Tesco 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91Tesco plc

Note 32 Explanation of transition to IFRSs

This is the first year that the Group has presented its financial statements under IFRSs.

The accounting policies set out in note 1 have been applied in preparing the financial statements for the year ended 25 February

2006, the comparative information presented in these financial statements for the year ended 26 February 2005 and in the

preparation of an opening IFRS Balance Sheet as at 28 February 2004 (the Group’s date of transition to IFRSs).

An explanation of how the transition from UK GAAP to IFRSs has affected the Group’s financial position, financial performance

and cash flows is set out in the following tables and the accompanying notes.

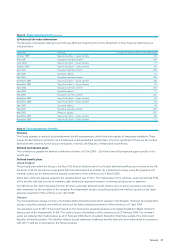

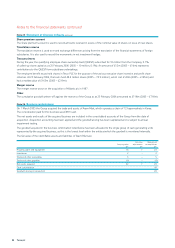

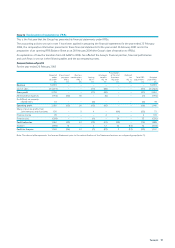

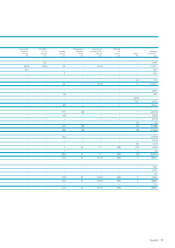

Reconciliation of profit

For the year ended 26 February 2005

Presentation

Reported Share-based Business Employee of JVs and Deferred

under payments combinations Leasing benefits Associates tax Total IFRS Restated

UK GAAP IFRS 2 IFRS 3 IAS 17 IAS 19 IAS 28/31 IAS 12 adjustments under IFRSs

£m £m £m £m £m £m £m £m £m

Revenue 33,974 – – – – – – – 33,974

Cost of sales (31,271) – – (11) (40) – – (51) (31,322)

Gross profit 2,703 – – (11) (40) – – (51) 2,652

Administrative expenses (754) (52) 56 – (5) – – (1) (755)

Profit/(loss) on property-

related items 53 – – (4) – – – (4) 49

Operating profit 2,002 (52) 56 (15) (45) – – (56) 1,946

Shareof post-tax profits from

Joint ventures and Associates 130 – 5 4 – (64) – (55) 75

Finance income 99 – – – 4 – – 4 103

Finance costs (269) – – (1) – 34 – 33 (236)

Profit before tax 1,962 (52) 61 (12) (41) (30) – (74) 1,888

Taxation (593) 16 – 5 12 32 (13) 52 (541)

Profit for the year 1,369 (36) 61 (7) (29) 2 (13) (22) 1,347

Note: The above table represents the Income Statement prior to the reclassification of the Taiwanese business as a disposal group (note 7).