U-Haul 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

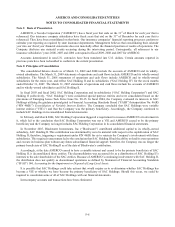

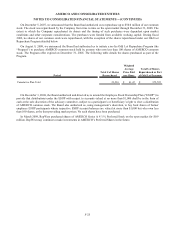

In April 2009, the FASB issued (FSP) FAS 107-1 and APB 28-1, Disclosures about Fair Value of Financial

Instruments, which increases the frequency of fair value disclosures to a quarterly instead of annual basis. The guidance

relates to fair value disclosures for any financial instruments that are not currently reflected on the balance sheet at fair

value. Effective for interim and annual periods ending after June 15, 2009, but entities may early adopt the FSP for the

interim and annual periods ending after March 15, 2009. The Company does not believe that the adoption of this statement

will have a material impact on our financial statements.

In April 2009, the FASB issued (FSP) FAS 157-4, Determining Fair Value When the Volume and Level of Activity for

the Asset or Liability Have Significantly Decreased and Identifying Transactions That Are Not Orderly, which provides

guidelines for a broad interpretation of when to apply market-based fair value measurements. The FSP reaffirms

management's need to use judgment to determine when a market that was once active has become inactive and in

determining fair values in markets that are no longer active. Effective for interim and annual periods ending after June 15,

2009, but entities may early adopt the FSP for the interim and annual periods ending after March 15, 2009.

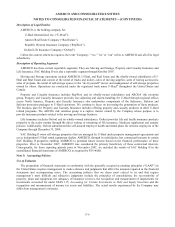

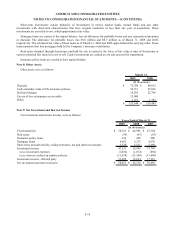

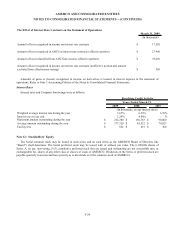

Note 4: Earnings Per Share

Net earnings for purposes of computing earnings per common share are net earnings less preferred stock dividends.

Preferred stock dividends include accrued dividends of AMERCO.

The weighted average common shares outstanding exclude post-1992 shares of the employee stock ownership plan that

have not been committed to be released. The unreleased shares net of shares committed to be released were 244,452,

294,369, and 344,288 as of March 31, 2009, 2008, and 2007, respectively.

6,100,000 shares of preferred stock have been excluded from the weighted average shares outstanding calculation

because they are not common stock and they are not convertible into common stock.

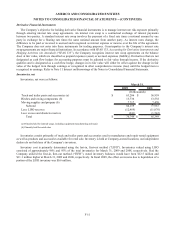

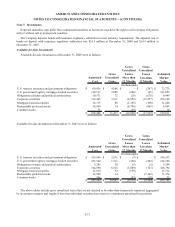

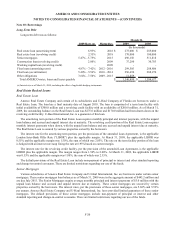

Note 5: Reinsurance Recoverables and Trade Receivables, Net

Reinsurance recoverables and trade receivables, net were as follows:

2009 2008

Reinsurance recoverable $ 173,472 $ 164,695

Trade accounts receivable 18,545 21,324

Paid losses recoverable 8,457 4,177

Accrued investment income 6,877 7,807

Premiums and agents' balances 2,503 2,098

Independent dealer receivable 707 720

Other receivable 4,763 3,432

215,324 204,253

Less: Allowance for doubtful accounts (1,471) (1,488)

$ 213,853 $ 202,765

March 31,

(In thousands)

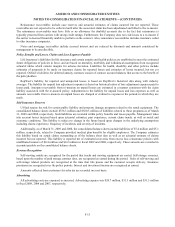

Note 6: Notes and Mortgage Receivables, Net

Notes and mortgage receivables, net were as follows:

2009 2008

Notes, mortgage receivables and other $ 2,937 $ 2,403

Less: Allowance for doubtful accounts (6) (315)

$ 2,931 $ 2,088

March 31,

(In thousands)

F-16