Tesco 2006 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2006 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101Tesco plc

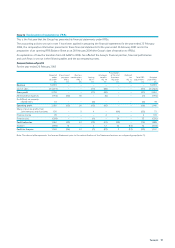

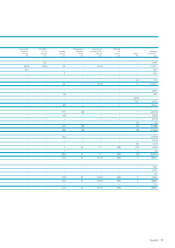

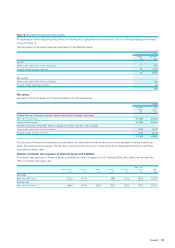

Note 33 Effect of adoption of IAS 32 and IAS 39 on Financial instruments continued

Financial Financial

Instruments: Instruments:

Presentation Recognition

Under IFRSs and and Under IFRSs

(excluding IAS Disclosure Measurement (including IAS

32 and IAS 39) IAS 32 IAS 39 32 and IAS 39)

£m £m £m £m

Non-current liabilities

Financial liabilities

–Borrowings (4,563) – (53) (4,616)

–Derivative financial instruments and other liabilities (a) – (228) (174) (402)

Post-employment benefit obligations (735) – – (735)

Other non-current liabilities (21) – – (21)

Deferred tax liabilities (b) (496) – 28 (468)

Provisions (6) – – (6)

(5,821) (228) (199) (6,248)

Net assets 8,654 (228) (86) 8,340

Equity

Share capital 389 – – 389

Share premium account 3,704 – – 3,704

Other reserves 40 – – 40

Retained earnings 4,470 (228) (86) 4,156

Equity attributable to equity holders of the parent 8,603 (228) (86) 8,289

Minorityinterests 51 – – 51

Total equity 8,654 (228) (86) 8,340

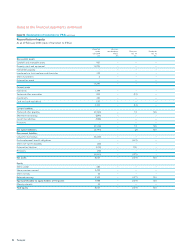

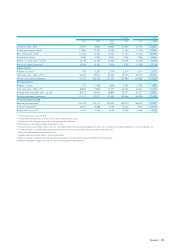

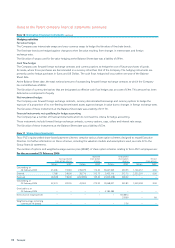

Notes

(a) The Group has entered into an agreement with the Samsung Corporation to purchase the remaining shares of Samsung Tesco Co. Limited. These shares are expected

tobe purchased in three tranches in 2007, 2011 and 2012. The purchase price will reflect the market value of these shares at the date of acquisition.

Under IAS 32, the net present value of the future payments are shown as a financial liability, the value of which was £228m at 27 February 2005.

(b) The deferred tax impacts of the introduction of IAS 32 and IAS 39 as at 27 February 2005 is £28m.

(c) In 2003, the Group monetised profitable interest rate swaps. The amount realised was held in deferred income and amortised through the interest line

in the Income Statement.

On transition to IAS 32 and IAS 39, the remaining credit balance held in deferred income of £163m was transferred to retained earnings.

Under IFRS 1, there is a corresponding credit of £163m to the value of financial liabilities, which is subsequently amortised through the interest line

in the Income Statement.

The net effect is a transfer of £163m from deferred income to financial liabilities, with no impact on the Income Statement and net assets.

(d) Other adjustments are due to the marking-to-market of financial instruments and the reclassification of other creditors and debtors which are defined

as net borrowings under IFRSs.