Tesco 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105Tesco plc

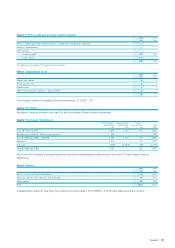

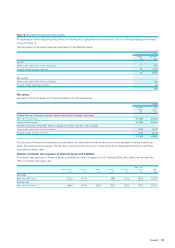

Notes to the Parent company financial statements

Note 1 Accounting policies

Basis of preparation of financial statements

These financial statements have been prepared under UK

GAAP using the historical cost convention modified for the

revaluation of certain financial instruments and in accordance

with applicable accounting standards and the Companies

Act 1985.

A summary of the Company’s significant accounting policies

are set out below.

Exemptions

The Directors have taken advantage of the exemption

available under section 230 of the Companies Act 1985 and

notpresented a Profit and loss account for the Company alone.

The Company has also taken advantage of the exemption from

preparing a Cash flow statement under the terms of FRS 1

‘Cash flow statements’. The cash flows of the Company are

included in the Tesco PLC Group financial statements.

The Company is also exempt under the terms of FRS 8

‘Related Parties’ from disclosing related party transactions with

entities that are part of the Tesco PLC Group.

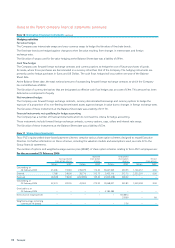

Changes in accounting policies

The Company has adopted the following standards in these

financial statements:

• FRS 17 ‘Retirement Benefits’ – full requirements

• FRS 20 ‘Share-based payment’

• FRS 21 ‘Events after the balance sheet date’

• FRS 25 ‘Financial Instruments: Disclosure and presentation’

• FRS 26 ‘Financial Instruments: Measurement’

• FRS 28 ‘Corresponding amounts’

The adoption of each of these standards represents a change

in accounting policy and the comparative figures have been

restated accordingly, except where the exemption to restate

comparatives has been taken for FRS 25 and FRS 26, which

havebeen adopted from 27 February 2005. Details of the

effect of the prior year adjustments are given in note 15.

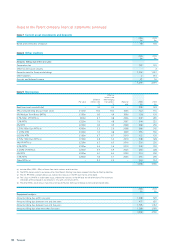

Money market deposits

Money market deposits are stated at cost. All income from

these investments is included in the Profit and loss account

as interest receivable and similar income.

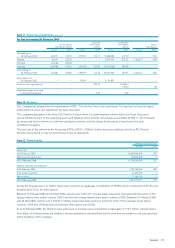

Investments in subsidiaries and joint ventures

Investments in subsidiaries and joint ventures are stated at cost

less, where appropriate, provisions for impairment.

Foreign currencies

Assets and liabilities in foreign currencies are translated into

Pounds Sterling at the financial year end exchange rates.

Share-based payments

Employees of the Company receive part of their remuneration

in the form of share-based payment transactions, whereby

employees render services in exchange for shares or rights over

shares (equity-settled transactions).

The fair value of employee share option plans is calculated at

the grant date using the Black-Scholes model. In accordance

with FRS 20 the resulting cost is charged to the Profit and loss

account over the vesting period. The value of the charge is

adjusted to reflect expected and actual levels of vesting.

Where a subsidiary awards options over the shares of the

Company, this is treated as a capital contribution.

Financial instruments

Financial assets and financial liabilities are recognised on the

Company’s Balance Sheet when the Company becomes a party

to the contractual provisions of the instrument.

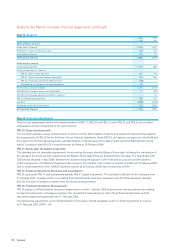

Debtors

Debtors are not interest-bearing and are stated at their

nominal value, reduced by appropriate allowances for

estimated irrecoverable amounts.

Current asset investments

Investments are classified as either held-for-trading or available-

for-sale, and are measured at subsequent reporting dates at fair

value. Gains and losses arising from changes in fair value for

available-for-sale investments are recognised directly in equity,

until the security is disposed of or is determined to be

impaired; at which time the cumulative gain or loss previously

recognised in equity is included in the net profit or loss for

the period.

Financial liabilities and equity

Financial liabilities and equity instruments are classified

according to the substance of the contractual arrangements

entered into. An equity instrument is any contract that gives a

residual interest in the assets of the Company after deducting

all of its liabilities.

Interest-bearing borrowings

Interest-bearing bank loans and overdrafts are initially recorded

at the value of the amount received, net of attributable

transaction costs. Subsequent to initial recognition, interest-

bearing borrowings are stated at amortised cost with any

differencebetween cost and redemption value being recognised

in the Profit and loss account over the period of the borrowings

on an effective interest basis.

Equity instruments

Equity instruments issued by the Company are recorded at the

value of the amount received, net of direct issue costs.

Derivative financial instruments and hedge accounting –

Accounting policy for year ended 25 February 2006

The Company uses derivative financial instruments to hedge

its exposure to foreign exchange and interest rate risks arising

from operating, financing and investment activities. The

Company does not hold or issue derivative financial

instruments for trading purposes, however if derivatives do not

qualify for hedge accounting they are accounted for as such.