Tesco 2006 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2006 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111Tesco plc

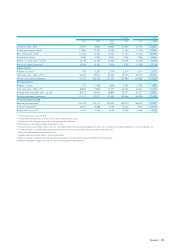

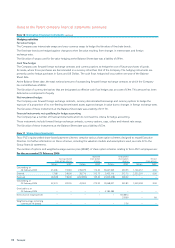

Note 11 Share-based payments continued

For the year ended 26 February 2005

Approved Unapproved

Savings-related share option share option Nil cost

share option scheme scheme scheme share options

Options WAEP Options WAEP Options WAEP Options WAEP

Outstanding at

28 February 2004 60,545 178.19 321,981 126.77 11,838,482 212.40 – 0.00

Granted 8,544 232.00 – – 2,503,453 253.25 1,126,257 0.00

Forfeited (6,443) 185.98 – – – – – –

Exercised (19,440) 162.26 (43,902) 205.00 (3,673,966) 186.38 – –

Outstanding at

26 February 2005 43,206 194.83 278,079 114.42 10,667,969 230.95 1,126,257 0.00

Exercisable as at

26 February 2005 – – 74,634 – 3,174,895 – – –

Exercise price range (pence) – – – 205.00 – 164.00 to

247.00 – Nil

Weighted average remaining

contractual life (years) – – – 3.30 – 3.80 – –

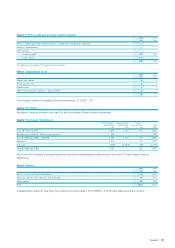

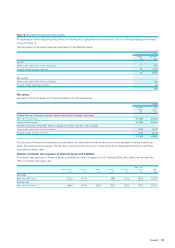

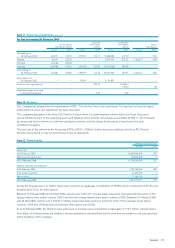

Note 12 Pensions

The Company has adopted the full requirements of FRS 17 for the first time in the current year. This has had no financial impact

and therefore no prior year adjustment has been presented.

The Company participates in the Tesco PLC Pension Scheme which is a multi-employer scheme within the Tesco Group and

cannot identify its share of the underlying assets and liabilities of the scheme. Accordingly, as permitted by FRS 17, the Company

has accounted for the scheme as a defined contribution scheme, and the charge for the period is based upon the cash

contributions payable.

The total costof the scheme tothe Group was £292m (2005 – £258m). Further disclosure relating to the Tesco PLC Pension

Scheme can be found in note 23 of the Group financial statements.

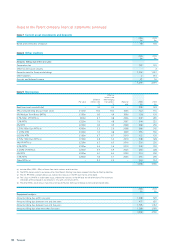

Note13 Sharecapital

Ordinary shares of 5p each

Number £m

Authorised:

At 26 February 2005 10,600,000,000 530

Authorised during the year 100,000,000 5

At 25 February 2006 10,700,000,000 535

Allotted, called up and fully paid:

At 26 February 2005 7,783,169,542 389

Scrip dividend election 53,639,219 3

Share options 57,668,156 3

At 25 February 2006 7,894,476,917 395

During the financial year, 111 million shares were issued for an aggregate consideration of £290m, which comprised £167m for scrip

dividend and £123m for share options.

Between 25 February 2006 and 24 April 2006, options over 3,425,477 ordinary shares have been exercised under the terms of the

savings-related share option scheme (1981) and the Irish savings-related share option scheme (2000). Between 25 February 2006

and 24 April 2006, options over 5,945,937 ordinary shares have been exercised under the terms of the executive share option

schemes (1994 and 1996) and the discretionary share option plan (2004).

As at 25 February 2006, the Directors were authorised to purchase up to a maximum in aggregate of 778.7 million ordinary shares.

The holders of ordinary shares are entitled to receive dividends as declared from time to time and are entitled to one vote per share

at the meetings of the Company.