Tesco 2006 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2006 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

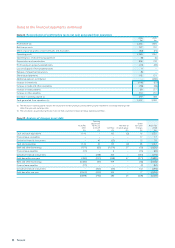

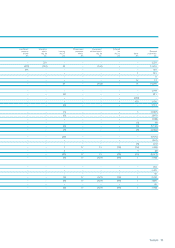

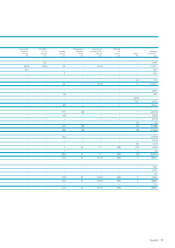

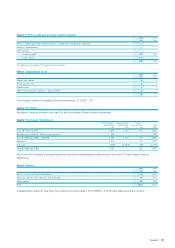

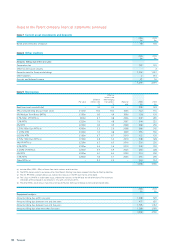

Note 32 Explanation of transition to IFRSs continued

Thereafter, the Group has chosen to apply the amendment to IAS 19 which allows actuarial gains and losses to be recognised

immediately in the Statement of Recognised Income and Expense i.e. the actuarial gains and losses will be taken directly to equity.

The incremental pre-tax Income Statement charge for 2004/05 from the adoption of IAS 19 is £41m. This is split between the

current service cost (increases operating costs by £45m) and the return on plan assets (increases finance income by £4m). The

related tax effect of this is a £12m credit to the Income Statement. The actuarial loss on the scheme for 2004/05, recognised

through reserves, is £230m, with an offsetting tax adjustment of £67m.

The February 2005 IAS 19 pension deficit is £735m, with an associated deferred tax asset of £279m.

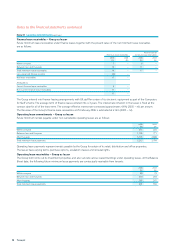

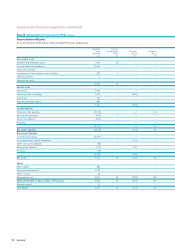

Joint ventures (IAS 31) and Associates (IAS 28)

The Group applies the equity method of accounting for joint ventures (JVs) and associates, which is largely consistent with how they

were accounted for under UK GAAP.

The adoption of IFRSs leads to a change in the presentation of the Group’s share of the results of our JVs and associates. Under UK

GAAP, we included our share of JV and associate operating profit before interest and tax and showed our share of their interest and

tax in the respective Group lines within the Profit and Loss Account. Under IFRSs, JV and associate profit is shown as a net figure i.e.

post interest and tax. This has the effect of reducing profit before tax, but reduces the tax charge. Overall, there is no impact on the

Group profit after tax as this is purely a presentational change.

Another impact of using the equity method of accounting for JVs and associates under IFRSs is that when the Balance Sheet

investment relating to a loss-making JV or associate reduces to nil then no further losses should be recognised in the Income

Statement. Under UK GAAP,losses would continue to be recognised. This change has led to a small adjustment in the opening

BalanceSheet of £1m and an increasein JV and associate profit of £2m in 2004/05.

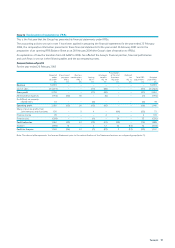

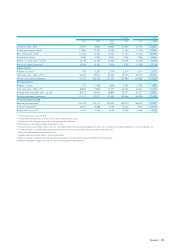

Impairment of assets (IAS 36)

Under IAS 36, individual assets arereviewed for impairment when there are any indicators of impairment. Where individual assets

do not generate cash flows independently from one another, the impairment reviews are carried out at the ‘Cash-Generating Unit’

level, which represents the lowest level at which cash flows are independently generated. The illustrative examples in IAS 36 suggest

that for retailers this is at the individual store level.

Following impairment reviews at the opening BalanceSheet date, we identified a small number of stores which required provisions

for impairment of £142m. This had the effect of reducing the total fixed asset balance by approximately 1% as at 29 February 2004.

Asimilar review was performed for 2004/05 but no further stores required an impairment provision. However, due to movements in

foreign exchange rates, the overall provision set against fixed assets increased by £10m – this consolidation adjustment has been

taken through equity, with no impact on the 2004/05 Income Statement.

The methodology and assumptions applied in the impairment reviews conducted on transition to IFRSs can be found in note 11.

IAS 36 has the additional effect of reducing the deferred tax liability by £15m as at February 2004 and £17m as at February 2005

(the movement year-on-year relates to foreign exchange differences which have been taken to equity). The deferred tax adjustments

arise because the impairment reviews have reduced the carrying values of certain assets qualifying for capital allowances, with no

corresponding change in the tax base.

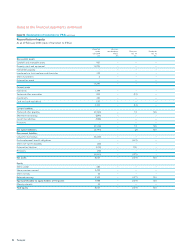

Intangible assets (IAS 38)

Under UK GAAP, we included licences and capitalised development costs within tangible fixed assets on the Balance Sheet.

Under IAS 38, ‘Intangible Assets’, such items are disclosed separately on the face of the Balance Sheet.

As a result, there is a reclassification of £255m in the opening Balance Sheet, and £306m in the Balance Sheet as at 26 February

2005, between Property, plant and equipment and Intangible assets. There is no impact on the Income Statement from this

reclassification.

98 Tesco plc

Notes to the financial statements continued