Tesco 2006 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2006 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75Tesco plc

Note 20 Financial instruments continued

Financial instruments under UK GAAP FRS 13 ‘Derivatives and other financial instruments: disclosures’ (relating to the

comparative period ended 26 February 2005)

An explanation of the objectives and policies for holding and issuing financial instruments is set out in the Operating and financial

review on page 16. Other than where these items have been included in the currency risk disclosures, short-term receivables and

payables have been excluded from the following analysis.

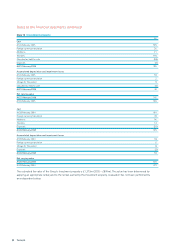

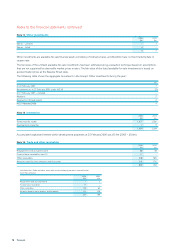

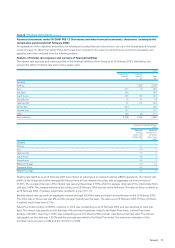

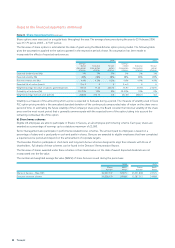

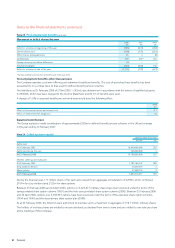

Analysis of interest rate exposure and currency of financial liabilities

The interest rate exposure and currency profile of the financial liabilities of the Group as at 26 February 2005, after taking into

account the effect of interest rate and currency swaps, were:

2005

Floating rate Fixed rate

liabilities liabilities Total

£m £m £m

Currency

Sterling – 2,203 2,203

Euro 577 24 601

Thai Baht 550 – 550

Czech Krona 335 139 474

Slovak Krona 13 31 44

Japanese Yen 23 141 164

Korean Won 654 – 654

Chinese Yuan 127 – 127

Other 149 22 171

Grossliabilities 2,428 2,560 4,988

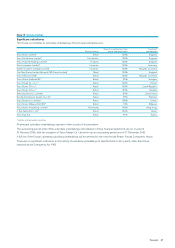

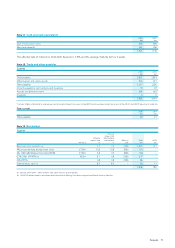

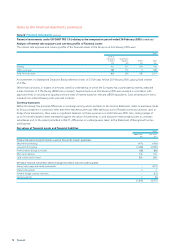

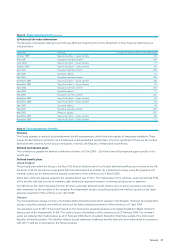

Fixed rate financial liabilities

2005

Weighted Weighted

average average time

interest rate for which

26 Feb 2005 rate is fixed

%Years

Currency

Sterling 5.7 7

Euro 5.4 1

Japanese Yen 1.3 5

Czech Krona 3.9 3

Slovak Krona 4.3 3

Malaysian Ringgit 7.9 12

Taiwanese Dollar 4.5 –

Weighted average 5.5 6

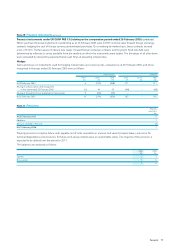

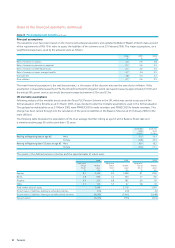

Floating rate liabilities as at 26 February 2005 bore interest at rates based on relevant national LIBOR equivalents. The interest rate

profile of the Group was further managed by the purchase of Euro interest rate collars with an aggregate notional principal of

£145m. The average strike rate of the interest rate caps purchased was 6.76%, while the average strike rate of the interest rate floors

sold was 2.98%. The average maturity of the collars as at 26 February 2005 was two and a half years. The value of these contracts as

at 26 February 2005, if realised, would have resulted in a loss of £1.7m.

Sterling interest rate caps with an aggregate notional principal of £600m were purchased during the year ended 26 February 2005.

The strike rate on these caps was 6% and the average maturity was five years. The value as at 26 February 2005 of these contracts,

if realised, would have been £3.5m.

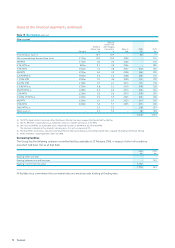

Retail Price Index funding of £226m, maturing in 2016, was outstanding as at 26 February 2005 and was classified as fixed rate

debt. The interest rate payable on this debt was 4% and the principal was linked to the Retail Price Index. Limited Price Index

funding, of £228m, maturing in 2025, was outstanding as at 26 February 2005 and was classified as fixed rate debt. The interest

rate payable on this debt was 3.322% and the principal was linked to the Retail Price Index. The maximum indexation of the

principal in any one year is 5.0% and the minimum is 0.0%.