the FSP for the interim and annual periods ending after March 15, 2009. The Company does not believe that the

adoption of this statement will have a material impact on our financial statements.

In April 2009, the FASB issued (FSP) FAS 157-4, Determining Fair Value When the Volume and Level of Activity

for the Asset or Liability Have Significantly Decreased and Identifying Transactions That Are Not Orderly, which

provides guidelines for a broad interpretation of when to apply market-based fair value measurements. The FSP

reaffirms management's need to use judgment to determine when a market that was once active has become inactive

and in determining fair values in markets that are no longer active. Effective for interim and annual periods ending

after June 15, 2009, but entities may early adopt the FSP for the interim and annual periods ending after March 15,

2009.

Results of Operations

AMERCO and Consolidated Entities

Fiscal 2009 Compared with Fiscal 2008

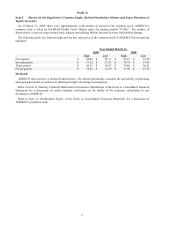

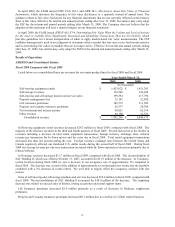

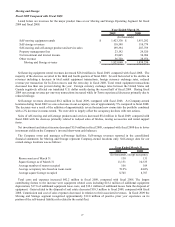

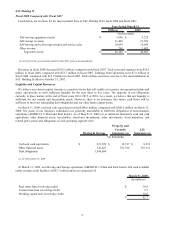

Listed below on a consolidated basis are revenues for our major product lines for fiscal 2009 and fiscal 2008:

2009 2008

Self-moving equipment rentals $ 1,423,022 $ 1,451,292

Self-storage revenues 110,548 122,248

Self-moving and self-storage product and service sales 199,394 217,798

Property management fees 23,192 22,820

Life insurance premiums 109,572 111,996

Property and casualty insurance premiums 28,337 28,388

Net investment and interest income 58,021 62,110

Other revenue 40,180 32,522

Consolidated revenue $ 1,992,266 $ 2,049,174

(In thousands)

Year Ended March 31,

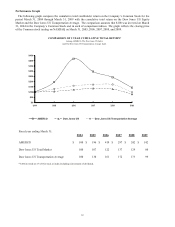

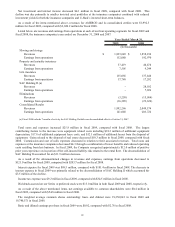

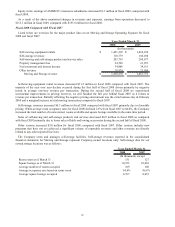

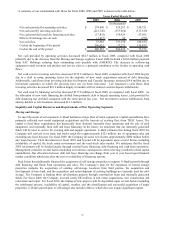

Self-moving equipment rental revenues decreased $28.3 million in fiscal 2009, compared with fiscal 2008. The

majority of the decrease occurred in the third and fourth quarters of fiscal 2009. Several factors led to the decline in

revenues including a decrease in total rental equipment transactions, foreign currency exchange rates, reduced

revenue per transaction for In-Town moves and the extra day in fiscal 2008. Total rental equipment transactions

decreased less than one percent during the year. Foreign currency exchange rates between the United States and

Canada negatively affected our translated U.S. dollar results during the second half of fiscal 2009. During fiscal

2009 our average revenue per one-way transactions increased while In-Town experienced decreases primarily due to

reduced mileage.

Self-storage revenues decreased $11.7 million in fiscal 2009, compared with fiscal 2008. The deconsolidation of

SAC Holding II, which was effective October 31, 2007, accounted for $11.5 million of the decrease. At Company-

owned locations during fiscal 2009 we saw a decrease in our occupancy rate of approximately 5% compared to

fiscal 2008. The decrease was a result of the addition of approximately seven thousand new rooms into the portfolio

combined with a 2% decrease in rooms rented. We were able to largely offset the occupancy declines with rate

actions.

Sales of self-moving and self-storage products and services decreased $18.4 million in fiscal 2009, compared with

fiscal 2008. The deconsolidation of SAC Holding II accounted for $10.0 million of the decrease. The remaining

decrease was related to reduced sales of hitches, towing accessories and rental support items.

Life Insurance premiums decreased $2.4 million primarily as a result of decreases in Medicare supplement

premiums.

Property and Casualty Insurance premiums decreased $0.1 million due to a decline in U-Haul related business.

23