Tesco 2006 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2006 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

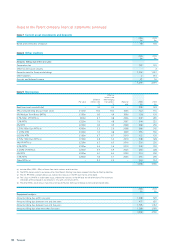

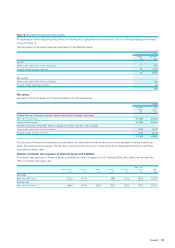

Notes to the Parent company financial statements continued

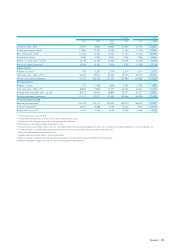

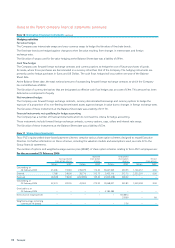

Note 14 Reserves

2006 2005

£m £m

Share premium account

At the start of the year 3,704 3,470

Premium on issue of shares less costs 120 143

Scrip dividend election 164 91

At the end of the year 3,988 3,704

Profit and loss reserve

As previously reported 1,136 683

Prior year adjustments: (Note 15)

FRS 20 ‘Share-based payment’ 261 94

FRS 21 ‘Events after the balance sheet date’ 410 365

FRS 26 ‘Financial instruments: Measurement’ (60) –

Deferred tax on changes in accounting policies 24 –

Profit and loss reserve restated 1,771 1,142

Gain/(loss) on foreign currency net investments 17 (72)

Tax effect of exchange adjustment offset in reserves –16

FRS 20 ‘Share-based payment’ 186 169

Dividend (609) (542)

Profit after tax for the financial year 399 1,094

At the end of the year 1,764 1,807

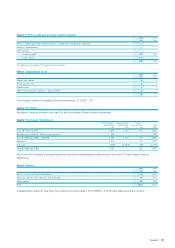

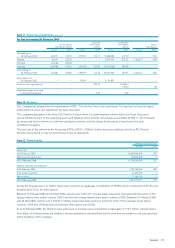

Note15 Prior year adjustments

The prior year adjustments relate to the implementation of FRS 17, FRS 20 and FRS 21, while FRS 25 and FRS 26 do not affect

comparatives and are only applied to the current period.

FRS 20 ‘Share-based payment’:

The Company operates a range of share-based incentive schemes (both awards of options and awards of shares) and has applied

the requirements of FRS 20 for the first time in these financial statements. Under FRS 20, an expense is recognised in the Profit and

loss account for all share-based payments calculated based on the fair value at the date of grant using the Black-Scholes pricing

model. Compliance with FRS 20 increased reserves by £94m at 29 February 2004.

FRS 21 ‘Events after the balance sheet date’:

This standard sets out amended requirements for accounting for events after the Balance Sheet date. Following the introduction of

this standard, dividends areonly recognised at the Balance Sheet date if they are declared before that date. The final dividend for

2003/04 was declared in April 2004, therefore the dividend charge recognised in the Profit and loss account and the dividend

creditor recognised in the Balance Sheet have been reversed. This resulted in an increase in reserves of £365m at 29 February 2004.

Due tosimilar treatment of the 2004/05 dividend, reserves at 26 February 2005 have increased by £410m.

FRS 25 ‘Financial instruments: Disclosure and presentation’:

FRS 25 supersedes FRS 13 and substantially amends FRS 4 ‘Capital instruments’. This standard is effective for the Company from

27 February 2005. However, as the consolidated financial statements have been prepared under the IFRS equivalent standard

(IAS 32), the parent Company is exempt from the disclosure requirements.

FRS 26 ‘Financial instruments: Measurement’:

FRS 26 applies toall listed entities for periods beginning on or after 1 January 2005 and prescribes new accounting rules relating

to financial instruments and hedge accounting. This standard has been adopted in full in these financial statements and the

requirement applied prospectively from 27 February 2006.

The deferred tax adjustments on the implementation of the above named standards results in a £24m adjustment to reserves

at 27 February 2005 (2004 – nil).

112 Tesco plc