Tesco 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77Tesco plc

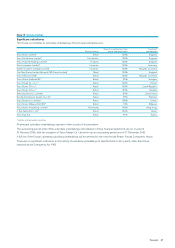

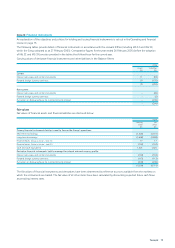

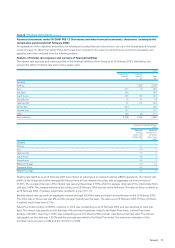

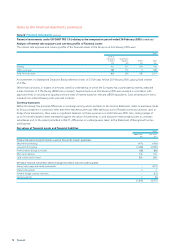

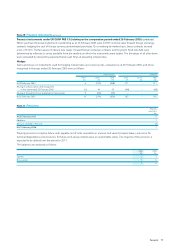

Note 20 Financial instruments continued

Financial instruments under UK GAAP FRS 13 (relating to the comparative period ended 26 February 2005) continued

Other significant financial instruments outstanding as at 26 February 2005 were £479m nominal value forward foreign exchange

contracts hedging the cost of foreign currency denominated purchases. On a marking-to-market basis, these contracts showed

aloss of £15m. The fair values of interest rate swaps, forward foreign exchange contracts and long-term fixed rate debt were

determined by reference to prices available from the markets on which the instruments were traded. The fair values of all other items

were calculated by discounting expected future cash flows at prevailing interest rates.

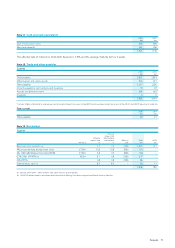

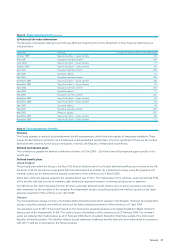

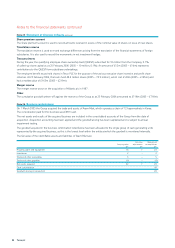

Hedges

Gains and losses on instruments used for hedging interest rates and currency risks, unrealised as at 26 February 2005, and those

recognised in the year ended 26 February 2005 were as follows:

Unrecognised Deferred

Gains Losses Total Gains Losses Total

£m £m £m £m £m £m

At 28 February 2004 6 (214) (208) 211 – 211

Arising in previous years and recognised

in the year ended 26 February 2005 (1) 44 43 (48) – (48)

Arising in the period to be recognised in future years 9 (44) (35) – – –

At 26 February 2005 14 (214) (200) 163 – 163

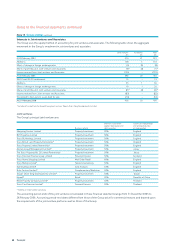

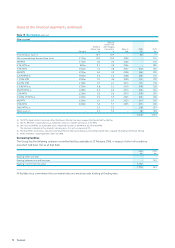

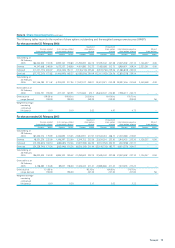

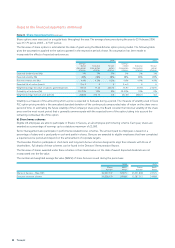

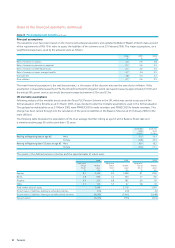

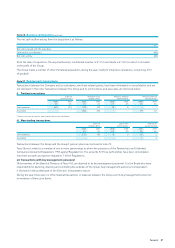

Note 21 Provisions

Property

provisions

£m

At 26 February 2005 9

Additions 1

Amount credited in the year (3)

At 25 February 2006 7

Property provisions comprise future rents payable net of rents receivable on onerous and vacant property leases, provisions for

terminal dilapidations and provisions for future rents above market value on unprofitable stores. The majority of the provision is

expected to be utilised over the period to 2017.

The balances are analysed as follows:

2006 2005

£m £m

Current 23

Non-current 56

79