Tesco 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76 Tesco plc

Notes to the financial statements continued

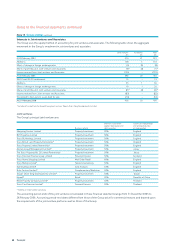

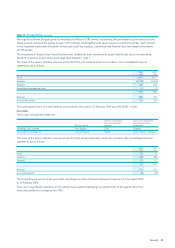

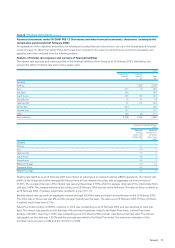

Note 20 Financial instruments continued

Financial instruments under UK GAAP FRS 13 (relating to the comparative period ended 26 February 2005) continued

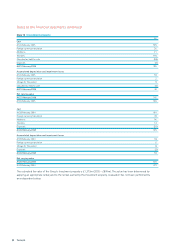

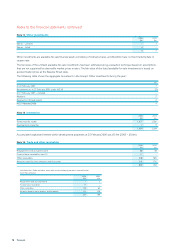

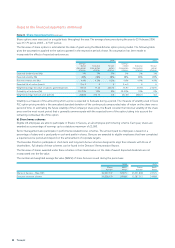

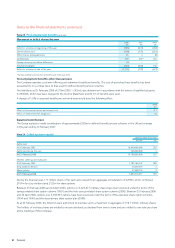

Analysis of interest rate exposure and currency profile of financial assets

The interest rate exposure and currency profile of the financial assets of the Group as at 26 February 2005 were:

2005

Cash at

bank and Short-term

in hand deposits Other Total

£m £m £m £m

Sterling 411 231 104 746

Other currencies 389 115 4 508

Total financial assets 800 346 108 1,254

An investment in collateralised Deutsche Bank preference shares of £150m was held at 26 February 2005, paying fixed interest

of 4.3%.

Other financial assets, in respect of amounts owed by undertakings in which the Company has a participating interest, attracted

arate of interest of 5.7% (being LIBOR plus a margin). Surplus funds as at 26 February 2005 were invested in accordance with

approved limits on security and liquidity and bore rates of interest based on relevant LIBOR equivalents. Cash at bank and in hand

included non-interest bearing cash and cash in transit.

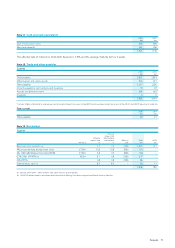

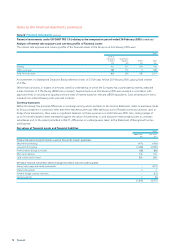

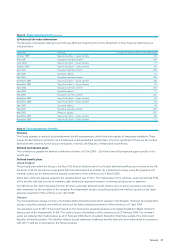

Currency exposures

Within the Group, the principal differences on exchange arising, which are taken to the Income Statement, relate to purchases made

by Group companies in currencies other than their reporting currencies. After taking account of forward currency purchases used to

hedge these transactions, there were no significant balances on these exposures as at 26 February 2005. Also, rolling hedges of

up to18 months duration weremaintained against the value of investments in, and long-term intercompany loans to, overseas

subsidiaries and, to the extent permitted in IAS 21, differences on exchange were taken to the Statement of Recognised Income

and Expense.

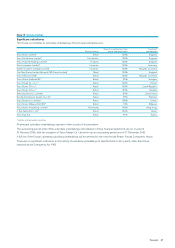

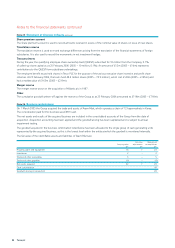

Fair values of financial assets and financial liabilities

2005

Book value Fair value

£m £m

Primary financial instruments held or issued to finance the Group’s operations:

Short-term borrowings (471) (469)

Long-term borrowings (4,486) (4,696)

Finance leases (Group as lessee) (88) (88)

Short-term deposits 346 346

Cash at bank and in hand 800 800

Derivative financial instruments held to manage the interest rate and currency profile:

Interest rate swaps and similar instruments – (181)

Interest rate options 42

Forward foreign currency contracts – (15)

Currency options 2 (6)

(3,893) (4,307)