U-Haul 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

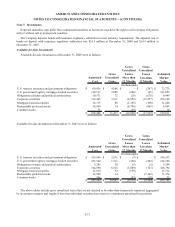

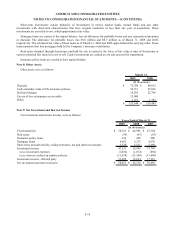

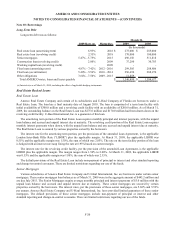

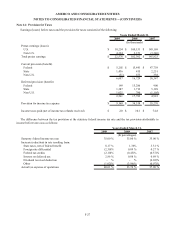

Note 7: Investments

Expected maturities may differ from contractual maturities as borrowers may have the right to call or prepay obligations

with or without call or prepayment penalties.

The Company deposits bonds with insurance regulatory authorities to meet statutory requirements. The adjusted cost of

bonds on deposit with insurance regulatory authorities was $14.4 million at December 31, 2008 and $14.9 million at

December 31, 2007.

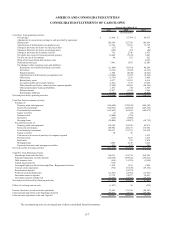

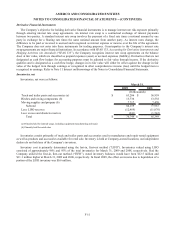

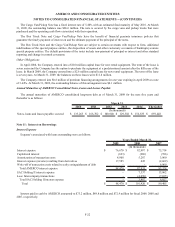

Available-for-Sale Investments

Available-for-sale investments at December 31, 2008 were as follows:

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

More than

12 Months

Gross

Unrealized

Losses

Less than

12 Months

Estimated

Market

Value

U.S. treasury securities and government obligations $ 69,936 $ 4,106 $ - $ (267) $ 73,775

U.S. government agency mortgage-backed securities 118,137 3,686 (106) (65) 121,652

Obligations of states and political subdivisions 10,571 72 (18) (676) 9,949

Corporate securities 312,465 3,511 (6,550) (15,257) 294,169

Mortgage-backed securities 12,713 88 (1,395) (198) 11,208

Redeemable preferred stocks 14,509 14 (4,786) (869) 8,868

Common stocks 75 - (65) - 10

$ 538,406 $ 11,477 $ (12,920) $ (17,332) $ 519,631

(In thousands)

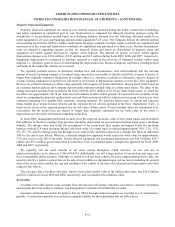

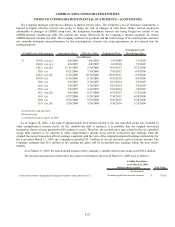

Available-for-sale investments at December 31, 2007 were as follows:

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

More than

12 Months

Gross

Unrealized

Losses

Less than

12 Months

Estimated

Market

Value

U.S. treasury securities and government obligations $ 143,969 $ 2,571 $ (5) $ - $ 146,535

U.S. government agency mortgage-backed securities 125,569 1,331 (398) (282) 126,220

Obligations of states and political subdivisions 5,281 20 (5) (2) 5,294

Corporate securities 324,890 6,516 (1,889) (721) 328,796

Mortgage-backed securities 15,618 93 (199) - 15,512

Redeemable preferred stocks 12,509 34 - (1,169) 11,374

Common stocks 106 - (43) (10) 53

$

627,942

$

10,565

$

(

2,539

)

$

(

2,184

)

$

633,784

(In thousands)

The above tables include gross unrealized losses that are not deemed to be other-than-temporarily impaired, aggregated

by investment category and length of time that individual securities have been in a continuous unrealized loss position.

F-17