Tesco 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97Tesco plc

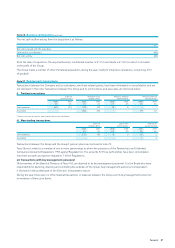

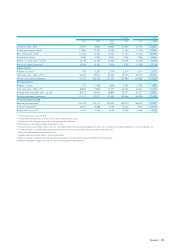

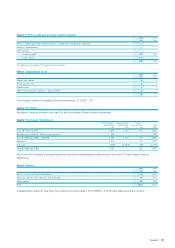

Note 32 Explanation of transition to IFRSs continued

Following a detailed review of our property lease portfolio, a small number of ‘building’ leases have been reclassified as finance

leases and brought onto the Balance Sheet as at 29 February 2004, based on the criteria of IAS 17. This led to a relatively small

increase in Property, plant and equipment, and a similar increase in the finance lease creditor.

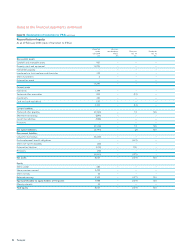

The following adjustments have been made at the opening Balance Sheet and as at 26 February 2005:

29 February 26 February

2004 2005

£m £m

Property, plant & equipment 29 49

Adjustment to net assets (4) (5)

The associated impact on the Income Statement of the above is that some UK GAAP operating lease expenses are replaced with

depreciation and financing charges for the building elements of the reclassified leases. Over the life of the lease, the total Income

Statement charge remains the same, but the timing of expenses will change, with more of the total expense recognised earlier

in the lease term. The net pre-tax impact on the Income Statement is immaterial for the year ended 26 February 2005.

In 2004/05 there was a one-off Income Statement adjustment of £4m, relating to the deferral of some profit from the sale and

leaseback transaction completed in April 2004, which instead will be recognised over the 25-year lease term.

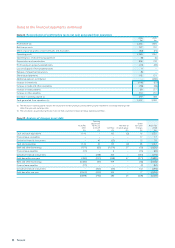

Fixed rental uplifts

The Group has a number of leases that contain minimum rental uplifts at predetermined rent review dates. Some of these leases

are with external landlords and some with the Group’s property joint ventures. The International Financial Reporting Interpretations

Committee (IFRIC) has recently clarified that it is necessary to account for these increases on a straight-line basis over the life of the

lease. Previously, the Group charged such increases to the Income Statement in the year they arose.

The total amount payable over the life of the lease remains unchanged but the timing of the Income Statement charge changes.

The excess of the rent charged to the Income Statement over the cash payment in any given period will be held on the Balance

Sheet in Trade and other payables. This change in accounting treatment has the following effect on the Balance Sheets as at

29 February 2004 and 26 February 2005, and the Income Statement for 2004/05.

29 February 2004/05 26 February

2004 Income 2005

BalanceSheet Statement Balance Sheet

£m £m £m

Operating profit impact (1) (12) (13)

Joint ventures and Associates –44

Deferred tax –33

Impact on net assets/profit after tax (1) (5) (6)

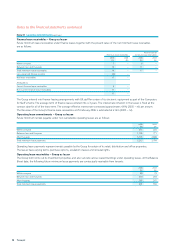

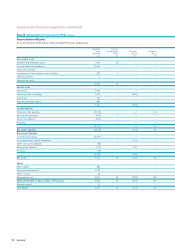

Employee benefits (IAS 19)

Post-employment benefits

For UK GAAP reporting, we applied the measurement and recognition policies of SSAP 24 ‘Accounting for pension costs’ for pensions

and other post-employment benefits, whilst providing detailed disclosures for the alternative measurement principles of FRS 17

‘Retirement Benefits’.

IAS 19 takes a similar approach to accounting for defined benefit schemes as FRS 17, thus on transition, the deficit disclosed under

FRS 17 has been recognised in the Balance Sheet. At the opening Balance Sheet, this resulted in a pre-tax reduction in net assets of

£676m representing the sum of the deficit plus the reversal of a SSAP 24 debtor in the UK GAAP Balance Sheet as at 29 February

2004. An associated deferred tax asset of £199m has been recognised in respect of the pension deficit. Therefore the total

adjustment to net assets as at 29 February 2004 was £477m.