Tesco 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81Tesco plc

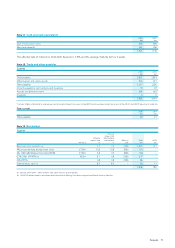

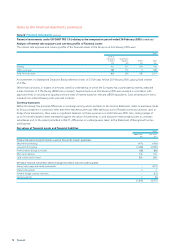

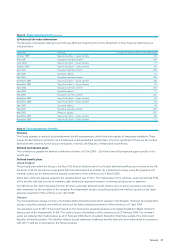

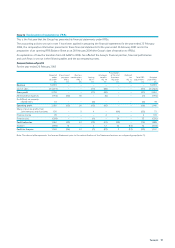

Note 22 Share-based payments continued

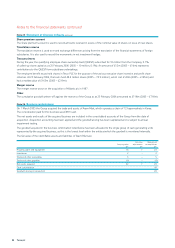

c) Historical fair value information

The fair value of all awards relating to pre-February 2004 but impacting the Income Statement in these financial statements are

included below:

Award date Plan type Fair value of individual award at grant date (pence)

October 1999 Save As You Earn – 5 year scheme 69

May 2000 Executive incentive scheme 209

June 2000 Save As You Earn – 5 year scheme 74

October 2000 Save As You Earn – 5 year scheme 90

April 2001 Executive incentive scheme 258

April 2001 Executive options 73

May 2001 Executive incentive scheme 246

November 2001 Save As you Earn – 5 year scheme 86

November 2001 Save As you Earn – 3 year scheme 76

April 2002 Executive incentive scheme 255

April 2002 Executive options 77

May 2002 Executive incentive scheme 262

November 2002 Save As You Earn – 5 year scheme 62

November 2002 Save As You Earn – 3 year scheme 56

April 2003 Executive options 49

May 2003 Executive incentive scheme 203

May 2003 Shares in Success 197

November 2003 Save As You Earn – 5 year scheme 80

November 2003 Save As You Earn – 3 year scheme 72

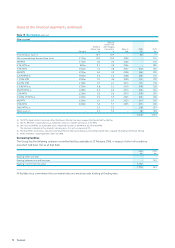

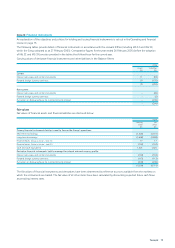

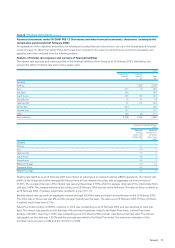

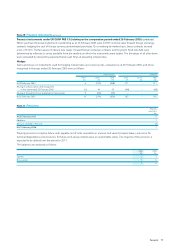

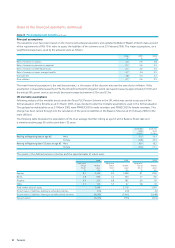

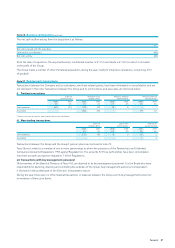

Note 23 Post-employment benefits

Pensions

The Group operates a variety of post-employment benefit arrangements, which cover the majority of employees worldwide. These

include funded defined contribution and funded and unfunded defined benefit plans. The most significant of these are the funded

defined benefit schemes for the Group’s employees in the UK, the Republic of Ireland and South Korea.

Defined contribution plans

The contributions payable for defined contribution schemes of £7m (2005 – £2m) have been fully expensed against profits in the

current year.

Defined benefit plans

United Kingdom

The principal plan within the Group is the Tesco PLC Pension Scheme, which is a funded defined benefit pension scheme in the UK,

the assets of which are held as a segregated fund and administered by trustees. An independent actuary, using the projected unit

method, carried out the latest triennial actuarial assessment of the scheme as at 31 March 2005.

At the date of the lastactuarial valuation the actuarial deficit was £153m. The market value of the schemes’ assets represented 95%

of the benefits that had accrued to members, after allowing for expected increases in earnings and pensions in payment.

The T&S Stores PLC Senior Executive Pension Scheme is a funded defined benefit scheme open to senior executives and certain

other employees at the invitation of the company. An independent actuary, using the projected unit method, carried out the latest

actuarial assessment of the scheme as at 1 April 2004.

Overseas

The most significant overseas scheme is the funded defined benefit scheme which operates in the Republic of Ireland. An independent

actuary,using the projected unit method, carried out the latest actuarial assessment of the scheme as at 1 April 2004.

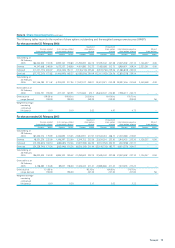

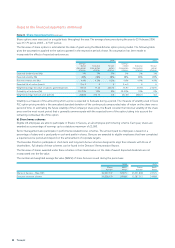

The valuations used for IAS 19 have been based on the most recent actuarial valuations and updated by Watson Wyatt Limited to

takeaccount of the requirements of IAS 19 in order to assess the liabilities of the schemes as at 25 February 2006. The schemes’

assets are stated at their market values as at 25 February 2006. Buck Consultants (Ireland) Limited have updated the most recent

Republic of Ireland valuation. The liabilities relating to post-retirement healthcare benefits have also been determined in accordance

with IAS 19, and areincorporated in the following tables.