Tesco 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69Tesco plc

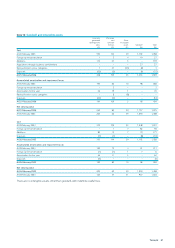

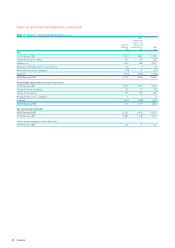

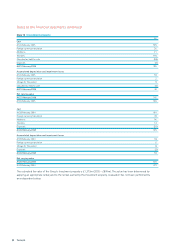

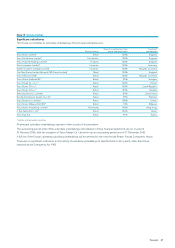

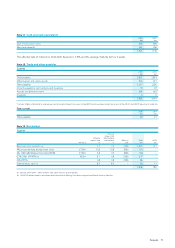

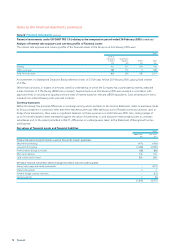

Note 13 Group entities continued

Although Tesco Home Shopping and dunnhumby are 60% and 53% owned, respectively, they are treated as joint ventures in the

Group accounts because the parties to each of the ventures work together with equal powers to control the entities. Each venturer

in the respective entity retain the power of veto and overall key strategic, operational and financial decisions require the consent

of both parties.

The investment in Taiwan Charn Yang Developments Limited has been transferred to assets held for sale due to its impending

transfer to Carrefour as part of the asset swap deal detailed in note 7.

The share of the assets, liabilities, revenue and profit of the joint ventures which are included in the consolidated financial

statements, are as follows:

2006 2005

£m£m

Assets 5,014 4,297

Liabilities (4,749) (4,054)

Goodwill 185 150

Cumulative unrecognised losses 63

456 396

Revenue 586 379

Profit for the period 85 78

The unrecognised share of losses made by joint ventures in the year to 25 February 2006 was £3m (2005 – £2m).

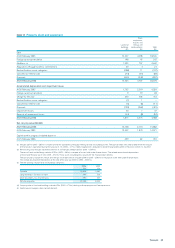

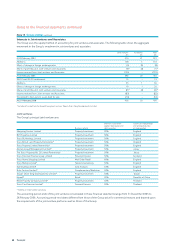

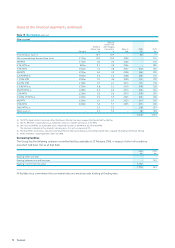

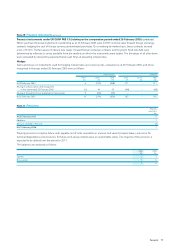

Associates

The Group’s principal associates are:

Share of issued capital, Country of incorporation

loan capital and debt and principal country

Business activity securities of operation

Greenergy Fuels Limited Fuel Supplier 25% England

GroceryWorks Holdings Inc Internet Retailer 38.5% United States of America

The share of the assets, liabilities, revenue and profit of the Group’s associates, which are included in the consolidated financial

statements, are as follows:

2006 2005

£m £m

Assets 72 43

Liabilities (65) (36)

Goodwill 13 13

20 20

Revenue 174 103

Loss for the period (2) (3)

The accounting period end of the associates consolidated in these financial statements range from 31 December 2005

to 28 February 2006.

There are no significant restrictions on the ability of associated undertakings to transfer funds to the parent, other than

those imposed by the Companies Act 1985.